Nexus between Money Supply and Food Prices: An Empirical Evidence from China

Review Article

Nexus between Money Supply and Food Prices: An Empirical Evidence from China

Khalid Khan1*, Hazrat Yousaf1, Noor Mohammad1, Munir Khan1 and Do Thi Thao2

1Lasbela University of Agriculture, Water and Marine Scienes (LUAWMS), Uthal, Balochistan, Pakistan; 2, School of Hospitality and Tourism, Hue University, Vietnam.

Abstract | This study aims to explore the impact of money supply on food prices in China. It investigates the time series data from 1995 to 2018 by employing Autoregressive Distributed Lag (ARDL) technique. Empirical results indicate that money supply has a significant and positive impact on food prices, as food prices are unswervingly linked to food security, real disposable income of households’and food production. The results of the study also revealed that the implication of monetary policy will be a significant instrument to influence poverty, food security, and consumption patterns in China.

Received | May 28, 2019; Accepted | June 21, 2019, 2019; Published | June 30, 2019

*Correspondence | Khalid Khan, Lasbela University of Agriculture, Water and Marine Scienes (LUAWMS), Uthal, Balochistan, Pakistan; Email: [email protected]

Citation | Khan, K., Yousaf, H., M0hammad, N., Khan, M. and Thao D.T., 2019. Nexus between money supply and food prices: An empirical evidence from China. Journal of Innovative Sciences, 5(1): 36-39.

DOI | http://dx.doi.org/10.17582/journal.jis/2019/5.1.36.39

Keywords | Food prices, Autoregressive distributed lag (ARDL), Money suppy

1. Introduction

Food prices in China are significantly grown over the last 20 years. Therefore, instability of food prices has been the main apprehension for policymakers. It affects both households’ disposable income and living standard of the masses. Typically, in the market economy, invisible hands such as supply and demand determine the price of any commodity and the same are admissible in case of food prices. In the recession, when supply exceeds demand, the prices of food items drop down vice versa.

In addition, food prices normally perpetuate serious political and economic consequences because most of the households from poor and middle class spend their 70 percent of income on food commodities. Besides, unstable food prices not only increase insecurity among farmers but also affect their investment decisions adversely. Other than that, the volatility of food prices has important policy implications for farmers in terms of credit, incomes and agricultural productivity. Consequently, stabilization of macroeconomic prices is indispensable for the long-term reforms in the economy.

Published research in the area also established the role of money supply in fluctuating the food prices. For instance, Peng et al. (2004) examined the effects of monetary variables on food prices in China. Bessler and David (1984) exhibited the positive relationship between money supply and prices of agriculture commodities. Devadoss and Meyers (1987) emphasized that the comparison of the prices of industrial commodities, agricultural prices are more responsive to the money supply in the United State. Saghaian et al. (2002) demonstrated that money supply has absolute linkage with food prices in the USA.

Presently in China, after twenty years of structural and macroeconomic adjustment programs, the food prices are mounting at a rapid rate. Nevertheless, food prices volatility is generally responsible for a lot of macroeconomic instabilities. More specifically, during the last decade in China, the food prices have increased remarkably. It amplified the concerns of policymakers and other government authorties.

China is one of the emerging economies which has recently acquired the status of upper-middle-income country. Notwithstanding, although China fascinating increase in per capita income lift up hundreds of millions of people out of the poverty line, but still socioeconomic problems such as cooling of the economy, reduction in GDP growth, high-income inequality, rural-urban division, general inflation, and food inflation need to be addressed in the country.. In the scenario where Chinese policymakers are striving hard to eradicate the absolute poverty from China by 2020, stability in the food prices have become key aspect for the policymakers aiming to keep the poor above the poverty line. Any kind of upsurge in food prices can lead to pushing back a lot of people below the poverty line which eventually can upset the Chinese objective of the poverty eradication. Keeping the economic phenomenon in mind, it is vital to study the nexus between monetary expansion and food prices in China. Therefore, the purpose of this study is to examine the effects of China monetary expansion on food prices.

2. Materials and Methods

2.1 Data and variables

The study applied time series data from 1995 to 2018. The proxies which are applied for money supply and food prices are M2 and Consumer Price Index (CPI) respectively. All the variables are deflated by GDP deflator 2010 to get their real values. Annual data was extracted from International Financial Statistics (IFS).

