Access to Credit and its Adequacy to Farmers in Khyber Pakhtun-khwa: The Case of Mardan District

Research Article

Access to Credit and its Adequacy to Farmers in Khyber Pakhtun-khwa: The Case of Mardan District

Shahab e Saqib1*, Mokbul Morshed Ahmad1, Sanaullah Panezai1, Hidayatullah2, Khalid Khan Khattak2

1Regional and Rural Development Planning (RRDP), School of Environment Resources and Development (SERD), Asian Institute of Technology (AIT), Thailand; 2Government College of Management Sciences-II Mardan, Khyber Pakhtunkhwa, Pakistan.

Abstract | Ensuring farmers’ access to agricultural credit market has been prioritized in agriculture finance policies of Pakistan. The main objectives of this study are to explore farmers’ access to different formal and informal credit sources, and to investigate their credit adequacy and the role of important socio-economic factors in access to credit. The data were collected from 87 farming households in Mardan Tehsil of Mardan District. Questionnaire was the main tool used to collect the data from farmers. The credit access ratio formula was employed that measured farmers’ access, in relative terms, to their landholdings. Likewise, credit adequacy formula was used to investigate farmers’ credit adequacy. A probit model was employed to find the important factors affecting access to credit. Results of access to credit ratio showed that small farmers had lower credit access to formal sources compared to medium and large farmers, whereas they had more access to informal sources. Similarly, small farmers have more credit inadequacy compared to medium and large farmers, and most of their credit gap was filled by informal sources. Probit model results showed that experience, education, landholding size and total income had positive relationship with access to credit whereas, age and farmers’ group had negative association with access to credit. Our findings suggest that there is a need to revamp the policy to address the interests of small landholders, particularly those who possess land less than 5 acres because they had limited access to formal sources of credit.

Received | January 28, 2016; Accepted | June 28, 2016; Published | August 20, 2016

Correspondence | Shahab e Saqib, Ph.D. Scholar Regional and Rural Development Planning, Asian Institute of Technology Bangkok, Thailand; Email: shahabmomand@gmail.com

Citation | Saqib, S., M.M. Ahmad, S. Panezai, Hidayatullah and K.K. Khattak. 2016. Access to credit and its adequacy to farmers in Khyber Pakhtunkhwa: The case of Mardan district. Sarhad Journal of Agriculture, 32(3): 184-191.

DOI | http://dx.doi.org/10.17582/journal.sja/2016.32.3.184.191

Keywords | Agricultural credit, Credit access, Credit adequacy, Mardan

Introduction

Ensuring farmers’ access to agricultural credit market has been prioritized in the agriculture finance policies of the State Bank of Pakistan. It remained the policy focus of all the succeeding governments to meet the credit requirements of the small farmers in Pakistan. Giving top priority to the interest of small farmers, the SBP had launched a loan scheme in 2003 for farmers. In that scheme, the large portion of loan was sanctioned to the small farmers. Of the total loan, 70% was allocated to subsistence farmers having landholding up to 12.5 acres, 20% of loan was allocated to economic landholding (12.6-50 aces) and 10% of it was allocated to above economic landholding who have landholding above 50 acres, particularly in Khyber Pakhtunkhwa and Punjab provinces (State Bank of Pakistan, 2003). In short, government has been making consistent efforts to improve the livelihood of farmers through provision of agricultural credit.

