Who Gets What? Citrus Marketing in Bunir District of Pakistan

Who Gets What? Citrus Marketing in Bunir District of Pakistan

Raza Ullah1*, Qaisar Shah Safi2, Ghaffar Ali3 and Irfan Ullah3

1Institute of Agricultural and Resource Economics, University of Agriculture, Faisalabad, Pakistan; 2National Bank of Pakistan; 3Department of Agricultural and Applied Economics, University of Agriculture, Peshawar, Pakistan.

Abstract | Citrus is a group perishable fruit and require good marketing practices, proper time and methods of harvesting, packaging, storage and processing. There are various middlemen (market intermediaries) involved at different stages in the marketing of citrus. This study is an attempt to examine the marketing margins of the intermediaries involve in the value chain of sweet oranges of citrus group. Three villages in Bunir district are randomly selected and a total of 120 sampled respondents are selected using proportional allocation method. The findings revealed that majority of the farmers sold their orchards to the pre-harvest contractors. The most widely used marketing channel was producers selling their orchard to pre-harvest contractor who then harvest the orchard, pack the produce and transport it to the market where the produce is handed to wholesalers. Wholesalers then channel the produce to retailer from where the ultimately consumers buy the product. It was also observed that considerable marketing margins were taken by the marketing intermediaries in the citrus value chain. It is recommended that the post-harvest management/marketing skills and market intelligence of the citrus growers should be developed to enable them practice self-marketing whereby they can easily pocket the market share of the pre-harvest contractors by eliminating him from the marketing chain.

Received | October 10, 2017; Accepted | August 07, 2017; Published | September 15, 2017

*Correspondence | Raza Ullah, Assistant Professor, Institute of Agricultural and Resource Economics, University of Agriculture, Faisalabad, Pakistan; Email: [email protected]

Citation | Ullah, R., Q.S. Safi, G. Ali and I. Ullah. 2017. Who gets what? Citrus marketing in Bunir District of Pakistan.. Sarhad Journal of Agriculture, 33(3): 474-479.

DOI | http://dx.doi.org/10.17582/journal.sja/2017/33.3.474.479

Keywords | Citrus marketing, Gross margins, Marketing channels, Market intermediaries, Citrus

Introduction

Citrus (Citrus sinensis L.) is one of the most significant fruit crop known from antiquity being a very good source of vitamin “C” with great antioxidant potential (Gorinstein et al., 2001). Citrus is placed among the important fruit crops worldwide being sown in more than 125 countries between latitude 35°-36° with suitable climates and in temperature range of 4oC-50oC (Naz et al., 2014). Brazil and China are the largest producers of citrus worldwide producing about 45 million tons (MT) of citrus fruit together, followed by USA, India, Mexico and Spain with a production of 10.7, 8.6, 7.2 and 5.5 MT, respectively (Anon, 2012a). Pakistan also occupies a prominent position in citrus production and is among the top 15 citrus-producing countries in the world (Mahmood et al., 2014). In Pakistan, citrus is cultivated over an area of 194,000 hectares with an annual production of 2.2 MT (Anon 2012b). Pakistan citrus industry is contributing 1% of fresh fruit from 2% area of cultivation yielding approximately 12.7 tons per hectare. Citrus is contributing 25% fruit production, of which Punjab’s share is 95% (GoP, 2010).

The perishable nature of citrus urges for proper time and methods of harvesting, packaging, storage and processing. There are wide gaps between the income received by the producer and the price paid by the ultimate consumer, which technically called marketing margin. Marketing margins have direct implication for income of citrus producers and hence development of citrus production in the area. The higher marketing margin reflects less income to citrus producers and more benefits to middlemen involved in citrus marketing. Thus it is important to find out the costs incurred and profits earned by various market intermediaries involved in the Citrus value chain. The present study is therefore, designed to examine the marketing margins of various intermediaries in the citrus value chain and to identify the main marketing channel used in the study area.

Materials and Method

Study area and sampling

This study was conducted in district Buner of the Khyber Pakhtunkhwa (KP) province of Pakistan. Agriculture is the largest sector of the district and the main source of livelihood. The climate of the area varies with the elevation and may be classified as dry sub-tropical. Buner district plays a key role in KP province in supplying citrus of high quality and taste. Citrus is one of the cash fruits and income source for the producers in Buner (GoP, 1999). Three villages in the district namely Dagar, Elay and Pir Abay were randomly selected for data collection. A list of citrus growers in the study area was obtained from the local government representatives in the study area and a proportionate sample size of 40 respondents were randomly selected from the list of citrus growers using proportional allocation sampling technique as suggested by Cochran (1977).

