Advances in Animal and Veterinary Sciences

Research Article

Impact of Technology and Government Incentives on the Performance of Broiler Contract Farming in Johor

Zineb Abdulaker Benalywa1,4*, Mohd Mansor Ismail1, 2, Mad Nasir Shamsudin1, Zulkornain Yusop3

1Department of Agribusiness and Bioresource Economics, University Putra Malaysia, 43400 Serdang, Selangor, Malaysia; 2Institute of Agricultural and Food Policy Studies, University Putra Malaysia, Malaysia, 43400 Serdang, Selangor, Malaysia; 3Department of Economics, University Putra Malaysia, 43400 Serdang, Selangor, Malaysia; 4Department of Agricultural Economics, University of Tripoli, Libya.

Abstract | Broiler farming project valuation has been widely assessed although contract farming term has not been considered. This study tends to evaluate the government incentives’ impact on the broiler contract farming in Johor (the leading chicken producer in Peninsular Malaysia) under different technologies using capital budgeting techniques. The study surveyed 70 farms in Johor. The result demonstrated that broiler contract farming overall was financially viable. These results showed that by using closed technology, the chance to provide higher profit and reduce the business risk is visible. Moreover, when the government executed tax incentives, the feasibility of the project is significantly enhanced.

Keywords | Broiler contract farming, Johor, Capital budgeting technique, Government incentives, Technology

Received | April 19, 2019; Accepted | May 18, 2019; Published | June 15, 2019

*Correspondence | Zineb Abdulaker Benalywa, Department of Agribusiness and Bioresource Economics, University Putra Malaysia, 43400 Serdang, Selangor, Malaysia; Email: zineb_a14@yahoo.com

Citation | Benalywa ZA, Ismail MM, Shamsudin MN, Yusop Z (2019). Impact of technology and government incentives on the performance of broiler contract farming in johor. Adv. Anim. Vet. Sci. 7(8): 641-647.

DOI | http://dx.doi.org/10.17582/journal.aavs/2019/7.8.641.647

ISSN (Online) | 2307-8316; ISSN (Print) | 2309-3331

Copyright © 2019 Benalywa et al. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Introduction

Broiler industry becomes one of the main industries in Malaysia (DVS, 2017). The reasons why Malaysian consume chicken is that, chicken meat is the staple protein source for all ethnic in Malaysia. Besides, it is safer and cheaper compared to red meat. The broiler industry in Malaysia is highly controlled by a few big enterprises or integrators. Contract farming was introduced to enhance the sustainability and to ensure a good income to small holders of broiler farms. Under the contracts, all inputs such as feed and day-old chicks are provided and organized by the parent firms which are consisting of large businesses specializing in producing, marketing and trading the chicken-based end products. Chang (2007) highlighted that the contract farming and vertical integration, which are main sorts of the world’s top effective broiler producers have caused improving the production, further efficient marketing, and the increasing amounts of val

ue-added products at relatively lesser expenses. This contract farming schemes have some weaknesses to the industry; for example, it might impose business threats to small independent broiler farmers (Benalywa et al., 2017; Benalywa et al., 2019). This is because the cost of production per chicken for small farmers might be higher than the production costs of the contract farmers. The value of feeds for bird raised commercially and reach up to 70% of production costs (Ravindran, 2013). According to the DVS (2016), feed represents the highest percentage in the broiler production cost, which constitutes more than 70% of the total production cost. DVS (2017) Indicated that the breakdown of the cost of production in 2015 contributed the highest percentage of 72% followed by Day Old Chicks with 21% of the total cost of production (Benalywa et al., 2018). Besides the issue of feed price volatility, production costs can also be reduced by the appropriate government incentives.

If this condition continues without proper policy interventions, small independent farmers will be unable to compete and sooner or later they will exit the industry (Benalywa et al., 2017). Taking into account the prospective contribution of smallholders and their social-economic welfare are not neglected, the government has introduced few incentives to control, protect and support the broiler industry predominantly small-scale farmers. All these incentives are managed by the Malaysian Investment Development Authority (MIDA) (Abdurofi et al., 2017). This study will deliberate the role of three agriculture incentives for broiler farmers in Malaysia.

