Impact of Foot and Mouth Disease (FMD) Outbreak on Financial Performance of Koperasi Peternakan Bandung Selatan (KPBS) Pangalengan

Research Article

Impact of Foot and Mouth Disease (FMD) Outbreak on Financial Performance of Koperasi Peternakan Bandung Selatan (KPBS) Pangalengan

Khansa N. Salsabilah*, Achmad Firman, Lilis Nurlina

Department of Social Economics, Faculty of Animal Husbandry, Padjadjaran University, Jl. Raya Bandung Sumedang Km 21 Jatinangor, Sumedang, Indonesia.

Abstract | The Foot and Mouth Disease (FMD) outbreak that occurred in Indonesia had an impact on the dairy cattle industry. KPBS Pangalengan is one of the dairy cooperatives that is also affected by the FMD outbreak and is feared to affect financial performance at KPBS Pangalengan. The purposes of this study are to determine the milk production and population of dairy cows before and during the FMD outbreak so that the impact can be known, and analyze the impact of FMD outbreak on the financial performance of KPBS Pangalengan. The financial performance analysis method was carried out using the Guidelines for Health Assessment of Savings and Loan Cooperatives and Cooperative Savings and Loan Units: Regulation of the Deputy for Supervision of the Ministry of Cooperatives and Small and Medium Enterprises of the Republic of Indonesia Number 06/PER/DEP.6/IV/2016 and Key Performance Indicators (KPI). Financial performance analysis emphasizes aspects of capital, quality of productive assets, efficiency, liquidity, and independence and growth. Meanwhile, KPIs emphasize the achievements of all financial aspects, where the KPI value is between 0 – 100%. Milk production, dairy cow population, and financial data were obtained from the 2021 and 2022 Annual Reports of KPBS Pangalengan. The results of the study based on the annual reports of KPBS Pangalengan show that the population of dairy cows at KPBS Pangalengan before FMD was 7,325 heads and during the FMD period was 5,870 heads or a decrease of 19%. The decrease in the number of dairy cows has also resulted in a decrease in milk production. Based on the reports, total milk production before FMD was 27,155,887.40 kg, and during FMD was 21,412,659.88 kg, or a decrease of 21%. Decreased milk production impacts financial performance before and during FMD. The results of the financial performance analysis determines that the value of financial performance before FMD was 57.50, and 56.79 during FMD. The financial performance value decreased slightly because FMD outbreak has occurred since 9 months in the study. This value has an impact on the KPI grading result, which is sufficient/enough. Long-term implications can adversely affect the performance and operations of KPBS Pangalengan in serving its members. Therefore, it is recommended to replace dairy cows that have been affected by FMD with imported dairy cattle.

Keywords | Milk production, Dairy cow population, Financial performance, FMD, Key performance indicator, Cooperatives

Received | June 11, 2024; Accepted | July 04, 2024; Published | August 09, 2024

*Correspondence | Khansa N. Salsabilah, Department of Social Economics, Faculty of Animal Husbandry, Padjadjaran University, Jl. Raya Bandung Sumedang Km 21 Jatinangor, Sumedang, Indonesia; Email: khansa18004@mail.unpad.ac.id

Citation | Salsabilah KN, Firman A, Nurlina L. 2024. Impact of foot and mouth disease (FMD) outbreak on financial performance of Koperasi Peternakan Bandung Selatan (KPBS) Pangalengan. Adv. Anim. Vet. Sci. 12(9): 1740-1751.

DOI | https://dx.doi.org/10.17582/journal.aavs/2024/12.9.1740.1751

ISSN (Online) | 2307-8316; ISSN (Print) | 2309-3331

Copyright: 2024 by the authors. Licensee ResearchersLinks Ltd, England, UK.

This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

INTRODUCTION

Dairy cattle are one of the ruminant commodities that have become part of the lives of farming communities in Indonesia, including West Java. One of the largest dairy cattle development centers in Indonesia is located in West Java. The Central Bureau of Statistics (2023) reports that West Java has the third-highest population of dairy cattle in Indonesia, behind East Java and Central Java. West Java also accounts for 20% of Indonesia’s overall dairy cattle population.

The biggest challenge facing the dairy cattle business is the spread of Strategic Infectious Animal Diseases (SIAD). One of the SIAD diseases feared by the dairy farming community is foot and mouth disease (FMD). The disease is characterized by fever, anorexia, excessive salivation, rashes on the lips, feet, udder, and also difficult to stand and limps (Ismail et al., 2023; Okti et al., 2023). The disease affects animals with cloven-hoop, including pigs, goats, sheep, dairy cattle, and beef cattle (Firman et al., 2022; Sutawi et al., 2020).

Foot and mouth disease has returned in Indonesia since April 2022, even though Indonesia was declared free in 1990 by the Office International des Epizooties (OIE). (West Java Food Security and Livestock Service Office, 2023). Given that West Java is one of Indonesia’s main centers for the growth of dairy cattle, in fact that the dairy cow industry is undoubtedly also hit the effects of the FMD outbreak. According to the Office, there were 42,230 FMD cases in dairy cattle in West Java in 2022, including 3,159 dead heads, 5,313 heads that required conditional slaughter, and 33,711 recoveries. The impact of FMD on the dairy industry is a 25% decrease in annual milk production, 10% less in fertility, slowed pregnancy, offspring deaths, and the culling of animals with persistent infections (Veterinary Research Center, 2000).

In the dairy cattle industry, dairy cooperatives play an important role in serving dairy farmers as members, such as collecting and distributing milk, concentrate feed supply, artificial insemination and animal health, savings and loan services, and providing credit guarantees. The role of cooperatives is huge for the development of dairy cattle, therefore problems that occur, such as FMD outbreaks, affect not only cooperatives but also dairy farmers.

KPBS Pangalengan is one of the largest dairy cooperatives out of 16 cooperatives in West Java province. The amount of fresh milk production reaches more than 20 million kg/year before 2022. Since April 2022, FMD outbreaks have continued to spread rapidly, especially in dairy farms, as farms are close to each other, including KPBS Pangalengan. In addition, the movement of people into dairy cowsheds is not strictly guarded, accelerating the spread of the FMD virus. In the four months since April 2022, there have been cases of dairy cattle deaths, or forced slaughter with veterinary permission, and cases of illness, the peak of which occurred in August 2022. The government conducted FMD vaccination at the end of August 2022. Since the vaccination program, FMD cases in dairy cattle have started to decline. However, dairy cows are affected by the FMD virus and then recover, their milk production maximun reaches 70%-80% (Aldeyano et al., 2023).