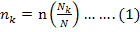

Where;

nK: The proportion of the sample in the kth village; n: Size of required sample; Nk: Total farmers in kth village; N: Total farmers in sampled villages in a district.

Moreover, 20 sampled respondents were also selected from each category of the middlemen including pre-harvest contractors, wholesalers, retailers and consumers.

Analytical technique

The marketing margins for each of the marketing agent are derived using the below equations.

Total cost of marketing: The total cost of marketing is calculated using the equation below.

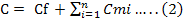

Where;

C: Total cost of marketing; Cf: Marketing cost incurred by grower; Cmi: Marketing cost incurred by ith middleman; n: Number of middlemen.

Net margins:

NM = SV – TC………. (3)

Where;

NM: Net Margin; SV: Sale value of the produce at different level; TC: Total Cost (purchase price + marketing cost)

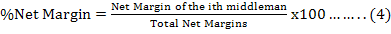

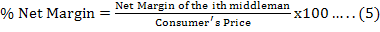

Net margin as a percentage of net market margins:

Net margin as a percentage of consumer’s price:

Results and Discussion

Marketing channels

Marketing channels are the routes through which agricultural as well as horticultural products move from producers to consumers. The length of the channel varies from commodity to commodity, depending on the quality to be moved, the form of consumer demand and degree of regional specialization in production. There are numerous market intermediaries operating at various stages of marketing. The citrus marketing channels are presented in Figure 1. Citrus marketing in the study area was mainly carried out by private entrepreneurs. An individual producer, contractor, commission agent, wholesaler and retailer were the principal marketing functionaries in the citrus marketing system.

Table 1: Cost of citrus marketing per crate (100 fruit units).

| Cost items | Producer | Contractor1 | Wholesaler2 | Retailer | Over all | |||||

| PKR3 | % | PKR | % | PKR | % | PKR | % | PKR | % | |

| Transportation charges/crate | ---- | -- | 28.06 | 27.22 | 18.25 | 34.93 | 3.00 | 60.0 | 49.31 | 30.76 |

| Cost of packaging (crate) | ---- | -- | 32.75 | 31.78 | ---- | --- | ---- | --- | 32.75 | 20.43 |

| Picking | ---- | -- | 3.02 | 2.93 | ---- | --- | ---- | --- | 3.02 | 1.88 |

| Grading | ---- | -- | 1.60 | 1.55 | --- | --- | --- | --- | 1.60 | 1.00 |

| Packing | ---- | -- | 6.97 | 6.76 | ---- | --- | --- | --- | 6.97 | 4.35 |

| Loading and unloading | ---- | -- | 2.00 | 1.94 | 2.00 | 3.83 | 2.00 | 40.0 | 6.00 | 3.74 |

| Cost of nails, paper and straw | ---- | -- | 5.17 | 5.02 | ---- | --- | ---- | --- | 5.17 | 3.22 |

| Market charges/ Commission @ 10% | ---- | -- | 23.50 | 22.80 | 32.00 | 61.24 | ---- | ---- | 55.50 | 34.62 |

| Total marketing cost/crate | ---- | -- | 103.07 | 100.00 | 52.25 | 100.00 | 5.00 | 100.00 | 160.32 |

100.00 |

Source: Derived from Survey Data 2010; 1: Sale price of the contractor: 235.00 per crate; 2: Sale price of the wholesaler: 320.00 per crate; 3: PKR is abbreviation for Pakistani Rupee, 1 PKR is approximately equal to 0.01 USD

The following were the prominent citrus marketing channels patronized by growers in Bunir district.

Channel I: Producer Commission agent Wholesaler Retailer consumer

Channel II: Producer Pre-harvest Contractor Commission agent wholesaler Retailer Consumer

Channel III: Producer Wholesaler Retailer Consumer

Majority of the producers (75%) sold their citrus orchards to the contractors, the contractors then sold the produce to the wholesaler, who were the main suppliers to the retailers and they ultimately sold their produce to the consumers (Channel II). It was revealed during the survey that some of the producers (20%) were involved in self-marketing who dispatched directly their produce to the commission agents, the commission agent then supply the produce to wholesaler from where the produce is supplied to retailers (Channel I). Similarly a small number of producers (5%) sold their produce to the wholesalers who then sold the produce to the retailers (Channel III). However, some retailers approach directly to the commission agents for the purchase of citrus as revealed during the survey.