Small farmers are the predominant stakeholders in Pakistan’s agriculture sector. They are the ones with landholdings up to 5 acres and constitute 74% of the total number of farmers’ community in the country. The landholding possessed by them is only 34% of the total cultivable area (Khan and Azhar, 1991). The landholding is considered as the main determinant of access to credit sources. Small farmers have limited access to agricultural credit. Besides their limited access to credit, they are also confronted with shortage of water, high transportation costs and low crop yields that have been serious issues during the last decades (Akram et al., 2008). Small farmers with landholding of 0.5 ha received 92% of their credit from informal sources and only 8% of it was from institutional credit. The farmers with landholding from 0.5-2 ha have received 81% of their credit from informal and 19% from formal sources (Sebopetji and Belete, 2009). Hence, approaching informal sources, they are also charged with high-interest rates. In many cases, they have to sell their produce at a very low price for paying the loan back that were taken from the traders. They faced difficulty in obtaining the required amount of credit from formal sources due to lack of collaterals (Khandker and Faruqee, 2003). Small farmers can only apply for credit that is needed in production such as seeds, fertilizers and pesticides, however, cannot apply for developmental loans such as for tractors, tube-well and farm machinery due to insufficient collaterals (Hussain, 2012). The farmers in Pakistan remain in dire need of financial support for the purchase of farm inputs, satisfying social needs and making the enduring upgrading of lands. In this situation, the savings and income of the farmers have always remained very low, and that is the reason that the farmers rely on loaned amount to meet their production requirements and daily needs. Agricultural credit not only can help in managerial efficiency but also affects the efficient resource allocation and further profitability of farming (Bashir and Mehmood, 2010).

Agricultural credit plays a significant role in enhancing agricultural productivity, farm income and improved livelihood system of the farmers in Pakistan. Effective availability of formal credit, on one hand, increases the use of modern and new technology while on the other hand, reduces the influence of private money lenders to make the small farmers efficient in the credit market (Hussain and Thapa, 2012). Hence, agricultural credit was not only important for farming but also for furnishing every sector of the economy in Pakistan (Khan et al., 2011). Undoubtedly, a plethora of research has studied and highlighted the role agriculture credit in crop production (Ayaz et al., 2011; Ayaz and Hussain, 2011; Javed et al., 2006; Jehan and Mohsin-Ud-Din, 2008; Romney et al., 2003), increase in income (Akram et al., 2008; Fayaz et al., 2006), livestock production (Abedullah et al., 2009; Burki and Khan, 2008). In addition agricultural credit has also played risk mitigating role in agriculture sector of Pakistan (Saqib et al., 2016; Ullah et al., 2016). However, there is limited literature available that has explored farmers’ access to credit with respect to landholding size and their credit adequacy.

The main objectives of this study are to explore farmers’ access to different formal and informal credit sources, and to investigate their credit adequacy and the role of important socio-economic factors in access to credit in a risk prone tehsil of Mardan District, Khyber Pakhtunkhwa.

Material and Methods

Study Area and Sampling

Mardan District came into existence in 1937, after it was departed from Peshawar District. The total area of Mardan district is 1632 square kilo meters. The district is comprised of three tehsils: Mardan Tehsil, Katlang Tehsil, and Takhtbahi Tehsil. Mardan Tehsil is the most populous tehsil among all three tehsils. There are 3,535 households that are highly vulnerable (Provincial Disaster Management Authority, 2013). Out of these household 680 were farm households living outside the city that was our target population. Mardan Tehsil in Mardan District was purposely selected as study area, firstly, due to its vulnerability to floods and heavy rains. For instance, it was one of the districts, affected by the massive floods in 2010. Secondly, after the floods, the farmers were in dire need of agricultural credit for preparing fields, buying seeds, and fertilizers as they had lost their assets in floods. Thirdly, Mardan District is also considered as one of the vulnerable district (Provincial Disaster Management Authority, 2013). The farming households were estimated from the population and household data provided by Provincial Disaster Management Authority (PDMA), which shows that 70% of the households in the rural areas were farm households (Saqib et al., 2016). A sample of 87 farming households’ head were interviewed by using the formula of Yamane (1967), with 10% precision value. Sampled respondents were divided into two categories such as small farmers having landholding size up to 5 acres and medium and large farmers who possessed landholding size above 5 acres.

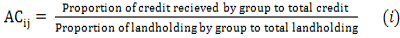

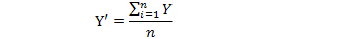

Credit Access Ratio

Access to credit is calculated by the equation that is used by (Amjad and Hasnu, 2007; Hussain and Thapa, 2012; Saqib et al., 2016; Ullah et al., 2015). The method has comparative advantage over other methods that are used for measuring access to credit because it counts the relative access of the farming households, and it shows access to credit per unit of land for each household. Access to formal and informal credit was separately calculated for each household.