In order to be sustainable, the broiler farming must operate profitably, particularly in the major producing areas. Johor and Perak account more than 50% of broiler production in Peninsular Malaysia (DVS, 2016). Johor recorded the larget production due to its closeness to Singapore, The main export destinations of live chickens for Malaysia. (DVS, 2016) indicated that the broiler contract farming system dominated 75% of the national broiler production while 65.3% of operators sell their production to those involved in contract marketing to hypermarkets and processing industries. The balance is sold as live birds in open markets (DVS, 2016).

Before considering any agricultural project as feasible and sustainable, financial evaluation is necessary before the government formulates policies that will help the industry to survive since the industry is vital for food security. That will ensure the accessibility and availability of the commodities at all levels of the population. This study emphasizes on financial assessment and the approach is to incorporate costs and benefits including all inputs and outputs and the appropriate government incentives aiming at enhancing farm profitability. The incentives incorporated in this research are Pioneer Status (PS) where a firm enjoys a partial exemption from income tax. A company receives this incentive pays only tax for five years on 30% of statutory income, starting from the production day. Investment Tax Allowance (ITA); the farm is entitled to an allowance of up to 70% of its capital expenditure acquired within five years starting from the day on which the first qualifying capital expenditure is incurred. Accelerated Capital Allowance (ACA); ACA on the capital expenditure is to be used within the following three years, that is, a preliminary allowance of 60% for the first year and a yearly allowance of 20% for the subsequent two years. These were also agreed by Fahim et al. (2013) who indicated that profit is the leading factor in the economic enterprise ’s investigation. The current study aims to evaluate the financial viability of broiler production in Johor with government incentives (various tax incentives) incorporated in the financial assessment to measure their relationships and impact on financial indicators. The knowledge of the effects of incentives of the government on tax payment of a firm would provide a guideline to formulate business plans and strategies for improving performance.

Capital budgeting plays a vital role in the financial management strategy of any organization for business expansion. Dayananda (2002) stated that capital budgeting is the technique of determining potential investment projects to maximize shareholders’ wealth. Many researchers have been attracted by capital budgeting approach in deciding alternative projects (Abdurofi et al., 2015; Al-Sharafat & Al-Fawwaz, 2013; Balamurugan & Manoharan, 2013; Benalywa et al., 2017; Firdaus & Komalasari, 2011; Mansor & abdurofi, 2014; Singh et al., 2010). In this study, the analysis provides a mutual understanding of firm profitability, return, and cost-benefit in the scope of private project evaluation. By doing this, all organizations ensure that their decision enhances their firm competitiveness over their rivalries. Sekwat (1999) indicated that in financial planning and decision-making capital budgeting is necessary as its tools lead to superior decision-making and can rationalize the choice of particular investments amongst competing for alternative investments. In the public finance literature, The net present value (NPV), the internal rate of return (IRR), payback period (PBP), and the profitability index (PI) are the most indicators used in the capital budgeting techniques, e.g., Sekwat (1999). These methods have been acknowledged as a principal technique and applied by many scholars, e.g., Pike (1996). NPV describes the amount of cash that the firms earn throughout the project life. The negative result of NPV displays that the cost exceeds the benefit which means that the project is not financially feasible. IRR is commonly employed in financial assessment to determine the profitability of a single clear and apparent project for the investors to digest. The IRR regulates the ratio at which capital investment can be adequate and consequently equate the capital investment cost to the project ’s present value (Cooper et al., 2002). If the IRR’s value is positive and greater than the discount rate, it demonstrates the viability of the project (Mackevičius & Tomaševič, 2010). The NPV and IRR have been supported in the literature (Slagmulder et al., 1995) as project evaluation indicators. It was agreed that in the bigger businesses operating in the U.S, IRR is the most favored technique whereas NPV is the next (Kengatharan, 2016). However, only NPV is consistent with profit maximization. Payback period is an adequate indicator to adopt the acceptability of an investment project as it determines how fast to recover the initial cash investment which has been used to finance the project (Boardman, 1985).

There are many factors that affect business performance, but this paper only emphasizes on Financial and technological aspects since these factors are more suitable for the study. The study attempts to provide a clear understanding of the existing status of broiler contract farming in Johor and describes the impact of various types of incentives which intend to be considered proper and feasible to attract newcomers to the industry. Furthermore, the changing technology in utilizing house construction of the broiler to improve the efficiency of coop and effectiveness in the system of the production generates extra costs and gaps among closed and open system. Though, these modified technologies will affect the broiler production’s cost and returns. Therefore, the study evaluated the impact of technology and government incentives on financial assessment principles by calculating the net present value (NPV), internal rate of return (IRR) and the benefit-cost ratio (BCR) and payback period (PBP) based on a sample of contract farmers.