Marketing cost of citrus

Marketing costs are the charges which are paid for any marketing activity, such as assembling, grading, packaging, transportation, wholesaling and retailing. The main cost items include in the marketing of citrus were cost of picking, grading, packaging, transportation, loading, unloading and commission charges. Marketing cost of citrus was analyzed at each stage and the details are given in Table 1.

A general observation from the Table 1 reveals that market charges (commission), transportation charges along with packaging were the main cost items in the marketing of citrus. Market charges (commission) account for 34.62 percent of the total marketing cost incurred in the marketing of citrus. The commission agents charged a fixed percentage (10%) of the total value. They conduct auction, receive payments from the buyers and then make payments to the sellers. Transportation of the product account for 30.76 percent of the total marketing cost. Domestic citrus were transported throughout the country in pickups over poor roads. Pickups were often overloaded. In combination with poor quality packing materials, overloading damages the fruit during transportation. Packaging also contributes 20 percent to the total cost of marketing of citrus. A wide range of inappropriate packaging materials were currently used for packing of fruits. These range from sacks, cartons and mostly wooden crates. The total marketing cost of citrus in the study area was reported to be PKR 160.32 while the marketing margins of citrus producers and various intermediaries involve in citrus marketing are discussed in the following sub-section.

Marketing margins of citrus

The price spread and marketing margins of citrus producers are presented in the Table 2.

Table 2: Details of price spread and marketing margins of citrus producer.

| S. No | Particulars | Cost (PKR /Crate) | %age of the Total Cost |

| A | Land rent* | 21.50 | 69.62 |

| B | Fertilizer cost* | 3.00 | 9.72 |

| C | Pesticide cost* | 2.50 | 8.10 |

| D | Labour cost (hoeing etc) * | 1.80 | 5.83 |

| F | Irrigation cost* | 2.08 | 6.74 |

| G | Total Cost | 30.88 | - |

| H | Total income (price received/crate) | 65.50 | - |

| I | Gross Margin of the Producer | 34.62 | - |

| % Gross Margin of Producer | 52.85 |

- |

Source: Derived from Survey Data; *: For details please see Annexure-I.

All the values associated with cost items presented in Table 2 are cost per crate (100 fruit units) in PKR. Land rent account for the largest cost in citrus production in the study area followed by fertilizer cost and pesticide cost. The average total cost of producing 100 units of citrus in the study area was reported to be PKR 30.88 while the gross revenue obtained by producer was PKR 65.50 per crate. The average net margin for producer in the study area was reported to be PKR 34.62.

Table 3 summarizes the cost per crate of citrus, purchase and sale prices and net margins of citrus market intermediaries. The table clearly depicts that producers incurred only the production cost, all the marketing costs were incurred by other market stakeholders in the study area. Keeping in mind the uncertainties associated with the value of the produce in terms of price fluctuations, financial constraints, natural disasters and catastrophic risks, the producers usually sell their orchards to the contractors and receive a lower sure value of the produce as against a higher but uncertain amount. Producers on average received PKR 65.5 for their produce and hence fetched a net market margin of PKR 34.62 which was 21 percent of total net marketing margins of citrus (PKR 164.8) and 9.7 percent of the consumer price (PKR 356).

The contractor incurred highest proportion (PKR 103.07) of the marketing cost per crate. The total cost per crate (purchase price + marketing cost) for contractor was PKR 168.57 while the average sale price for orchard contractor was PKR 235. Hence, the orchard contractor on average generated PKR 66.43 per crate as their net market margins which was 40 percent of the total marketing cost and 18.7 percent of the consumer price. Wholesaler received the produce from the contractor at the rate of PKR 235 and incurred additional PKR 52.25 as marketing expenses. The total cost per crate for wholesaler was PKR 287.25 while the sale price for wholesaler was PKR 330.75. The wholesaler on average generated PKR 32.75 as their net market margins which was 20 percent of the total marketing cost per crate of citrus and 9.2 percent of the consumer price. The retailer received the produce at the rate of PKR 320 per crate and incur additional PKR 5 as marketing cost (for loading and unloading the produce). The total per crate cost of citrus for retailer was PKR 325 while the average price received was PKR 356. The net market margins generated by retailers was PKR 31