Where;

AC= access to credit

i= farming households

j= either formal or informal sources

The results of this analysis will be: if;

AC= 1 the farmer’s group access to credit is equal to average access to credit.

AC > 1 the famer’s group access to credit is greater than average access to credit.

AC< 1 the farmer’s group access to credit is less than average access to credit.

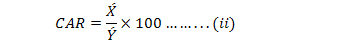

Credit Adequacy Ratio

Besides access to credit sources, adequacy of credit is very important for agriculture productivity (Samal, 2002). Farmer’s adequacy of credit was calculated by the method know as credit adequacy ratio suggested by Hussain and Thapa (2012), Saqib (2015) and Hussain and Thapa (2015). Initially, the credit gap was calculated, after that it was expanded to find out the credit adequacy ratio.

Where;

CAR = groups credit adequacy ratio

X′ = annual average amount of the credit received by group Z

And,

N = the number of farmers in A group

Y′ = average annual amount demanded by Z group

Where;

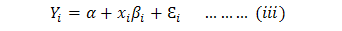

Regression Model

The dependent variable in this study is a binary variable 1= access to credit and 0= no access. Therefore, Probit model was employed to investigate the important factors that affect farmers’ access to agricultural credit.

Where:

Yi is the binary dependent variable, in our case Yi represents access to credit and no access to credit. As mentioned in above lines, Xi is a vector of independent variables. The independent variables; age and experience are measured by years, education by years of schooling for each household head, and total landholding size by acres. Distance is a dummy used in our study as: 1= within 500 meter from the bank of the river and 0= otherwise, total income of the household is given in PKR, family size is the number of persons in a family, farm labour is the number of labor working in the field, proportion of labour is a ratio of working labour to total family labour and D is dummy for the farmers’ categories; 1= small subsistence farmer and 0= otherwise. Likewise, βi is the vector of unknown parameter and is Ɛi the error term.

Results and Discussion

Access to Credit

The results of access to credit ratio are given in Table 1. According to the analysis of the total formal credit, only 9.5% is received by small farmers while a majority (90.5%) was received by medium and large farmers. Regarding landholding size, of the total borrowers’ farmers, the share of small farmers is 11.0% while medium and large farmers have 89.0% of the landholding in this group. In case of their share in informal credit and in the landholding size, the credit access ratio was calculated as 0.86 which is less than average access to credit. For middle and large farmers, the credit access ratio is 1.02 which is just equal to average access to credit. In informal credit sources, the share of group’s informal credit to total informal credit is 55.3% for the small farmers and 44.7% for the medium and large farmers. Regarding their landholding, the share of small farmers is 31% while medium and large farmers have 69% of the landholding in this group.

Table 1: Farmers’ access to agricultural credit

| Credit Share | Landholding Share | Credit Access Ratio | ||||

| Farmers’ Groups | Formal credit to total formal credit (%) | Informal credit to total informal credit (%) | Formal borrower to total land of all formal borrowers (%) | Informal borrower to total land of all informal borrowers (%) | Formal Credit | Informal Credit |

|

Small Farmers (n=57) |

9.50 | 55.30 | 11.00 | 31.00 | 0.86 | 1.78 |

|

Medium and Large Farmers (n=30) |

90.50 | 44.70 | 89.00 | 69.00 | 1.02 | 0.64 |

| T-test | 3.96 | 6.33 | ||||

|

P-Value |

0.000*** | 0.000*** | ||||

Source: Field Survey, 2015; Significance Level: ***=P < .01

| Farmers’ Groups |

Credit Demand (PKR / household / year) |

Credit Received (PKR/household/year) |

Adequacy | Inadequacy of Credit (%) | |||

| Formal Sources | Informal Sources | Total | Adequacy of Formal Credit (%) | Adequacy of Total Credit (%) | |||