Methodology

Data Collection and Study Area

The study focused on the primary data from questionnaires via a face to face interview with the contract farmers in Johor, Peninsular Malaysia in 2016. The data collection source included data of a cost of input and output, initial farm investment. Stratified sampling was initially used as a sampling method while the targeted respondents were categorized explicitly for the contract farming in two different cooping systems (open and close). Based on the sampling technique described above, the study selected 70 contract farms in Johor State as respondents.

Statistical Analysis

Capital budgeting techniques were applied in this study to analyze the data, which included NPV, IRR, PI and PB. The discount rate was 10% during the project assessment as this is the current maximum loan rate at most commercial banks in Malaysia. Along with an essential evaluation of financial appraisal, the simulation involving government tax incentives in the financial projection was also implemented to find out their impact.

Net Present Value (NPV): Net Present Value or a discounted cash flow technique. The positive result of NPV indicates that the project is financially viable and accepted. The formula below is used in calculation:

As:

CF = Cash Flow

r = Discount Rate

t = Time

Internal Rate Return (IRR)

It is the discount rate when the net profit value of the project is equal to zero. IRR shall be compared to the firm’s cost of capital. The rate means, to make positive shareholder wealth the project must surpass.

As:

CF = Cash Flow

r = Discount Rate

t = Time

IRR = Internal Rate of Return

Profitability Index (PI) or Benefit Cost Ratio (BCR): PI is calculated by dividing the present value of the project cash flows by the cost. PI describes the potential profit from money invested.

As:

CF = Cash Flow

r = Discount Rate

t = Time

PV = Present Value

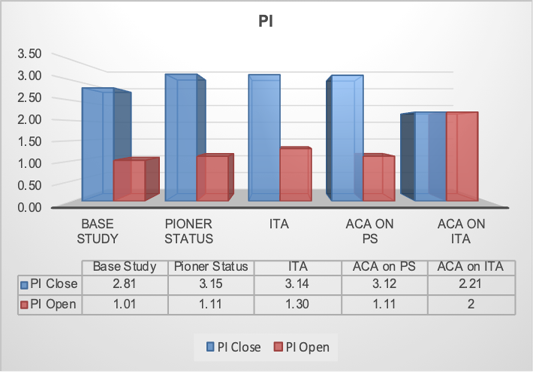

Payback Period (PBP) It is the expected number of years required to recover the initial investment. PBP can be calculated by:

Analysis assumptions:

Assumptions were made from a survey and associated secondary data were used.

The duration of the project is ten years, based on the economic age of the coop houses.

The interest rate used is for loans from Bank Negara 2017 which was 10%.

This price was the market price when the study was conducted.

There are six production cycles each year. Each production cycle takes 35 days.

In the growing period, one bird consumes 2.89 kg of feed.

The income tax rate is 25%.

Results and discussion

Capital Budgeting Analysis of Broiler Farming

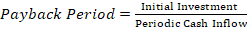

Figure 1 shows the results of NPV. From the results under normal cost and return situation, it is evident that NPV was positive for both the open and closed systems at 10% discount rate, hence, indicating the financial soundness of the investment on broiler production in differing technology. However, the results revealed that the highest value of NPV was obtained by broiler farms using the closed system, indicate the close one distributes huge costs and revenues during the farm’s operation as the cash flow of the closed system was higher than that in open system as the NPV is calculated by discounting the cash flows at the company opportunity cost of capital (Copeland et al., 1983). Inducing tax incentives to the farms generated higher profit to the broiler farming in Johor (Mansor & Abdurofi, 2014). The government incentives such as PS, ITA and ACA improved the value of NPV significantly. These incentives provide the same patterns that the amalgamation of ITA and ACA made greater sufficient cash to both open and closed systems then, PS with ACA, ITA, and PS. The integrated broiler farming is an economically viable and feasible technology for adoption which could solve the issues of sustainability.