The number of cases of dairy cow deaths, forced slaughter, and decreased productivity of dairy cows has an impact on the amount of milk production produced by dairy farmers in the Pangalengan area. Another impact is a decrease in revenue from the sale of milk from cooperatives to milk processing companies. Based on the annual report of KPBS Pangalengan (2022), there was a 21.15% decrease in revenue and 6.99% loss of dairy cows during the FMD outbreak from April to December 2022.

Based on the background above, previous research has illustrated the negative impact of FMD outbreaks on dairy cattle. It is interesting to study the effect of the FMD outbreak that occurred for 9 months from April to December 2022 on the largest dairy cooperative in West Java, especially on milk production and financial performance. Consequently, in order to assess the cooperative’s financial standing, it is essential to examine its financial performance because financial performance is one of the success factors of an institution or company (Kotane and Merlino, 2012).

Research on the financial performance of cooperatives during the PMK period is still limited, especially at KPBS Pangalengan, therefore this research can be used to improve the financial performance of cooperatives in several aspects of financial assessment. According to Regulation of the Deputy for Supervision of the Ministry of Cooperatives and Small and Medium Enterprises of the Republic of Indonesia Number 06/PER/DEP.6/IV/2016, some aspects of cooperative financial performance assessment are aspects of capital, quality aspects of productive assets, efficiency aspects, liquidity aspects, and aspects of independence and growth. Previous research related to financial performance on several aspects of liquidity, activity, solvency, and profitability had good performance at KPBS Pangalengan before FMD (Sumantri et al., 2005). Meanwhile, there was a decrease in the aspects of capital, liquidity, and independence and growth in the KPS Bogor cooperative (Firman et al., 2024). The latest research can hypothesize that FMD can reduce financial performance at KPBS Pangalengan.

Therefore, impact of Foot and Mouth Disease (FMD) outbreak on financial performance of KPBS Pangalengan is an interesting topic to research. The purpose of this study is

Table 1: Aspects of Cooperative Financial Performance Assessment According to the Ministry of Cooperatives and SMEs Number 06/PER/DEP.6/IV/2016.

|

No |

Aspect |

Component |

Ratio Value (%) |

Indicator Value |

|

1 |

Capital |

|||

|

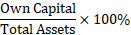

Ratio of Own Capital Ratio to Total Assets |

0 |

0 |

||

|

1 – 20 |

25 |

|||

|

21 – 40 |

50 |

|||

|

41 – 60 |

100 |

|||

|

61 – 80 |

50 |

|||

|

81 – 100 |

25 |

|||

|

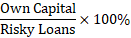

Ratio of Own Capital to Risky Loans |

0 |

0 |

||

|

1 – 20 |

25 |

|||

|

21 – 40 |

50 |

|||

|

41 – 60 |

100 |

|||

|

61 – 80 |

50 |

|||

|

81 – 100 |

25 |

|||

|

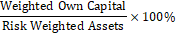

Ratio Own Capital Adequacy |

< 4 |

0 |

||

|

4 ≤ x < 6 |

50 |

|||

|

6 ≤ x < 8 |

75 |

|||

|

> 8 |

100 |

|||

|

2 |

Earning Assets Quality |

|||

|

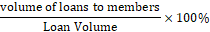

Loan Volume Ratio |

≤ 25 |

0 |

||

|

26 – 50 |

50 |

|||

|

51 – 75 |

75 |

|||

|

> 75 |

100 |

|||

|

Non-Performing Loan Risk Ratio |

≥ 45 |

0 |

||

|

40 < x < 45 |

10 |

|||

|

30 < x ≤ 40 |

20 |

|||

|

20 < x ≤ 30 |

40 |

|||

|

10 < x ≤ 20 |

60 |

|||

|

0 < x ≤ 10 |

80 |

|||

|

0 |

100 |

|||

|

Risk Reserve Ratio |

0 |

0 |

||

|

1 – 10 |

10 |

|||

|

11 – 20 |

20 |

|||

|

21 – 30 |

30 |

|||

|

31 – 40 |

40 |

|||

|

41 – 50 |

50 |

|||

|

51 – 60 |

60 |

|||

|

61 – 70 |

70 |

|||

|

71 – 80 |

80 |

|||

|

81 – 90 |

90 |

|||

|

91 – 100 |

100 |

|||

|

3 |

Efficiency |

|||

|

Ratio of Operating Expenses for Cooperative Member |

≥ 100 |

0 |

||

|

95 ≤ x < 100 |

50 |

|||

|

90 ≤ x < 95 |

75 |

|||

|

< 90 |

100 |

|||

|

b. Ratio of Operating Expenses |

> 80 |

25 |

||

|

60 < x ≤ 80 |

50 |

|||

|

40 < x ≤ 60 |

75 |

|||

|

≤ 40 |

100 |

|||

|

Service Efficiency Ratio |

< 5 |

100 |

||

|

5 < x < 10 |

75 |

|||

|

10 ≤ x ≤ 15 |

50 |

|||

|

> 15 |

0 |

|||

|

4 |

Liquidity |

|||

|

Cash Ratio |

≤ 10 |

25 |

||

|

10 < x ≤ 15 |

100 |

|||

|

15 < x ≤ 20 |

50 |

|||

|

> 20 |

25 |

|||

|

Loan to Fund Ratio |

< 60 |

25 |

||

|

60 ≤ x < 70 |

50 |

|||

|

70 ≤ x <80 |

75 |

|||

|

80 ≤ x <90 |

100 |

|||

|

5 |

Independence and Growth |

|||

|

Asset Rentability |

< 5 |

25 |

||

|

5 ≤ x < 7.5 |

50 |

|||

|

7.5 ≤ x < 10 |

75 |

|||

|

≥ 10 |

100 |

|||

|

b. Cooperative Equity Rentability |

< 3 |

25 |

||

|

3 ≤ x < 4 |

50 |

|||

|

4 ≤ x < 5 |

75 |

|||

|

≥ 5 |

100 |

|||

|

c. Service Operational Independence |

≤ 100 |

0 |

||

|

> 100 |

100 |

|||

to determine the milk production and population of dairy cows at KPBS Pangalengan before and during the FMD outbreak and analyze the impact of the FMD outbreak on the financial performance of KPBS Pangalengan.