| Y |

Xf |

Xin |

Xt |

A1 |

A2 |

100- A2 |

|

|

Small Farmers (n=57) |

70,017.5 | 7,017.5 | 36,596.5 | 43,614.0 | 10.00 | 62.29 | 37.71 |

|

Medium and Large Farmers (n=30) |

168,666.6 | 91,333.3 | 52,400.0 | 143,733.7 | 54.20 | 85.00 | 15.00 |

| T-test | 11.5 | ||||||

|

P-Value |

0.000*** | ||||||

Source: Field Survey, 2015; Significance Level: ***=P < .01

The results of these two percentage ratios gave us access credit ratio that is 1.78 for small farmers that is above the average access to credit. This ratio is 0.64 for medium and large farmers that is below the average credit access.

The results of this study show that small farmers had limited access to formal credit which are consistent with findings of Hussain and Thapa (2012). Most of the small farmers were getting credit from informal sources as there was no need of collaterals. Only personal guarantee is sufficient in spite of the high cost of this credit. On average, the amount of the credit received is very low from informal sources that is one tenth of the total credit which indicates that small farmers had limited access to credit. Hence, the landholding is most readily available collaterals to get loans from formal sources.

About landholding size and farmers’ access to agricultural credit, it is argued that the landholding size was a very significant factor in accessing loans from formal sources. Moreover, it is also seen as a symbol of higher social status in the society which help in getting loans from informal sources. The lack of collateral also covered a large number of cases of ‘unacceptable’ informal sources. The land was the most important readily acceptable form of collateral. This deprived a large number of tenants and landless people to participate in the formal credit markets. Small farmers (57 out of total sample size) were holding less than or equal to 5 acres of the land and only six of them reported taking loans from the formal sources whereas majority of them were taking loans from informal sources. According to the conditions of loan about the agriculture credit policies, for Zari Taraqiati Bank Limited, the land ownership certificate is to be produced at the time of loan sanctioned, and most of the farmers in small farmers had limited landholding size to get these loans. Those farmers had better access who had more landholding size. The results of our study are consistent with the findings of other studies (Akram et al., 2008; Amjad and Hasnu, 2007; Hussain and Thapa, 2012; Nouman et al., 2013; Owuor and Shem, 2012). They have found a significant and positive relationships between access to credit and landholding size, whereas contrary to findings of Dzadze et al. (2012) who reported that there is no link between landholding and access to credit.

Adequacy of Credit

Results obtained from equation (ii) regarding credit adequacy of farmers in the study area are mentioned in Table 2. The amount of the credit was measured in Pakistani Rupees per household per year. The farmers received credit in terms in-kind and services which were converted into amount as per the market value during June-July 2015 (data collection period). In-kind credit was in the form of seeds, fertilizers, pesticides and other farm machinery. Services included the ploughing and other field preparation activities, usually for a period of one crop season. The small farmers were 57 in numbers and had demanded an average of PKR (Pakistan Rupee is abbreviated as PKR, and 1 PKR= 0.00953 USD (dated 14 Jan 2016, State Bank of Pakistan)). 70,017.50 per annum, whereas the medium and large farmers had demanded an average of PKR 1,68,666.6 per annum per household. The medium and large farmers demanded credit was two times more than the small farmers. Although they had large landholding and were comparatively richer than small farmers. The credit received by small farmers from formal sources such as banks was on average PKR 7,017.5 per annum per household. Only six households among them were accessing formal sources of credit. The medium and large farmers were getting on average PKR 91,333.3 per annum per annum. In the case of informal sources, small farmers were receiving on average PKR 36,596.5 per household, whereas the medium and large farmers were getting on average PKR 52,400 per annum per household. In case of total credit, from both formal and informal sources, the small farmers were receiving on average PKR 43,614 whereas the large farmer received PKR 143,733.7, which was three times greater than the amount of small farmers.