Figure 1: Net Present Value NPV Results

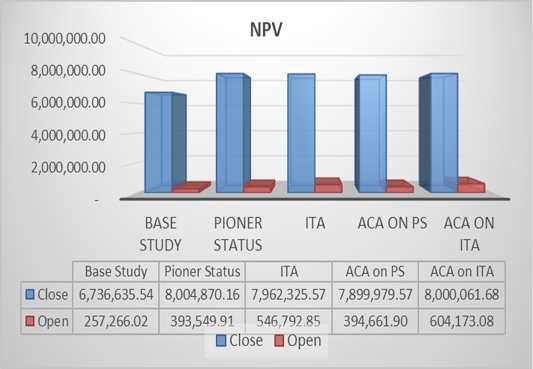

The IRR rate was highest on closed farms 43% followed by those under the open coop system 15% Figure 2. Since IRR is greater than the discount rate representing the capital’ opportunity cost, farms using the closed system are more financially viable. Meanwhile, farms which use the open system are at risk in the long run. Copeland et al. (1983) stated that if we use the IRR principle for independent projects, we accept any projects that have more than 10% of the opportunity capital cost. Applying the closed system technology in the production of the broiler, the opportunity to reduce the jeopardy in the long-term project assessment and gain greater profit is observable. Regarding the incentive situations, the IRR values have increased meaningfully since the application of incentives. In order to provide more feasibility to the broiler project, a combination of ACA and ITA which adds a higher value for both systems should be used by the farmers. The result, though, has a similar pattern to NPV and this tax situation is appropriate to achieve higher profitability of the broiler project. It can be seen that the integrated broiler farming is economically viable in the locality, so it will sustain for long time.

Figure 2: Internal Rate of Return IRR Results

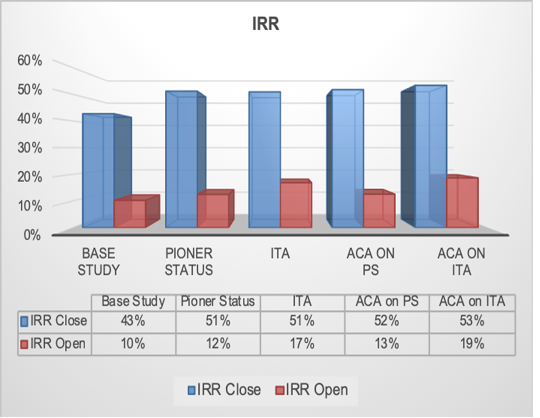

Profitability Index (PI) results are shown in Figure 3; PI determines the precise amount of profit from the money invested by the prospective investor. PI of the base period in an open system was 1.26, which means that the project earned only 26 sen per RM 1 invested in the project. Then, the closed system 2.81 recorded a higher profit, since the farm in the closed system can earn RM 1.81 for every RM invested. That implies the visibility of the project in terms of time value of money. Furthermore, regarding the particular tax scenarios, applying for the tax exemptions revealed better feasibility. ITA with ACA was the best lucrative project with attainment return in both open and closed systems as RM 2 and RM 3.16, respectively. Followed by other scenarios, ITA, PS, then PS on ACA. The values of financial indicators used indicated that adopting the closed system technology of farms for contract broiler production will be encouraging, profitable and viable.

Figure 3: Profitability Index PI Results

| Simulation | Normal | Situation 1 (Cost of feed) | Situation 2 (Cost of DOC) | ||