MATERIALS AND METHODS

Object and subject of research

The objects studied were data related to the dairy cow population, milk production, and financial statements obtained from the Annual Report of KPBS Pangalengan in 2021 and 2022. The research subjects are informants from KPBS Pangalengan consisting of three cooperative administrators, two financial staff, two production staff, and 2 heads of dairy farmer group representatives.

Research location and data collection

The research location was determined by purposive sampling, namely KPBS Pangalengan, West Java-Indonesia. The dairy cooperative is the first dairy cooperative established in Indonesia and also the largest cooperative in West Java.

The data research consisted of primary and secondary data. Primary data was obtained from informants consisting of three cooperative administrators, two financial staff, two production staff, and two heads of dairy farmer group representatives through a questionnaire guide. Meanwhile, secondary data was obtained from KPBS Pangalengan, namely the annual report of KPBS Pangalengan in 2021 and 2022 in the form of softfile. Secondary data collected is data related to dairy cow population data, milk production, and aspects of financial performance.

Analysis method

This research is a case study at the KPBS Pangalengan using descriptive quantitative analysis method. A case study is an empirical method empirical method that investigates a contemporary phenomenon or case in depth and in a real-world context, which is used especially when the boundaries between phenomenon and context are not clearly visible (Yin, 2018). This research is focused on the phenomenon of the KPBS Pangalengan work area, therefore the results of this research cannot be used for other dairy cooperative areas in West Java.

The analysis method used for the comparison of milk production and dairy cow population before and during using paired t-test. The hypothesis of this study is H0 if there is no difference between milk production and dairy cow population before and during FMD, while H1 if there is a difference in milk production and dairy cow population before and during FMD.

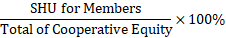

Financial performance analysis consists of capital, quality of productive assets, efficiency, liquidity, independence and growth aspects analyzed using regulation No. 06/PER/DEP.6/IV/2016 see Table 1. The table shows the aspects of financial performance and their assessment measures.

The aggregate results of all aspects of financial performance are measured using Key Performance Index (KPI) and the size value can be seen in Table 2. (Rahardja et al., 2012).

|

Indicator |

Performance Category |

|

Y ≥ 100% |

Very good |

|

75% ≤ Y < 100% |

Good |

|

50% ≤ Y < 75% |

Enough/Sufficient |

|

25% ≤ Y < 50% |

Less |

|

Y < 25% |

Very Less |

RESULTS AND DISCUSSIONS

Milk production and dairy cow population at KPBS Ppangalengan before and during FMD

Actually, the FMD incident occurred in mid-April 2022 but the Indonesian Government through the Ministry of Agriculture announced it in the early week of May 2022. Initially, FMD was detected in Gresik, Lamongan, Mojokerto and Sidoarjo districts in East Java Province and Aceh Tamiang district, Aceh Province (Firman et al., 2022). Since then, the FMD outbreak spread rapidly within four months throughout Indonesia, including to KPBS Panglengan, West Java (Figure 1). The figure shows the spread of the virus in the Pangalengan region (marked in green). The entire region has been affected by the FMD virus. According to the Department of Food Security and Livestock, West Java Province (2023) reports that According to the Department of Food Security and Livestock, West Java Province (2023) reported that 14,097 dairy cows were sick, 762 dairy cows died, 1,096 dairy cows were slaughtered with veterinary permission, and 12,239 dairy cows recovered.

Table 3: Condition of KPBS Pangalengan before and during FMD outbreak.

|

Assessment Criteria |

Month |

|||||||||||

|

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

|

|

Milk Production (kg/month) |

||||||||||||

|

2021 |

2,202 |

2,235 |

2,297 |

2,283 |

2,243 |

2,240 |

2,179 |

2,175 |

2,195 |

2,186 |

2,178 |

2,170 |

|

2022 |

2,566 |

2,318 |

2,530 |

2,403 |

2,307 |

1,892 |

1,869 |

1,681 |

1,630 |

1,601 |

1,614 |

1,648 |

|

Number of Lactation cows (heads) |

||||||||||||

|

2021 |

6,568 |

6,562 |

6,562 |

6,563 |

6,530 |

6,670 |

6,775 |

6,858 |

6,768 |

6,662 |

6,762 |

6,894 |

|

2022 |

7,279 |

7,186 |

7,137 |

7,097 |

7,050 |

6,988 |

6,476 |

6,281 |

6,231 |

6,192 |

6,184 |

5,870 |

Source: KPBS Pangalengan Financial Statements for 2021 and 2022.

The development of milk production and lactating dairy cow population in the study area can be seen in Table 3. The table shows the difference in milk production and lactating dairy cow population between 2021 and 2022 (highlighted in gray is the start of FMD). In 2021 to May 2022, milk production growth was above 2,000 tons/month. However, milk production has decreased dramatically since June 2022 below 1,892 tons/month.

Table 4: Paired T-tests on milk production and population of lactating dairy cows before and during FMD.

|

Variable |

N |

Mean |

St. Dev |

Correlation |

Sig |

|

Lactating Dairy Cow Population |

|||||

|

2021 |

12 |

6680.4167 |

127.40591 |

-.492 |

.105 |

|

2022 |

12 |

6830.9167 |

653.84923 |

||

|

Milk Production |

|||||

|

2021 |

12 |

2215216.5000 |

43532.54299 |

.767 |

.004 |

|

2022 |

12 |

2004977.7500 |

388379.18699 |

||

Table 4. shows the results of the comparison analysis using Paired T-tests. The results show that there is a significant difference for the milk production variable, while there is no significant difference for the lactating dairy cow population variable. Therefore, the impact of FMD does not have a significant effect on reducing the number of lactating dairy cows, but it does have a significant impact on milk production.

Financial performance of KPBS Pangalengan before and during FMD outbreak

The analysis of the cooperative’s financial performance follows the ministry regulations mentioned earlier. There are five aspects used to measure financial performance, namely aspects of capital, productive asset quality, efficiency, liquidity, and aspects of independence and growth. The results of the analysis of the financial aspects are described as follows.