Regarding adequacy, small farmers were getting only 10% of the total credit they demanded from formal sources whereas the medium and large farmers had adequate access (54.2% of the total amount demanded) to formal sources. The adequacy of credit to medium and large farmers were five times greater than the credit adequacy of small farmers. In total credit adequacy, the small farmers had received 62.29% of the total credit demanded, whereas the large farmers had got 85.0% of the total credit demanded from both of the sources. Furthermore, the role of informal sources in fulfilling the total credit demand were also calculated. In case of small farmers, 52.29% of the total demand was fulfilled by informal sources, whereas in case of large farmers, the informal sources had also a significant contribution of 30.8% of the total credit demanded. About inadequacy, the small farmers had 37.71% of the credit inadequacy whereas, the medium and large farmers had only 15% of it.

Small farmers had more shortage of funds to run their daily farm activities. The most adequate source of credit was the formal source (banks) in the study area. Two banks such as Zari Taraqiati Bank Limited and Khushali Bank were providing credit to farmers. Banks needed collaterals and security for giving loans to farmers. Although some farmers were getting loans from Khushali Bank without collaterals. They were provided loans on the group basis, yet the amount was not adequate. For example, PKR 15,000 to maximum PKR 50,000 at interest rate of 25% were given for a period of 3 to 12 months (Khushali Bank, 2015). Our results confirms the findings of Shah et al. (2008) who reported high interests on credit. Small farmers lacked the collateral that deprived them of having more access to formal sources and consequently resulted in inadequate credit. The results of this study are in accordance with the findings of Samal (2002), who reported a huge gap between the demand and supply of agriculture credit. Contrary to these, our results are in contrast with the findings of Singh and Sekhon (2005). They concluded that in Punjab India which was the developed region of agriculture, there was an inverse relationship between lands holding and credit gap. As per the findings of the study, the farmers with landholding up to 5 acres were the most disadvantaged group of farmers. The landholding size is considered as the main factor associated with adequacy of credit. An increase in the landholding guaranteed more credit adequacy, in other words, medium and large farmers were more credit adequate than the small farmers. Results of the study were in agreement with the findings of Hussain and Thapa (2012). They concluded that as the farmers’ category changed from lower small holders to middle smallholder, the credit inadequacy decreased from 48% to 16%, whereas it was recorded only 7% among the upper smallholders. The landholding on one hand increased their access to different credit sources, while on the other hand, it also increased adequacy of credit (Ijioma and Osondu, 2015; Nouman et al., 2013).

Regression Results

Several factors are influencing access to agricultural credit. The results of the probit model mentioned in Table 3. Age has a significant (p-value =0.075) negative association (β= -0.035) with credit showing that when the age increases, access to credit farmers’ decreases. Our findings regarding age are in agreement with Sebopetji and Belete (2009). They reported that the age has negative relation with the farmers’ decision in using the agricultural credit. However, Bashir and Mehmood (2010), revealed that age positively affect access to credit. Marginal effects of age show that as age increases by one unit, the probability of access decreases by 1.2%. Education has positive (β=0.103) and highly significant (p-value=0.047) association with credit. Its corresponding results of marginal effects show that if educational level increases by one unit, it increases access to agricultural credit by 3.6%. Likewise, experience of farmers has positive relationship (β=0.078) with credit significant at p-value=0.006. Marginal effects in Table 3 show that one-unit increase in experience of farmers can increase the probability to have access to agricultural credit by 2.7%. This means that in the case of formal sources, access the farmer’s experience play an important role. Farmers with more experience could better understand the terms and conditions and the procedure of getting credit because they would have made several attempts for getting loans from banks. Even the cost of credit will be lower for the farmers who had more experience in farming. Our results were found in agreement with the results of Nouman et al. (2013), Oboh and Ekpebu (2011) and Saleem and Jan (2011). They all were unanimously agreed on the stated positive relationship of access to agricultural credit and experience. Similarly, total landholding has positive co-efficient (β=0.103) with farmers’ access to credit and was highly significant at p-value=0.046. Therefore, the landholding size was a very significant factor in accessing loans from formal sources. Moreover, it was also a symbol of higher social status in the society which helps in getting loans from informal sources. The results of this study for landholding are consistent with findings of Hussain and Thapa (2012), who reported that small upper holders having landholding size from 2.5 acres to 5.00 acres had above average access to formal sources of credit, whereas, the lower smallholders had lower access. Total income of the farmers has positive (β=2.1 ×10-6) association with credit and was significant at p-value=0.029. Unlike the results of landholdings, dummy of farmers has significant (p-value=0.02) negative (β=-1.09) association with credit. The results of marginal effects show that if the dummy variable changes from large subsistence farmers to small subsistence farmers (from 0 to 1), it will increase the probability of access to credit by 109%.