Table 3: Market margins of various intermediaries in citrus marketing.

| Market Margins | Producer | Orchard Contractor | Wholesaler | Retailer | Consumer (end-user) |

| Purchase price /Crate (PKR) | *30.88 | 65.5 | 235.0 | 320.0 | 356.0 |

| Marketing costs/Crate (PKR) | 0 | 103.07 | 52.25 | 5.0 | Total marketing cost=160.32 |

| Total cost/Crate (PKR) | 0 | 168.57 | 287.25 | 325.0 | |

| Sale price/Crate (PKR) | 65.5 | 235.0 | 320.75 | 356 | |

| Net margin per Crate (PKR) | 34.62 | 66.43 | 32.75 | 31.0 | Total net margins= 164.8 |

| % in total net market margin | 21 | 40 | 20 | 19 | |

| % net margin in consumer’s price | 9.7 | 18.7 | 9.2 | 8.7 |

*: Production cost/Crate (which is 8.7% of consumer price).

which was 19 percent of the total marketing cost of citrus and 8.7 percent of the consumer price.

The total marketing cost incurred by various middlemen per crate in the citrus value chain was 45 percent of the consumer’s price while the total net margins generated by various middlemen in the citrus value chain was 46.29 percent of the consumer’s price. Highest net margin, PKR 66.43 is received by the orchard contractor in the citrus value chain while producer only received PKR 34.62 as net margin in citrus marketing. Producers’ share in the net margins can be increased by eliminating/reducing the role of middlemen (particularly orchard contractor) and encouraging self-marketing.

Conclusion

Based on the findings it can be concluded that majority of the citrus growers in the study area sold their produce to pre-harvest contractors who further channelized the produce to wholesalers. The wholesalers supplied the produce to the retailers who advanced the produce to the ultimate consumers. Main cost items in citrus production were market charges (commission), transportation cost and packaging cost. The pre harvest contractors’ share was the highest in terms of percent net margins followed by the producer. Marketing cost and margins indicated that the producers may pocket the share of the pre-harvest contractor by eliminating the pre-harvest contractor through initiation of self-marketing. The findings suggest that the Government should activate/motivate the Agricultural Department (Extension Wing) to establish the fruit growers’ cooperative marketing societies/associations. The government institution should also device policies particularly for the capacity building of citrus farmers on value addition activities (harvesting/picking, sorting, grading, packing, collective transportation, price information and direct marketing) which may result in sustainable improvement in farmers’ income in the long-run. The horticultural experts (Research Wing) should also extend services in post-harvest management/marketing skills to enable farmers practice self-marketing in order to increase their market share by eliminating the pre-harvest contractors in the citrus value chain.

Authors Contribution

Raza Ullah was the main investigator of the study. Qaisar Shah Safi helped during major revision of the article. Ghaffar Ali analysed the data and Irfan Ullah helped in report writing.

References

Anon. 2012a. Key industry statistics for citrus growers. Citrus Growers Association of Southern Africa. Pp. 48.

Anon. 2012b. Agricultural Statistics of Pakistan (ed. Aslam, M. and Ullah, H.). Ministry of National Food Security and Research, Government of Pakistan. pp. 272.

Cochran, W.G. 1977. Sampling techniques, 3rd edition, Willey and Sons, New York.

Gorinstein, S., O. Martin-Belloso, Y. Park, R. Haruenkit, A. Lojek, I. Milan, A. Caspi, I. Libman and S. Trakhtenberg. 2001. Comparison of some biochemical characteristics of different citrus fruits, Food Chem. 74: 309-315. https://doi.org/10.1016/S0308-8146(01)00157-1

Government of Pakistan. 2010. Economic Survey of Pakistan, Economic Advisory Wing. Finance Division, Islamabad, Pakistan.

Government of Pakistan. 1999. District census report of Buner, population census organization statistic division Government of Pakistan, Islamabad. pp 1-3 and 16-17.

Mahmood, R.A. Rehman, and M. Ahmad. 2014. Prospects of biological control of citrus insect pests in Pakistan. J. Agric. Res. 52(2): 229-244.

Naz, S., K. Shahzadi, S. Rashid, F. Saleem, A. Zafarullah, and S. Ahmad. 2014. Molecular Characterization and phylogenetic relationship of different citrus varieties of Pakistan. J. Anim. Plant Sci. 24(1):315-320.

To share on other social networks, click on any share button. What are these?