Capital aspects

The ratio of own capital to total assets and the own capital’s capacity to handle and repay riskier loans are used to gauge the capital component and the company’s ability to support its whole asset base (Putri and Pasek, 2023). Supported by the statement of Gunarwati, et al. (2020), capital structure is a crucial aspect for cooperatives because it directly affects the financial position of the cooperative, it is known that the optimal capital structure is able to maintain a balance between risk and return.

The results of the analysis of the capital aspects of KPBS Pangalengan before and during FMD show that the decline in the performance of capital aspects based on its three variables (Table 5). This shows that the impact of FMD for nine months (April - December 2022) affects the capital aspect even though the decline is still low. The capital aspect is very important for cooperatives because the cooperative’s ability to win over members’ trust and receive their money for investment will also be indicated (Hidayatin et al., 2022). The results of another study showed the same decline in capital aspects during FMD in the KPS Bogor, a dairy cooperative in Bogor District, West Java (Firman et al., 2024).

The results of the analysis show that the ratio of own capital to total assets at KPBS Pangalengan both before and during FMD resulted in the same ratio, namely 32.65%. It can be said to be not optimal because it has not reached a balance between the amount of own capital and total assets, therefore cooperative was needed to equalize it. The cooperative’s ability to cover the likelihood of risky loans is demonstrated by the ratio of own capital to risky loans. As hazardous loans can be insured by own capital, a larger ratio of own capital to risky loans indicates a stronger cooperative environment (Kalefi, 2018). The analysis’s findings indicate that a rise in risky loans during PMK has resulted in a 6.92% fall in the own capital to risky loan ratio (Table 5). The performance of cooperative capital will be impacted by the rise in risky loans, which resulted from a decline in milk output and the loss of productive dairy cows, which caused members to fall behind on their payments. Analysis of the own capital adequacy ratio shows the adequacy of the capital owned by the cooperative in anticipating the risk of loss where the higher the ratio value indicates the healthier the capital adequacy of a cooperative (Hidayatin et al., 2022). According to Kalefi (2018), the own capital adequacy ratio is said to be healthy if the value is more than 8% because own capital can guarantee risk-weighted assets (ATMR). The results showed a decrease in the capital adequacy ratio during the FMD, however, it should be noted that both in the period before the FMD and during the FMD, the value of KPBS Pangalengan’s own capital adequacy ratio showed a figure above 8%, meaning that the capital adequacy owned was still able to anticipate the risk of loss during the FMD period.

Table 5: Capital aspects of KPBS Pangalengan.

|

No. |

Capital Aspects |

Before FMD (2021) (%) |

During FMD (2022) (%) |

|

1 |

Ratio of Own Capital to Total Assets |

32.65 |

32.65 |

|

2 |

Ratio of Own Capital to risky loans |

97.00 |

90.08 |

|

3 |

Capital Adequacy Ratio |

95.00 |

94.00 |

Source: Secondary data after processing, 2024.

Productive asset quality aspects

Overall, the quality of productive assets declined during FMD at KPBS Pangalengan (Table 6). Farmers do not borrow credit from cooperatives because they do not have collateral or are afraid of not being able to pay the installments. To cover their daily livelihoods, many farmers sold their assets, such as land and dairy cows. This is different from the KPS Bogor dairy cooperative where this aspect of the ratio has increased due to an increase in the volume of loans by farmers (Firman et al., 2024). Analysis of the quality aspects of productive assets is carried out to determine how much assets are producing, because the placement of these assets is to achieve the expected level of income (Tarsono and Haspian, 2022). The ratios used in analyzing the quality aspects of productive assets consist of loan volume ratios, non-performing loan risk ratios, and risk reserve ratios.

Table 6: Productive asset quality aspects of KPBS Pangalengan.

|

No. |

Productive Asset Quality Aspects |

Before FMD (2021) (%) |

During FMD (2022) (%) |

|

1 |

Loan Volume Ratio |

20.79 |

18.57 |

|

2 |

Non-performing Loan Risk Ratio |

8.60 |

9.92 |

|

3 |

Risk Reserve Ratio |

351.49 |

269.58 |

Source: Secondary data after processing, 2024.

Analysis of the loan volume ratio is carried out to determine the level of cooperative saving and borrowing activities to its members (Susandini and Fatmawati, 2017). Based on the results of the analysis, it is known that the loan volume ratio of KPBS Pangalengan during FMD has decreased because the members’ savings and borrowing activities have decreased during the FMD period (Table 6). The findings of the interview results show that the decline in savings and borrowing activities occurred because farmers were reluctant to make loans to cooperatives during the FMD period because they did not have collateral due to the death of their dairy cows. Therefore, they were worried to unable repay their debts to the cooperative. Meanwhile, farmers tend to prefer selling their assets to fulfill their daily needs, namely land asset.

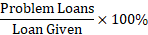

By comparing non-performing loans with loans issued by cooperatives, the ratio of the risk of non-performing loans to loans provided is analyzed in order to determine the risk of non-performing loans from all loans provided (Susandini and Fatmawati, 2017). The likelihood of non-performing loans occurring decreases with a lower resultant ratio (Kalefi, 2018). The results of the analysis show that KPBS Pangalengan experienced an increase in the ratio of non-performing loan risk during FMD so that it can be seen that the level of risk of non-performing loans was higher during the FMD period. This is due to the decline in the ability of farmers to return loans to cooperatives due to the impact on farmers’ dairy cattle businesses due to FMD. Supported by the statement of Firman, et al. (2024), namely one possibility of an increase in the risk of non-performing loans is due to the inability of money borrowers, namely farmers, to return their loans to cooperatives so that this becomes a burden for cooperatives in managing their finances.

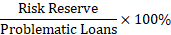

The risk reserve ratio shows the ability of the risk reserves owned by the cooperative to cover problematic loans, the higher the ratio value, the better because the risk reserves are able to cover problematic loans (Kalefi, 2018). The risk reserve ratio of KPBS Pangalengan decreased during the PMK period. The decrease in the risk reserve ratio is indicated due to the reduction in the amount of reserves owned by KPBS during PMK. However, it should be noted that both in the period before PMK and during PMK, the value of the reserve ratio of KPBS Pangalengan showed a figure above 100%, meaning that the cooperative’s asset reserves were still able to cover non-performing loans that increased during the PMK period.