Table 3: Results of the Probit model

|

Variable

|

Results of Probit Model | Marginal Effects | ||||

| β | SE | P-value | β | SE | P-value | |

| Age | -0.035 | 0.019 | 0.075* | -0.012 | 0.006 | 0.071* |

| Education | 0.103 | 0.051 | 0.470 | 0.036 | 0.017 | 0.040 |

| Experience | 0.078 | 0.028 | 0.000*** | 0.027 | 0.010 | 0.00*** |

| Landholding size | 0.103 | 0.051 | 0.046** | 0.036 | 0.018 | 0.045** |

| Distance | -0.229 | 0.358 | 0.522 | -0.080 | 0.125 | 0.523 |

| Income |

2.1 ×10-6 |

9.9 ×10-7 |

0.029** |

7.6×10--7 |

0.000 | 0.036** |

| Family size | -0.066 | 0.049 | 0.178 | 0.023 | 0.168 | 0.169 |

| Farm labor | 0.112 | 0.135 | 0.406 | 0.039 | 0.047 | 0.407 |

| Proportion of labor | -0.412 | 0.603 | 0.497 | -0.144 | 0.212 | 0.496 |

| Dummy | -1.090 | 0.471 | 0.020** | -0.401 | 0.169 | 0.018** |

| Log Likelihood | 27.77 | |||||

| LR Chi-square | 58.90 | |||||

|

Chi-square P-value |

0.000 | |||||

|

Pseudo R2 |

0.515 | |||||

Source: Field Survey, 2015; Note: SE=standard error, β=coefficient; Significance levels: *= P < .10; **=P < .05; ***=P < .01

Conclusions

Measures towards institutionalization of agricultural credit have paid off in terms of diminishing share of informal sources in total credit received by the farmers. However, inequitable access to credit across different groups of farmers have persisted an intractable problem with increasing inequalities in access to credit. Small farmers have still low access to credit compared to medium and large farmers due to their lack of collaterals and low landholding size. Their limited access lead to credit inadequacy. The medium and large farmers’ groups were the main beneficiary from agricultural credit policy. There is need to revamp the policy to address the interests of small landholders particularly those who possess land less than 5 acres because they have limited access to formal sources of credit.

Acknowledgements

We would like to thank both reviewers and the editor of this journal for their insightful comments on the paper, as these comments led us to an improvement of the manuscript. The principal author and third author accredit the support of the Higher Education Commission of Pakistan for the award of a Ph.D. scholarships. The authors also extend their thanks to Mr. Ubaid Ali Lecturer GPGC Nowshera, for proof reading of the manuscript.

Authors’ Contributions

Mr. Shahab e Saqib has designed the study by drafting the introduction, literature review and discussion part of the paper. Dr. Mokbul Morshed Ahmad has supervised the entire process of write up of the research. Mr. Sanaullah Panezai has critically evaluated and proof read the article. Mr. Hidayat Ullah had contributed in data collection and summarizing the literature related to the agricultural credit. Mr. Khalid Khan Khattak’s main contribution was in the analysis of data.

References

Abedullah, N., M. Khalid and S. Kouser. 2009. The role of agricultural credit in the growth of livestock sector: A case study of Faisalabad. Pak. Vet. J. 29(2):81-84.

