Zarqa Khalid1*, Muhammad Asad ur Rehman Naseer1, Raza Ullah1 and Shahzad Khan2

1Institute of Agricultural and Resource Economics (IARE), University of Agriculture Faisalabad, Punjab, Pakistan; 2Institute of Development Studies (IDS), The University of Agriculture, Peshawar, Khyber Pakhtunkhwa, Pakistan.

Abstract | Cotton is the most considerable non-food cash crop of Pakistan and it contributes significantly to the national income of the country. Cotton supplies raw material to the domestic textile industries and is also exported in the raw and processed form to other countries. Pakistan was a net exporter of cotton but now becomes a net importer due to its continuous domestic consumption and stagnant yield. This study aims to assess the trade competitiveness of cotton crop for the world’s 10 leading cotton exporters using revealed comparative advantage indices and relative competitive advantage indices such as Revealed Comparative Advantage (RCA), Revealed Symmetric Comparative Advantage (RSCA), Relative Import Advantage (RMA), Relative Export Advantage (RXA) and Relative Trade Advantage (RTA). The data were taken from the International Trade Center (ITC) UN-COMTRADE Statistics of cotton export and import from 2009-18. The findings revealed that Pakistan has a competitive and comparative advantage in exports of cotton while having a disadvantage in imports of cotton and also has no specialization in its exports. The results suggested that Pakistan has to explore new potential markets to strengthen its comparative and competitive advantage as well as raise cotton export earnings.

Received | April 03, 2020; Accepted | December 14, 2020; Published | February 21, 2021

*Correspondence | Zarqa Khalid, Institute of Agricultural and Resource Economics (IARE), University of Agriculture Faisalabad, Punjab, Pakistan; Email: [email protected]

Citation | Khalid, Z., M.A.R. Naseer, R. Ullah and S. Khan. 2021. Measuring the global trade competitiveness of Pakistan’s cotton crop. Sarhad Journal of Agriculture, 37(1): 158-166.

DOI | http://dx.doi.org/10.17582/journal.sja/2021/37.1.158.166

Keywords | International trade, Revealed comparative advantage, Revealed symmetric comparative advantage, Relative export advantage, Relative import advantage, Relative trade advantage, Cotton crop

Introduction

Competition is the fundamental economic instrument of the market economy. Competing with other institutions/organizations, to achieve the advantage associated with the functioning of the domestic and global market is a vital component of the activity of each institution/organization (Juchniewicz, 2014; Misala, 2007). The concept of comparative advantage and competitiveness is used to achieve the objectives of the world trade benefits (Bojnec and Ferto, 2012). As the theory of comparative advantage justifies the pattern of specialization of any country at the international level without facing any trade barrier in markets. Due to state intervention, a commodity cannot compete even if it has a comparative advantage or a commodity may compete even it has no comparative advantage over it (Valenciano et al., 2012). While the term export competitiveness has been explained in so many approaches along with different scopes in literature. The concept of competitiveness is explained as a country (firm/entity) can trade its products to meet the required demand of global consumer (like quantity, quality, and price) at the same time to maximize its profit to make the country economically better (Turi et al., 2014). At the domestic level firms or industries compete within the border and at the international level, countries compete outside the boundaries to gain maximum returns for their products (Naseer et al., 2019; Ariyawardana and Collins, 2013).

The concept of comparative advantage was firstly familiarized by Ricardo (1817) (classical economist), Heckscher (1949), and Ohlin (1933) (neo-classical economists) (Sachithra et al., 2012; Ilyas et al., 2009). Balassa (1977, 1965) put forward further explanation with the concept of revealed comparative advantage. Vollrath (1987) was among those researchers who presented the difference between competitive and comparative advantage. He contended that comparative advantage is useful to well-functioning, efficient, and undistorted prices in the market while if there are distortions in markets competitive advantage is deemed appropriate to apply (Ilyas et al., 2009; Vollrath, 1987).

In the past few years, South Asian countries have been gone through many structural changes and the GDP share of the agricultural sector in the economy has sharply declined (IGC, 2010). Technological advancement rises in income, and liberalization of trade during the past couple of decades also caused multiple changes in the capacity and the structure of world trade. The cotton crop and its products play a significant role as the globalization of the agriculture sector increases. However, dynamic consequences in foreign markets leave a major impact on the local industry. Identification of prominent contributors to the international cotton market provides the basis for understanding the international cotton economy (Iqbal et al., 2013).

Pakistan is blessed with agricultural resources including a feasible climate, sufficient land, and water resources that are beneficial to produce agricultural products (Naseer et al., 2016). The agriculture sector is known as the backbone of the economy of Pakistan contributing around 18.9 percent in Gross Domestic Product (GDP), absorbing about 38.5 percent of the manpower (GOP, 2019), and the main source to provide the raw material for many value-added sectors (GOP, 2018; Naseer et al., 2019).