The study employes the ARDL technique to achieve the objective of the study. The ARDL approach has some econometric advantages over other econometrics techniques which can be applied in the given situation. First, the ARDL technique tackles the problem of endogeneity proficiently. Second, this technique is applicable nevertheless variables are integrated at level/ first difference/ mixed of both. Third, a dynamic Error Correction Model (ECM) term which shows the speed of adjustment of the model toward equilibrium, can be easily projected through a simple linear transformation. Last, the ARDL technique assumes that all variables are endogenous. However, to establish a long-term relationship among the variables, F-test developed by Pesaran et al. (2001) is also applied. The approach defines two groups of essential values. The first group supposed that all of the variables are stationary at level while the second group of values presumed that variables are non-stationary at level but stationary on the first difference.

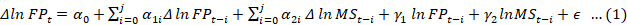

In addition, for the sake of robust econometric results of the variables, the model is converted into natural logarithms as suggested by Cameron (1994) and Khan et al. (2012). The ADRL framework of the study is as under;

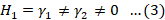

Whereas, the long run coefficients of Equation (1) are α1i and α2i while the short run parameters are y1 and y2 Hereafter, the null and alternative hypotheses of Equation (1) are given below;

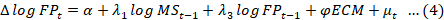

The null hypothesis tested through the bounds test to compare the computed F-statistic value with tabulated critical values provided by Pesaran et al. (2001). If the computed value of F-statistic greater than the upper-level values of the bound test, then the null hypothesis will be rejected. Nevertheless, if the calculated value of F-statistic lies below the lower and upper bounds, then the result would be inconclusive. After the validation of the co-integration among the variables, Equation (4) is estimated for the short run relationship and as well as for ECM.

Finally, to test the significance of the estimated results, the model is also tested for stability and standard diagnostic checks.

2.3 Experimental work of the study

Formerly to apply any econometric technique to the data for the factual results, it is vital to test the data for stationarity. For this purpose, the Augmented Dickey Fuller (ADF) and Phillips Perron (PP) tests have been applied. Further, the stationarity test is also one of the pre-requisites for the applicability of the ARDL technique.

Henceforth, Table 1 illustrates the empirical results of ADF and PP tests. The results revealed that all the variables are stationary on the first difference. Henceforward, the ARDL technique is applicable to the data.

Table 1: Results of PP and ADF.

|

Variables |

PP |

ADF |

|

Ln (MS) |

-1.11 |

-1.14 |

|

Δ Ln (MS) |

-9.51** |

-6.10** |

|

Ln (FP) |

-0.30 |

0.29 |

|

Δ Ln FP |

-4.11** |

-3.31* |

Note: ***p<0.01; **p<0.05; * p<0.10.

Table 2: Results of ARDL (1, 1, 1, 0, 1) model.

|

Variables |

FPt-1 |

MS |

|

|

Coefficients |

0.43*** |

-0.49** |

|

|

T -Values |

3.81 |

-2.97 |

|

|

R2 |

0.98 |

DW |

|

|

F-Sat (7,32) |

1452*** |

Adj: R2 |

0.97 |

|

AIC |

-897 |

SBC |

-904 |

Note: ***p<0.01; **p<0.05; * p<0.10.

Hereafter, the bound test was applied to test the long-run association between the variables. The critical values of bound test for the lower bound on 1%, 5%, and 10%, are 2.425, 2.850, and 3.81 respectively. Whereas, the calculated F-statistic is 12.0101, which is greater than all critical values of bound test on the different significance level. Consequently, the null hypothesis of no long-run relationship is rejected, and it is clinched that both variables are co-integrated with each other in the long run.

Similarly, Table 3 exhibits the results of the ARDL model. Morespecifically, row one, two, three and four report the long run results while row five to nine postulate the short-run results of the ARDL model. The long-run results show that the coefficient of the money supply appears statistically significant with accurate sign and magnitude. It indicates that money supply played an important role in the long -run determination of food prices in China. Likewise, the model revealed the same inference for the short run. However, the magnitude of the short-run coefficient of the money supply is greater than the long-run coefficient. It establishes the fact that the impact of money supply on food prices is robust in short-run as compared to the long-run, which is consistent with the classical perspective of the quantity theory of money. Additionally, Table 3 also depicts the value of the ECM based on the ARDL approach. The value of the coefficient of ECM is -0.43, which suggests that the deviation from equilibrium is corrected by 43 percent over each year.