Akram, W., Z. Hussain, M.H. Sial and I. Hussain. 2008. Agricultural credit constraints and borrowing behavior of farmers in rural Punjab. Euro. J. Sci. Res. 23(2):294-304.

Amjad, S., and S. Hasnu. 2007. Smallholders’ access to rural credit: Evidence from Pakistan. Lahore J. Econ. 12(2):1-25.

Ayaz, S., S. Anwar, M.H. Sial and Z. Hussain. 2011. Role of agricultural credit on production efficiency of farming sector in Pakistan-a data envelopment analysis. Pak. J. Life Soc. Sci. 9(1):38-44.

Ayaz, S., and Z. Hussain. 2011. Impact of institutional credit on production efficiency of farming sector: A case study of District Faisalabad. Pak. Econ. Soc. Rev. 49(2):149-162.

Bashir, M.K., and Y. Mehmood. 2010. Institutional credit and rice productivity: A case study of District Lahore, Pakistan. China Agric. Econ. Rev. 2(4):412-419. http://dx.doi.org/10.1108/17561371011097722

Burki, A.A., and M.A. Khan. 2008. Milk supply chain and efficiency of smallholder dairy producers in Pakistan. Working Paper No. 08-62: Lahore University of Management Sciences. Available at: http://www.eaber.org/sites/default/files/documents/LUMS_Burki_2008.pdf. [Accessed 10 October 2015].

Dzadze, P., R. Aidoo and G. Nurah. 2012. Factors determining access to formal credit in Ghana: A case study of smallholder farmers in the Abura-Asebu Kwamankese district of central region of Ghana. J. Dev. Agri. Econ. 4(14):416-423.

Fayaz, M., D. Jan, A.U. Jan and B. Hussain. 2006. Effects of short term credit advanced by ZTBL for enhancement of crop productivity and income of growers. J. Agr. Bio. Sci. 1(4):15-18.

Hussain, A. 2012. Small holder access to agricultural credit and its effects on farm productivity, income and household food security in Pakistan. Ph.D. Thesis, Asian Institute of Technology, Thailand.

Hussain, A., and G.B. Thapa. 2015. Fungibility of smallholder agricultural credit: empirical evidence from Pakistan. Europ. J. Dev. Res. http://dx.doi.org/10.1057/ejdr.2015.55

Hussain, A., and G.B. Thapa. 2012. Smallholders’ access to agricultural credit in Pakistan. Food Sec. 4(1): 73-85. http://dx.doi.org/10.1007/s12571-012-0167-2

Ijioma, J.C., and C.K. Osondu. 2015. Agricultural credit sources and determinants of credit acquisition by farmers in Idemili Local Government Area of Anambra State. J. Agri. Sci. Tech. 5(1):34-43.

Javed, M.S., S. Hassan, S.A. Adil, A.S. Ahmad, M.W.A. Chattah and Z. Nawaz. 2006. Impact assessment of micro-credit programme of PRSP on crop productivity. Pak. J Agri. Sci. 43(3-4):209-212.

Jehan, N., and M. Mohsin-Ud-Din. 2008. Raising farm productivity through agricultural credit (A Case Study of Zarai Tarraqiati Bank of Pakistan Limited). Sarhad J. Agri. 24(4):693-696.

Khan, N., M. Shafi, M. Shah, Z. Islam, M. Arif, R. Javed and N. Shah. 2011. Review of past literature on agriculture credit in rural area of Pakistan. Sarhad J. Agri. 27(1):103-110.

Khan, R.A.R., and B. Azhar. 1991. Some operational issues and institutional constraints in lending to small farmers [with comments]. Pak. Dev. Rev. 30(4):1029-1037.

Khandker, S.R., and R.R. Faruqee. 2003. The impact of farm credit in Pakistan. Agri. Econ. 28(3):197-213. http://dx.doi.org/10.1111/j.1574-0862.2003.tb00138.x

Khushali Bank. 2015. Khulai Karza Scheme. Available at: http://www.khushhalibank.com.pk/Khushhali-Qarza [Accessed 10 October 2015].