Cotton, also known as “white gold”, is profitable cash (non-food) crop (Alexandra, 2013) that belongs to the family of flowering plants “Malvaceae” (Iqbal et al., 2013). Pakistan is a major cotton-producing country and occupies the fourth position as the world’s largest cotton producer following India, China, and the USA (PCCC, 2017). During 2017-18, the total area under cotton crop was 2699 thousand hectares with a total production of 11936 million bales and recorded a growth of 11.8 percent over the last year’s production. The increased production is mainly attributed to better economic returns received during last year, government promotion campaigns of cotton, timely rains, and availability of inputs on the subsidized rate (GOP, 2019).

The cotton export value of Pakistan and the world has been increased from 2008 to 2013 and then started to decline till 2018. During 2018, the total value of cotton export from Pakistan was US$3498.997 million (GOP, 2018), and the main foreign markets were China, UK, the USA, Germany, Italy, Spain, Australia, and many other countries. The exports of cotton and cotton made products contribute 10 percent to the GDP of Pakistan and 55 percent of the total export earnings of the country (Maqbool et al., 2019). Pakistan is also a major consumer of cotton, consuming 9 percent of the world’s total cotton (PCCC, 2017). Out of the total cotton produced, 30-40 percent is consumed domestically while the remaining is exported in the form of cotton yarn, fresh cotton, and garments (GOP, 2006). Rice and cotton are two major exported items and export focus together on 8-10 countries, primarily developed countries (Afridi et al., 2016).

Cotton is a political crop due to its significance in worldwide trade and to the economies of several developing countries. In various countries, cotton exports not only are a vibrant contribution to foreign exchange earnings but also for a noteworthy share of GDP and tax income. Keeping in view the importance of the cotton crop in the world as well as Pakistan’s economy and the socio-economic development of the country, this study is designed to evaluate the current pattern in the international trade of Pakistan’s cotton crop. The major objective of this study is to find out the comparative advantage of the ten world’s largest exporters of cotton. This research uses the actual export flow of the cotton crop of Pakistan and compares it with its major export competitors. In Pakistan, several research studies have been conducted to calculate the export competitiveness of various crops in the agriculture sector as well as for other sectors. The previous research studies on competitiveness in Pakistan used Balassa’s Revealed Comparative Advantage (RCA) index. However, few of them measured the normality assumption in the traditional RCA index.

Therefore, this study applies the latest concept of Vollrath’s Revealed Symmetric Comparative Advantage (RSCA) to measure competitiveness along with the modified version of Vollrath indices known as Relative Export Advantage (RXA), Relative Import Advantage (RMA), and Relative Trade Advantage (RTA). Additionally, in the case of cotton, the literature is more specified using all these methodologies in a single study. The earlier studies such as (Afridi et al., 2016; Anwar and Husaain, 2009; Bashimov, 2015; Iqbal et al., 2013; Joolaie et al., 2013; Leelavathi et al., 2015; Maqbool et al., 2020; Zaheer et al., 2015; Samuel and Rejani, 2015; Sheikh, 2014) used Gravity Model, RCA, Bilateral Revealed Comparative Advantage (BRCA), RSCA, Domestic Resource Cost (DRC), Shift Share Analysis. Moreover, cotton is considered as the lifeline for Pakistan’s economy as the export revenue of the country is heavily dependent on the cotton crop. Since the last decade, the cotton export has become flat as international competitors come into the World market which shrunken Pakistan’s share in the global trade. In this study, an attempt was made by keeping the top ten cotton producers in the World using the last ten years of data. Keeping in view the importance of the cotton sector of Pakistan, the study in hand is designed to evaluate cotton exports from Pakistan, its competitiveness, and specialization compared with world-leading cotton exporters.

Materials and Methods

This study is evaluating the global trade competitiveness of Pakistan’s cotton crop with 10 world-leading exporters. To calculate the relevant indices, export, and import values data of the cotton crop during 2009-2018 for the top ten leading cotton producers and the world were taken from the International Trade Centre (ITC). Various indicators were used to compute the competitive and comparative advantages. To get a clear image of competitiveness, RCA, RSCA, RTA, RXA, and RMA were employed on the collected data. These indices offer a valuable measure to evaluate the comparative advantage and competitive advantage based on actual trade performance.

Revealed comparative advantage (RCA)

Haberler (1936) presented the concept of comparative advantage based on opportunity cost theory and this theory also gained popularity as a law of comparative cost. This only constructs theoretical arguments while the literature of trade also requires to be considered in evaluating the comparative advantage (Naseer et al., 2019; Abbas and Waheed, 2017; Salvatore, 2013). Balassa (1965) filled this gap who presented the theory of revealed comparative advantage (RCA), to measure the comparative advantage based on the structure and performance of the trade. This theory disclosed that a country’s trade pattern reflects both changes in endowment factors, and relative cost, resulting in comparative advantage.

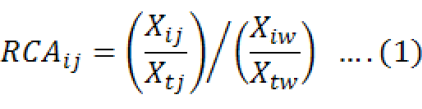

Balassa (1965) RCA index, one of the most widely used methods in an export measure of competitiveness and trade specialization of the country in which they have competitiveness over the other countries or rest of the world (Akhtar, 2013) can be expressed as follows:

Where;

ith exported from country jth (RCAij), Xij= exports of ith products from country jth, Xtj=total exports value all products of the jth country, Xiw=exports value of the ith product in the world and Xtw=total export value of all products of the world. The RCA index value ranges from 0 to ∞. If RCA > 1 for a country, then it is supposed to be that particular country has a comparative advantage in a particular product and vice versa (Wiranthai and Mubarok 2017; Rifin, 2013; Nwachukwu et al., 2010).