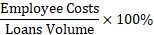

Efficiency aspect

The efficiency aspect is the ability of cooperatives to work by using time, money, and other things related to cooperative operations in the most effective way so as to produce optimal results (Tarsono and Haspian, 2022). There are three indicators that determine financial efficiency in cooperatives, namely the Ratio of Operating Expenses, Ratio of Cooperative Expenses, and Service Efficiency Ratio. The variable Operating Expense Ratio and Cooperative Expense Ratio increased during the FMD period, while the Service Efficiency Ratio decreased due to the cooperative’s efficiency in business and operations (Table 7). This condition is similar to the KPS Bogor cooperative where there was an increase in the ratio for the variable Operating Expense Ratio and Cooperative Expense Ratio, while the Service Efficiency Ratio decreased (Firman et al., 2024).

Table 7: Efficiency aspects of KPBS Pangalengan.

|

No. |

Efficiency Aspect |

Before FMD (2021) (%) |

During FMD (2022) (%) |

|

1 |

Operating expense ratio for cooperative members |

94.53 |

99.12 |

|

2 |

Cooperative operating expense ratio |

92.51 |

94.16 |

|

3 |

Service Efficiency Ratio |

31.00 |

20.00 |

Source: Secondary data after processing, 2024.

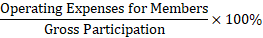

The Ratio of Operating Expenses for cooperative members shows the amount of member operating expenses from the entire amount of gross participation of cooperative members (Putrayasa, et al. 2015). Based on the results, it is known that there was an increase in the Ratio of Operating Expenses at KPBS Pangalengan during the PMK period. This shows that there is a decrease in the efficiency of expenses related to cooperative operational activities incurred by KPBS Pangalengan. In line with the results of research by Firman, et al. (2024) regarding the Ratio of Operating Expenses of KPS Bogor which increased during FMD because the cooperative provided a more intensive level of service in order to prevent and cure dairy cows during FMD.

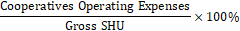

Analysis of the ratio of operating expenses to gross SHU (residual profit) is carried out to measure the level of profit from SHU funds used (Susandini and Fatmawati, 2017). the higher the ratio of operating expenses generated, the higher the operating expenses incurred by the cooperative and the less SHU is indicated. Based on the results of the calculation, it is known that KPBS Pangalengan experienced an increase in the ratio of operating expenses during PMK conditions and this occurred because there was a decrease in gross SHU generated during the PMK period (Table 7). In line with the statement of Firman, et al. (2024) that the impact of FMD affects the business expenses borne by cooperatives and the acquisition of gross SHU.

The service efficiency ratio illustrates the cooperative’s ability to provide efficient services based on its assets. The lower the service efficiency ratio, the higher the cost incurred by the cooperative in providing loan volume so that the cooperative is considered capable of maximizing the service efficiency of the cooperative’s savings and loan activities. The volume of loans becomes a dividing factor in this ratio so that the higher the volume of loans, the lower the ratio value (Firman, et al. 2024). The service efficiency ratio of KPBS Pangalengan decreased during PMK because there was an increase in loan volume during the PMK period. In line with the results of research by Firman, et al. (2024) related to the service efficiency ratio at KPBS Bogor which decreased due to an increase in the volume of loans to cooperatives during PMK conditions.

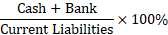

Liquidity aspect

According to Dewi (2016) posits that liquidity serves as a gauge of a firm’s capacity to meet its immediate financial obligations through its accessible assets, and that a high level of liquidity indicates that the company is safe or liquid. However, a level of liquidity that is too high also does not always mean good for the performance of the cooperative because there are assets that are idle or not channeled, therefore it is necessary to ensure that liquidity is at the right level so that all assets can be maximally utilized in order to meet the needs of members (Saputro and Mujino, 2020). Overall, the liquidity aspect variables showed a modest increase in the ratio during the FMD (Table 8). The same thing was done by KPS Bogor in its liquidity aspects (Firman et al., 2024).

Table 8: Liquidity aspects of KPBS Pangalengan.

|

No. |

Liquidity Aspect |

Before FMD (2021) (%) |

During FMD (2022) (%) |

|

1 |

Cash Ratio |

48.36 |

49.08 |

|

2 |

Loan to Fund Ratio |

81.01 |

94.00 |

Source: Secondary data after processing, 2024.

According to Nutri and Wahyuningrum (2019), the cash ratio shows the adequacy of the cooperative’s cash inventory in meeting short-term obligations. The optimal cash ratio that shows the liquidity of the cooperative is at a value of 10 < x ≤ 15 because the cooperative is declared capable of paying short-term obligations with available cash and those deposited in the bank (Kalefi, 2018). Based on the research results, it is known that the cash ratio of KPBS Pangalengan both before PMK and during PMK is not balanced because it shows a figure of more than 15% even during the PMK period the cash ratio has increased. KPBS Pangalengan experienced higher over-liquidity during the FMD period due to the ineffective use of funds during FMD due to the increased intensity of prevention and cure services for FMD-affected cattle so that there were many funds that were not channeled to meet short-term obligations. Over liquidity is a condition where the cooperative has excess funds and this incident is not good because there are indications of activities that are not carried out optimally where management is less able to carry out operational activities properly, especially in terms of using the funds owned (Kasmir, 2016). Based on these conditions, KPBS Pangalengan needs to make efforts to balance the funds channeled to meet its current obligations.

By relying on financing, the ability of cooperatives to repay borrower withdrawals of funds is measured by analysis of the loans to funds ratio (Ulfa, 2020). According to Kalefi (2018), cooperatives are deemed liquid if the percentage of loans given to funds is higher since it indicates that more funds are being distributed to members. Based on the results of the analysis, it is known that the ratio of loans provided to funds at KPBS Pangalengan has increased during the PMK period. This shows that the ability of KPBS Pangalengan to anticipate the withdrawal of funds by members in conditions before and during PMK is considered safe. This result is in line with the research of Firman et al (2024), where the ratio of loans to funds at KPS Bogor both before and during PMK shows a high ratio, which is above 90% so that it is indicated that the cooperative is able to anticipate the withdrawal of funds by members during the PMK period.

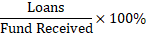

Aspects of independence and growth

The aspect of independence and growth aims to determine the ability of cooperatives to use their capital to residual profit (SHU), while other terms commonly used are profitability (Anwari and Ramadhani, 2017). Assessment of the aspects of independence and growth is carried out on three ratios, namely asset profitability, own capital profitability, and operational independence. Table 9. shows that the value of the independence and growth aspects.