Nouman, M., M.F. Siddiqi, S.M. Asim and Z. Hussain. 2013. Impact of socio-economic characteristics of farmers on access to agricultural credit. Sarhad J. Agri. 29(3):469-476.

Oboh, V.U., and I.D. Ekpebu. (2011). Determinants of formal agricultural credit allocation to the farm sector by arable crop farmers in Benue State, Nigeria. African J. Agri. Res. 6(1):181-185.

Owuor, G., and A. Shem. (2012). Informal credit and factor productivity in Africa: Does informal credit matter? Paper presented at the 2012 Conference, August 18-24, 2012, Foz do Iguacu, Brazil.

Provincial Disaster Management Authority. (2013). Contengency Plan Khyber Pakhtunkhwa. Available at: http://pdma.gov.pk/downloads/Monsoon_Contingency_Plan_KP_2013.pdf. [14 October 2014 Accessed 14 October 2014].

Romney, D., P. Thorne, B. Lukuyu and P. Thornton. (2003). Maize as food and feed in intensive smallholder systems: Management options for improved integration in mixed farming systems of east and southern Africa. Field Crops Res. 84(1):159-168. http://dx.doi.org/10.1016/S0378-4290(03)00147-3

Saleem, M.A., and F.A. Jan. 2011. The impact of agricultural credit on agricultural productivity in Dera Ismail Khan (District) Khyber Pakhtonkhawa Pakistan. Euro. J. Bussiness Manag. 3(2):38-44.

Samal, B. 2002. Institutional credit flow to West Bengal Agriculture: Revisited. Indian J. Agri. Econ. 57(3):546-559.

Saqib, S. 2015. Access, adequacy and utilization of agricultural credit to farmers in Pakistan: The case of Mardan District, Khyber Pakhtunkhwa. MS Thesis, Asian Institute of Technology, Thailand.

Saqib, S.E., M.M. Ahmad, S. Panezai and U. Ali. (2016). Factors influencing farmers’ adoption of agricultural credit as a risk management strategy: The case of Pakistan. Int. J. Disast. Risk Red. 17:67-76. http://dx.doi.org/10.1016/j.ijdrr.2016.03.008

Sebopetji, T., and A. Belete. (2009). An application of probit analysis to factors affecting small-scale farmers decision to take credit: A case study of the Greater Letaba Local Municipality in South Africa. African J. Agri. Res. 4(8):718-723.

Shah, M.K., H. Khan, and Z. Khan. (2008). Impact of agricultural credit on farm productivity and income of farmers in mountainous agriculture in northern Pakistan: A case study of selected villages in District Chitral. Sarhad J. Agri. 24(4):713-718.

Singh, H., and M. Sekhon. (2005). Cash-in Benefits of the Kisan Credit Card Scheme: Onus is upon the Farmer. Indian J. Agri. Econ. 60(3):319-334.

State Bank of Pakistan. 2003. Agricultural Loans Scheme. Available at: http://www.sbp.org.pk/acd/Events/appendex-I.pdf. [Accessed 4 October 2015].

Ullah, R., D. Jourdain, G.P. Shivakoti and S. Dhakal. (2015). Managing catastrophic risks in agriculture: Simultaneous adoption of diversification and precautionary savings. Int. J. Disast. Risk Red. 12:268-277. http://dx.doi.org/10.1016/j.ijdrr.2015.02.001

Ullah, R., G.P. Shivakoti, A. Kamran and F. Zulfiqar. (2016). Farmers versus nature: managing disaster risks at farm level. Nat. Hazards. 83(3):1931-1945. http://dx.doi.org/10.1007/s11069-016-2278-0

Yamane, T. 1967. Statistics: an introductory analysis Harper & Row, New York, Evanston & London and John Weather Hill, Inc., Tokyo.

To share on other social networks, click on any share button. What are these?