| Increased by 20% | Increased by 50% | Increased by 20% | Increased by 50% | ||

| Open | |||||

| NPV | 257,266.02 | 13,525.84 | -352,084.43 | -99,870.46 | -635,575.18 |

| IRR | 15% | 10% | 2% | 8% | -5% |

| PI | 1.25 | 1.10 | 1.01 | 0.89 | 0.36 |

| PBP | 5.15 | 6.48 | 10.58 | 7.36 | 12 |

| Close | |||||

| NPV | 6,736,635.54 | 4,163,379.02 | 2,990,504.82 | 5,432,401.04 | 4,128,166.54 |

| IRR | 43% | 31% | 25% | 37% | 31% |

| PI | 2.81 | 2.11 | 1.80 | 2.46 | 1.93 |

| PBP | 2.36 | 3.06 | 3.63 | 2.73 |

3.24 |

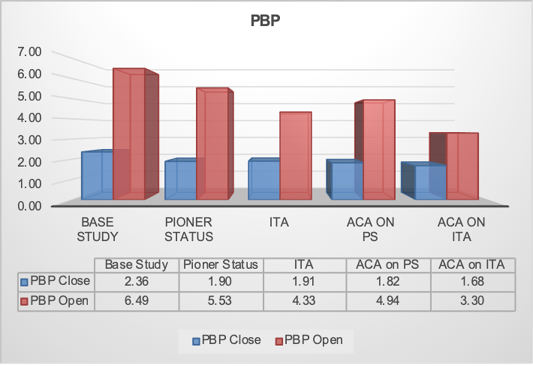

Figure 4, Represents the impacts of both situations, non-tax and a tax incentive for pay back period in the production of broiler contract farming. The PBP value of non-tax incentive (base study) in the open system showed 5.15; this assumed that the business might retrieve its preliminary investment in more than six years. Conversely, to obtain the capital invested in two years or less, the closed scheme may be a very profitable system to be applied to the broiler farmhouse. Further, many agricultural businesses need more than five years to repay their capital investment. Therefore, to recover fixed spending swiftly, farms used closed system appears to be a feasible choice. Concerning incentive scenarios, other similar indicators with the applying of ACA on ITA tax inducement resulted in the smaller PBP of open and closed schemes are around 2.91 and 1.68 years, respectively to recuperate the capital invested. Consequently, the need for broiler farm to ascertain the system is advocated for superior cash flow and financial feasibility.

Figure 4: Pay Back Period PBP Results

Sensitivity Analysis

Conducting a sensitivity analysis is essential to expect any moving situation in the market alteration in the project assessment, this method is furthermore suitable to reduce the risk in assessing the verdict of project valuation which may be recommended to investors. The error change in the examination of possible alteration and the influence of the rate in an economic model might generate a parameter implication via the sensitivity analysis role (Pannell, 1997). In the current study, the alteration in costs appraises the economic indicators of the project of broiler contract valuation is demonstrated in Table 1. The research proposed the alteration of shifting the cost of feed and the expenses of DOC as these costs are introduced as the core expenditure of project process in broiler farmhouses percentages applied for the simulation are by 20%, and 50%.

From the outcome in Table 1, increasing the cost of feed by 20% for the open and closed coop of broiler contract farms, the financial valuation indicators are sustained in the profitable assessment in the closed system. The change of IRR value for the close system is dropped from 43% to 31%, while the open system is noticeably declined by 5% of the base rate of IRR. Once the feed input rises by 50%, a value of the open system was dramatically changed; the industry serves as worsening feasibility; the NPV value is negative, IRR value is below than discount rate and the firm may not get a profit regarding PI. In contrast, when the feed cost increased by (50%), the closed system remains in line with the lucrative project evaluation. The IRR shows a decline from 43% to 25%; certainly, still profitable. Moreover, the results of the second scenario as a rise of Day Old Chick cost, close system are not showing a major problem. Whereas open system NPV values dropped to be negative and IRR declined to less than the discount rate. Recently the world facing an increasing trend of cereal prices (in particular corn and soya bean) which are challenging the industry, hence it is vital that the industry find cheaper feed alternative particularly from local like palm kernel cake (PKC) to maintain its competitiveness and sustainability (Awad et al., 2015). Nevertheless, the finding provides similar outcome with (Singh et al., 2010) that investment of broiler farms is financially viable except the small stockbreeders are extremely sensitive in increasing costs. It is agreed that a broiler farm investment focusing on contract broiler production is a comparatively easy business to run. The fluctuating prices tend to compensate for each other for a positive net profit. Nevertheless, if a worst scenario of low prices of chicken and high prices of feed arise, good management practices would be critical to maintain profitability.

Conclusion

In conclusion, farmers may choice the simultaneous tax incentives when Accelerated Capital Allowance (ACA) on Investment Tax Allowance (ITA) to achieve the best feasibility of the project profitability. An open system is sensitive to changes in the cost of feed and the rise of DOC cost whereas the closed system may be adequately sustained during the feed cost increment. It can be said that in the long-term projection the open coop technology has a higher risk than the closed coop technology. Hence, the study advocated that the government shall apply the incentive schemes. At the same time, alternative feed sources should be developed from local materials to avoid the adverse impact of high feed cost on the feasibility of the broiler project.

Acknowledgment

The authors acknowledge the grant research (No: 5526015) from the Ministry of Education (MOE), Malaysia for data collections.

Conflict of interest

The authors declare no conflict of interest.

authors contribution

The authors contributed equally.

References