Table 9: Aspects of independence and growth of KPBS Pangalengan.

|

No. |

Capital Aspects |

Before FMD (2021) (%) |

During FMD (2022) (%) |

|

1 |

Asset Profitability |

1.35 |

1.00 |

|

2 |

Own Capital Profitability |

2.81 |

3.04 |

|

3 |

Operational Independence of Services |

109.67 |

107.66 |

Source: secondary data after processing, 2024.

According to Nugroho and Mas’ud (2021), asset profitability is the ratio of SHU to total assets, a high level of profitability indicates higher effectiveness in asset management. According to Kalefi (2018), if the percentage of asset profitability of a cooperative produces a value above 10%, the better the cooperative’s ability to utilize assets to generate SHU. Based on the results of the analysis, it is known that the asset rentability ratio of KPBS Pangalengan in the conditions before and during PMK shows a figure below 5%, even during PMK the ratio has decreased. This condition shows the lack of effectiveness of asset management so that the SHU provided by the cooperative is still relatively small compared to total assets. The remaining results of operations (SHU) can be maximized by increasing income through member participation.

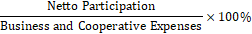

Own capital profitability ratio is an indicator in assessing aspects of independence and growth in cooperatives by measuring the ability of the cooperative’s own capital to generate SHU for members. The remaining profit of the member’s share is SHU obtained by members for the participation of principal savings, mandatory savings, and cooperative service utilization transactions (Nutri and Wahyuningrum, 2019). According to Kalefi (2018), if the ratio of own capital profitability shows >5%, the cooperative can be declared independent with its own capital working in it to generate profits. As for the results of the analysis, it is known that the profitability of own capital of KPBS Pangalengan both before and during PMK is still below 5%. This shows that the condition of KPBS Pangalengan’s own capital profitability is still bad because KPBS Pangalengan’s ability to pay SHU to its members is still low. In line with the statement of Saputro and Mujino (2020), the low rentability of own capital in cooperatives is due to the very small amount of SHU distributed to members when compared to total own capital. According to Tarsono and Haspian (2022), the cause of the low ratio of own capital profitability in cooperatives is the distribution of loans that do not maximize own capital in the form of reserve funds and mandatory savings of members. KPBS Pangalengan needs to increase the SHU income of its members by maximizing the participation of principal savings, mandatory savings, and service transactions.

Analysis of this ratio is carried out to determine how much net participation in covering business expenses and operating expenses incurred by the cooperative. A cooperative is declared to have high operational independence if the resulting operational independence ratio is >100% (Nutri and Wahyuningrum, 2019). Based on the results of the analysis, it is known that KPBS Pangalengan experienced a decrease in the ratio of operational independence during the PMK period. However, both in the conditions before PMK and during PMK, the operational independence ratio of KPBS Pangalengan showed a number >100%. Similar results were also shown in the research of Firman et al (2024) where the operational independence of the Bogor KPS service in conditions before and during FMD showed a number >100%. This indicates that KPBS Pangalengan has operational independence by generating profits in covering operational costs both in conditions before FMD and during FMD.

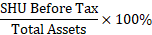

Measurement of financial performance of KPBS Pangalengan with key performance indicator

Overall aspects of the cooperative’s financial performance are measured by Key Performance Indicators (KPI) using Table 2. The KPI score determines the financial performance which is assessed by qualitative measures, namely very good, good, sufficient, less, and very less.

Table 10. shows that the KPI score was the “enough” category both before and during FMD. However, there was a decrease in the value of financial performance during FMD which occurred due to the loss of dairy cattle population and resulted in decreased milk production. However, the upkeep of dairy cows and the treatment of cattle afflicted with FMD continue to be costly for farmers and cooperatives, which has an effect on their income levels. Based on Firman, et al. (2024) reveals the decline in financial performance was due to dairy cow deaths and dairy cows being forcibly slaughtered with veterinary permission. The deriv

Table 10: Measurement of financial performance of KPBS Pangalengan with KPI.

|

No. |

Financial Performance Aspects |

Before PMK (2021) |

During FMD (2022) |

||

|

Ratio Value (%) |

Indicator Value |

Ratio Value (%) |

Indicator Value |

||

|

1 |

Capital |

||||

|

Ratio of equity capital to total assets |

32.65 |

50 |

32.65 |

50 |

|

|

Ratio of equity capital to risky loans |

97.00 |

100 |

90.08 |

90 |

|

|

Own capital adequacy ratio |

95.00 |

100 |

94.00 |

100 |

|

|

2 |

Earning Asset Quality |

||||

|

Loan volume ratio |

20.79 |

0 |

18.57 |

0 |

|

|

Non-performing loan risk ratio |

8.60 |

80 |

9.92 |

80 |

|

|

Risk reserve ratio |

351.49 |

100 |

269.58 |

100 |

|

|

3 |

Efficiency |

||||

|

Ratio of Operating Expenses |

94.53 |

75 |

99.12 |

50 |

|

|

Ratio of Operating Expenses |

92.51 |

25 |

94.16 |

25 |

|

|

Service efficiency ratio |

31.00 |

0 |

20.00 |

0 |

|

|

4 |

Liquidity |

||||

|

Cash ratio |

48.36 |

25 |

49.08 |

25 |

|

|

Loan to fund ratio |

81.01 |

100 |

94.00 |

100 |

|

|

5 |

Independence and Growth |

||||

|

Asset profitability |

1.35 |

25 |

1.00 |

25 |

|

|

Own capital profitability |

2.81 |

25 |

3.04 |

50 |

|

|

Operational Independence |

109.67 |

100 |

107.66 |

100 |

|

|

Average Financial Performance |

57.50 |

56.79 |

|||

|

KPI Category |

Enough |

Enough |

|||

Source: Secondary data after processing, 2024.

ative impact is a decrease in milk production, both at the farmer and cooperative level. Supported by the statement of Khotimah, et al (2024), farmers incurred more costs for the treatment of dairy cows affected by FMD, before the free vaccine from the government. The same thing was expressed by informants during an interview with a representative of the head of the farmer group that farmers focus on the health and recovery of their dairy cows affected by FMD.