Table 3: ARDL long run coefficients.

|

Variables |

FP |

MS |

|

Coefficients |

0.410*** |

-0.12* |

|

T –Values |

2.96 |

2.01 |

|

ARDL Model Error Correction Representation |

||

|

Variables |

ΔY |

ΔW |

|

Coefficients |

0.511*** |

-0.49*** |

|

T –Values |

3.840 |

-2.96 |

|

R2 |

0.75 |

|

|

F-Sat(7,32) |

24*** |

|

|

Diagnostic test |

||

|

Diagnostic test |

x2 |

P-Values |

|

LM test serial correlation |

15.89 |

-0.081 |

|

White test for heteroscedisticity |

3.56 |

0.023 |

|

Ramsey’s Reset test for functional form |

0.55 |

0.002 |

Note: ARDL (0, 0, 1, 0, and 1) based on SBC and ***p<0.01; **p<0.05; * p<0.10.

The outcomes of the standard diagnostic tests are reported at the bottommost of Table 3. These results indicate that the model contented the entire standard diagnostic tests of autocorrelation, normality, functional form, and heteroscedasticity.

3. Conclusions

This study applied the ARDL approach to estimate the impact of money supply on food prices. The empirical results illustrated that the money supply has a positive impact on the food prices in China. Consequently, it can be concluded that the effect of money supply on food prices is not neutral in the long run. It is therefore proposed that the monetary policy should be the best instrument to control inflation in general and food inflation in China. Moreover, there is a strong indication that inflation puts agricultur sector under enormous pressure. Nevertheless, this study has significant implication for the monetary and food price authorities. By considering the strong correlation between the variables, this study recommends that policymakers in agriculture sector and macroeconomics should work together to develop policy reforms for the food prices in China.

Authors Contribution

Khalid Khan and Hazrat Yousaf prepared the first draft of the manuscript and did the overall supervision. Whereas Noor Mohammed, Munir Khan and Do Thi Thao contributed to the data collection, cleaning, estimation and interpretation.

References

Tweeten, L.G., 1980. Macroeconomics in crisis: Agriculture in an underachieving economy. American Journal of Agricultural Economics, 62(5): 853-865. https://doi.org/10.2307/1240273

Bessler, D.A., 1984. Relative prices and money: a vector autoregression on Brazilian data. American Journal of Agricultural Economics, 66(1): 25-30. https://doi.org/10.2307/1240612

Cameron, S., 1994. A review of the econometric evidence on the effects of capital punishment. The Journal of Socio-Economics, 23(1-2): 197-214. https://doi.org/10.1016/1053-5357(94)90027-2

Devadoss, S., and Meyers, W.H., 1987. Relative Prices and Money: Further Results for the United States. American Journal of Agricultural Economics, 69(4). https://doi.org/10.2307/1242195

Engle, R.F. and Granger, C.W., 1987. Co-integration and error correction: representation, estimation and testing. Econometrica: Journal of the Econometric Society, 251-276. https://doi.org/10.2307/1913236

Khan. K. and Manzoor H.M., 2012. The testing of Hall’s Permanent Income Hypothesis: a case study of Pakistan. Asian Economic and Financial Review 2(4): 518-522

Layson, S., 1983. Homicide and deterrence: Another view of the Canadian time-series evidence. Canadian Journal of Economics, 52-73. https://doi.org/10.2307/134975

Peng, X., Marchant, M.A. and Reed, M.R., 2004. Identifying monetary impacts on food prices in China: A VEC model approach (No. 377-2016-20852).

Perron, P., 1989. The great crash, the oil price shock, and the unit root hypothesis. Econometrica: Journal of the Econometric Society, 1361-1401. https://doi.org/10.2307/1913712

Pesaran, M.H., Shin, Y. and Smith, R.J., 2001. Bounds testing approaches to the analysis of level relationships. Journal of applied econometrics, 16(3): 289-326. https://doi.org/10.1002/jae.616

Saghaian, S.H., Reed, M.R. and Marchant, M.A., 2002. Monetary impacts and overshooting of agricultural prices in an open economy. American Journal of Agricultural Economics, 84(1): 90-103. https://doi.org/10.1111/1467-8276.00245

To share on other social networks, click on any share button. What are these?