Based on the analysis, it is known that KPBS Pangalengan has experienced an increase in the level of risk of non-performing loans due to an increase in member arrears during FMD and this will have an impact on the financial performance of KPBS Pangalengan. In line with the statement (Mulyono, et al. 2023), non-performing loans can reduce the performance of cooperatives and have the potential to cause losses to cooperatives because they can threaten the smooth circulation of funds in cooperatives. The increase in member arrears is due to the decline in the ability of farmers to repay loans to cooperatives due to the impact on farmers’ dairy cattle businesses due to FMD.

The results of the analysis show that KPBS Pangalengan’s savings and loan activities during the FMD period decreased because farmers were worried that they would not be able to repay their debts to the cooperative due to the impact of their dairy cattle business, so they were reluctant to make loans. Meanwhile, to fulfill their daily needs, farmers prefer to sell their assets, namely dairy cows. The decline in savings and loan activities has an impact on the financial performance of the cooperative because the management of own capital is not maximized considering that the cooperative’s own capital consists of principal savings, mandatory savings, reserve funds, and grants (Firman, et al. 2024). According to Purbowati and Hendrawan (2018), lending is a form of business carried out by cooperatives to manage the capital owned from donations and member deposits to provide a loan to members by taking advantage of interest payments from cooperative installments made by members.

Based on the results of the study, it is known that the cash ratio of KPBS Pangalengan experienced higher overliquidity during FMD because it indicated that there were many funds that were not channeled to meet short-term obligations. This is due to the ineffective use of KPBS Pangalengan’s cash during FMD because the level of preventive and curative services for dairy cows affected by FMD became more intensive. Furthermore, from the results of the study it is also known that the profitability of assets and own capital of KPBS Pangalengan in FMD conditions shows a low number. This is because KPBS Pangalengan’s revenue from dairy products has decreased due to FMD and this condition shows the lack of effectiveness in managing assets and own capital so that the cooperative’s ability to pay SHU to its members is low. Supported by the statement of Putri and Pasek (2023), the low SHU acquisition occurs due to the fact that there is very little money circulation compared to the money invested and this has an impact on the small capital used to carry out cooperative activities so that it also has an impact on the small SHU acquisition.

CONCLUSIONS AND RECOMMENDATIONS

Based on the research results described above, it can be concluded as follows: (1) the amount of milk production before and during FMD proved to be significantly different where during FMD there was a decrease in milk production. (2) the number of lactating dairy cows the results of the analysis did not prove significant, meaning that the decrease in the number of dairy cows during FMD can still be tolerated. (3) Based on the aspects of financial performance measured, some aspects decreased and increased before and during FMD. (4) The overall financial performance, both before and during FMD, was in the “Sufficient” category although there was a slight decrease in value during FMD.

Due to the massive impact of FMD, such as the decline in milk production caused by the large number of dead and slaughtered dairy cows, the level of milk revenue has decreased. In addition, many dairy cows recovered from FMD, but their productivity decreased by about 70 - 80 percent of productivity before FMD. It is recommended to KPBS Pangalengan to replace dairy cows owned by members who have been affected by FMD with healthy dairy cows from abroad, especially imported cows from FMD-free countries. The import of dairy cows can be done between dairy cooperatives, banks, and the government so that farmers can get new dairy cows with high productivity levels.

ACKNOWLEDGMENTS

We express our gratitude to the Ministry of Education, Culture, Research, and Technology for providing funding for this study under the Research and Community Service (2023) initiative.

Novelty statement

The novelty of this research is to analyze how FMD outbreaks can impact the financial performance of Koperasi Peternakan Bandung Selatan (KPBS) Pangalengan using the Regulation of the Deputy for Supervision of the Ministry of Cooperatives and Small and Medium Enterprises of the Republic of Indonesia Number 06/PER/DEP.6 /IV/2016 on Guidelines for Health Assessment of Savings and Loan Cooperatives and Cooperative Savings and Loan Units and further reviewed with key performance analysis.

Author’s Contributions

Achmad Firman: Conceptualization, Supervision, Validation, Review, Editing. Khansa Nurul Salsabilah: Writing Original Draft, Data Analysis, Resources, Editing. Lilis Nurlina: Conceptualization, Review, Supervision, Validation.

Conflict of interests

The authors have declared no conflict of interest.

REFERENCES

Aldeyano FR, Sudrajat A, Susiati AM, Cristi RF (2023). Level of understanding of dairy cattle farmers againts foot and mouth disease cases in West Bandung Lembang. Agrivet., 11(1): 115-124. https://doi.org/10.31949/agrivet.v11i1.6119

Anwari MK, Ramadhani W (2018). Health measurement of sharia financial services cooperatives (KJKS) based on the regulation of the minister of state of cooperatives, small and medium enterprises of the Republic of Indonesia No. 07/Per/Dep.6/IV/2016 (Case Study of KJKS Kalbar Madani West Kalimantan). Al-Maslahah Sharia Science Journal Vol. 14 (1).

Central Bureau of Statistics. (2023). Dairy Cattle Population by Province 2020 - 2022. Central Bureau of Statistics of the Republic of Indonesia.

Dewi U (2016). Analysis of the effect of liquidity level on efficiency and working capital requirements at PT Industri Telekomunikasi Indonesia (PERSERO). J. Econom. Busin. Entrepren., Vol. 10 (2): 91-103.

Directorate General of Livestock and Animal Health. (2014). Indonesian Veterinary Emergency Preparedness (KIAT VETINDO) Foot and Mouth Disease. 3rd edition. Jakarta: Directorate General of Animal Husbandry and Animal Health, Ministry of Agriculture.

Firman A, Trisman I, Puradireja RH (2022). Economic Impact of Foot and Mouth Disease Outbreaks in Cattle and Buffalo in Indonesia. Mimbar Agribisnis Vol. 8(2): 1123-1129. https://doi.org/10.25157/ma.v8i2.7749

Firman A, Mauludin MA, Kusmayadi T (2024). Financial Performance of Bogor Milk Production Cooperative (KPS) Before and During Foot and Mouth Disease. Mimbar Agribisnis Vol. 10(1): 2579-8340. https://doi.org/10.25157/ma.v10i1.12678

Firman A, Mauludin MA, Kusmayadi T (2024). Financial Performance of Dairy Cooperatives in West Java - Indonesia During the Covid-19 Pandemic and Foot-and-Mouth Disease Outbreak. Buletin Peternakan Vol. 48(1): 20-33. https://doi.org/10.21059/buletinpeternak.v48i1.88816

Food Security and Livestock Service Office of West Java Province. (2023). Technical Review of Importation of Dairy Cattle Seedlings. Bandung: Food Security and Livestock Service Office of West Java Province.

Gunarwati AM, Maryan S, Sudarwati (2020). Edunomika. Scientific Science Edunomika Vol. 4 (2): 701-709. https://doi.org/10.29040/jie.v4i02.1219

Hidayatin DA, Sari RP, Sari N (2022). Analysis of the Financial Health of Sharia Savings and Loan and Financing Cooperatives amid the Covid19 Pandemic. Unesa Account. J., Vol. 10 (3): 55 - 67. https://doi.org/10.26740/akunesa.v10n3.p55-67

Ismail I., et al. (2023). Clinical Examination of Foot and Mouth Disease of Dairy Cows in Sukamurni, Cilawu, Garut, West Java, Indonesia. IOP Conf. Ser: Eath Environ. Sci. 1174: 1-7. https://doi.org/10.1088/1755-1315/1174/1/012005

Kalefi S (2018). Assessment of the Health Level of Savings and Loan Cooperative (KSP) CU Bangun Sejahtera Banguntapan Bantul Year 2012-2016. J. Ekobis Dewantara, Vol. 1 (6): 12–23.

Kasmir (2016). Financial Statement Analysis. PT Raja Grafindo Persada: Jakarta.

Inta Kotane I, Merlino IK (2012). Assessment of financial indicators for evaluation of business performance. European Integration Studies, 6: 216-224. https://doi.org/10.5755/j01.eis.0.6.1554

Okti RD., et al. (2023). Socialization of prevention and handling of FMD virus in livestock in Mojosari Village, Puger District, Jember Regency. J. Anim. Sci. Res., Vol. 2(1): 1–8.

Khotimah YK, Wibowo H, Helbawanti O, Suryani HF (2024). Economic Impact of Foot and Mouth Disease Outbreak on Farmers in Semarang Regency. Mimbar Mimbar Agribusiness Vol. 10 (1): 818-824. https://doi.org/10.25157/ma.v10i1.12574

Koperasi Peternakan Bandung Selatan (KPBS) Pangalengan. (2021). Annual Report of KPBS Pangalengan for Financial Year 2021. Bandung Regency: KPBS Pangalengan.

Koperasi Peternakan Bandung Selatan (KPBS) Pangalengan. (2022). Annual Report of KPBS Pangalengan for Fiscal Year 2022. Bandung Regency: KPBS Pangalengan

Mulyono H, Idayati I, Sari WM (2023). Analysis of bad credit risk implementation at mardiharjo saving and loan cooperative “RIAS” P1. Ecombis review: Sci. J. Econ. Busin., Vol. 11 (1): 703-712: https://doi.org/10.37676/ekombis.v11i1.3403

Nugroho AY, Mas’ud AA (2021). Projection of BEP, RC ratio and R/L ratio on business feasibility (Case study on taoge business in Wonoagung village Tirtoyudo Malang Regency. J. Coop. Manag., Vol 2 (1): 26–37.

Nutri AF, Wahyuningrum Christiana. (2019). Assessment of cooperative health level from the aspects of liquidity, capital, independence, and growth of KSP Sahabat Setia SMAN 6 Kupang. Ekobis: J. Manag. Sci. Account., Vol 7 (1): 16 – 30.

Office des Internationale Epizootis (OIE). (2022). Official Disease Status. http://www.woah.org/en/document/foo t_and_mouth_disease/ [Accessed on February 19, 2024].

Purbowati R, Hendrawan SA (2018). Analyzing Bad Credit Problems in Savings and Loan Cooperatives. Management and Business Review Vol. 2 (1): 1–15. https://doi.org/10.21067/mbr.v2i1.4612

Putrayasa IMA, Dewi NWK, Suta IWP (2015). Health Level Analysis of Giri Sari Sedana Cooperative in Mengwi. J. Busin. Entrepren., Vol. 11(2): 115–125.

Putri KNPA, Pasek GW (2023). Cooperative Health Level from the Aspects of Capital, Liquidity, and Rentability at KSP Sanjiwani. Journal of Professional Accounting Vol. 14 (1): 148–159. https://doi.org/10.23887/jap.v14i01.63451

Rahardja U, Yusup M, Rosyifa E. (2012). Optimization of Key Performance Indicators (KPI) Through Balance Scorecard Approach Efforts to Implement Performance Management System (PMS) in Higher Education. Creative Communication and Innovative Technology Journal. Vol 6(1): 17–34. https://doi.org/10.33050/ccit.v6i1.373

Saputro DY, Mujino. (2020). Analysis of the health level assessment of the Kaliurang Pakem “Kartini” savings and loan cooperative, Sleman, Yogyakarta. E-BISMA Vol. 1 (2): 54-63. https://doi.org/10.37631/e-bisma.v1i2.191

Sumantri B, Nufus N, Andani A. (2005). Financial performance of south bandung cattle breeding cooperation (KPBS) Pangalengan, West Java. Indon. J. Agric. Sci., Vol. 7(2): 125–132.

Susandini A, Fatmawati N. (2017). Cooperative financial health based on the regulation of the minister of cooperatives and UMKM RI number 14/Per/M.KUKM/VII/2009 at KP-RI Sumekar Sumenep. Eco-Entrepeneur Vol. 3 (1): 177-191.

Sutawi, Wahyudi A, Malik A, Suyatno, Hidayati A, Rahayu ID, Hartatie ES (2023). Re-emergence of foot and mouth disease outbreak in Indonesia: A review. Adv. Anim. Vet. Sci. 11(2): 264-271. https://doi.org/10.17582/journal.aavs/2023/11.2.264.271

Tarsono O, Haspian P. (2022). Analysis of the health and performance of the PT KBN (Persero) employee cooperative savings and loan unit for 2019 - 2021. STEI Manag. J. Vol. 5 (2): 9-26.

Ulfa M. (2020). Loan to Deposit Ratio on the Profitability of Bank Rakyat Indonesia. Wadiah: J. Islam. Bank., Vol. 4 (2): 1-21. https://doi.org/10.30762/wadiah.v4i2.3082

Veterinary Research Center. (2000). Getting to Know More about Foot and Mouth Disease. Bogor: Veterinary Research Center

Yin RK (2018). Case study research and applications. SAGE Publications, Inc.

To share on other social networks, click on any share button. What are these?