Revealed symmetric comparative advantage (RSCA)

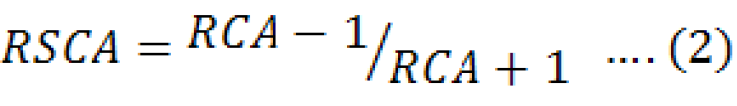

Some studies developed the compulsory and appropriate monotonic conditions under identical homothetic preferences to examine the relationship between the Balassa index and pre-trade prices for different industries between the two countries. There is a risk of non-normality arises due to the value between 0 and ∞ in Balassa RCA index and using regression analysis employing RCA index values gives excessive weight to values more than unity (Hassan and Rehman, 2015; Esmaeili, 2014; Cole et al., 2005; Laursen, 1998). There is one solution to handle it by employing the logarithm transformation form of the Balassa index (Vollrath, 1991). This solution is not convenient as the weights of allocation to undefined, large, and small values that occur even if the export is equivalent to 0 (Dalum et al., 1998). RSCA is a transformation from a basic RCA index (Javed et al., 2017; Laursen, 2015; Esmaeili, 2014) where;

Now, the value of the RSCA index lies between -1 to +1. This is the symmetric index and if the RSCA value is lower than 0 indicates that there are under-specialization and comparative disadvantage and vice versa (Esmaeili, 2014).

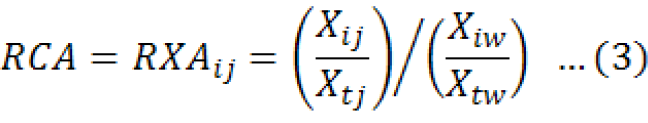

Relative export advantage (RXA)

Revealed Comparative Advantage Index (RCA) was firstly formulated by Balassa (1965) and improved by Vollrath (1991) to avoid the double-counting between countries. A modified version of Vollrath is known as Relative Export Advantage (RXA). Where RXA defined as;

Where;

X denotes exports, i is a product, j is a country, t is a set of all products, and w is a set of all countries. If the RXA value is higher than 1, the country holds a comparative advantage and specialization in the product under consideration. Estimation indicates that it has a robust export sector and higher competitiveness and vice versa (Hassan and Rehman, 2015).

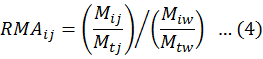

Relative import advantage (RMA)

Vollrath (1991) has been proposed other comparative advantage indices. The Relative Import Advantage (RMA) index same defined as the Relative Export Advantage (RXA) index, but it involves imports (M) rather than exports (X). RMA defined as follows:

As M denotes to imports, i is a product, j is a country, t is a set of all products, and w is a set of all countries. In this index, if the RMA index is less than 1 shows higher competitiveness and relative comparative advantage (Maqbool et al., 2019; Mamoon et al., 2011).

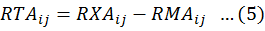

Relative trade advantage (RTA)

There is another index which is known as the Relative Trade Advantage (RTA) index that shows the net trade disadvantage and advantage between RMA and RXA (Singgu and Antwi, 2014; Akhtar et al., 2013). Where;

The value of RTA can be less and greater than zero (0). If the value of RTA is positive, it indicates a comparative advantage. The negative value of RTA is an indication of comparative disadvantage (Hoang et al., 2017; Latruffe, 2010).

Results and Discussion

The findings of the world’s top 10 exporters of the cotton industry from 2009 until 2018 average values (10 years latest accessible data) are presented in Table 1. The main cotton export destinations of Pakistan are China, Bangladesh, turkey Italy and the USA (ITC, 2019). Revealed Comparative Advantage (RCA) index of Balassa (1965) used to compute the comparative advantage of the cotton industry of selected countries. The calculated RCA for selected countries shows different patterns among countries under consideration period. It reveals that 9 out of 10 countries China, USA, India, Pakistan, Vietnam, Turkey, Australia, Brazil, and Italy got a comparative advantage in the export of cotton as their RCA value lies above than 1 while Hong Kong has a comparative disadvantage because its value of calculated RCA is less 1. The situation of the Pakistani cotton sector is comparable as Pakistan is the fourth major cotton exporter and holds the first highest comparative advantage.

In order to make a better evaluation of competitiveness for exporting commodities, the transformation was made in the RCA index, one is RSCA which is between -1 and +1. By looking at the table it can be observed that all countries have RSCA values between -1 and +1 except Hong Kong. Results of the RSCA index indicate the comparative advantage of all countries only except from Hong Kong which had a comparative disadvantage. Pakistan has an uppermost value of RSCA index is evidencing highest comparative advantage in the cotton industry but there was observed fall in RSCA value of Pakistan, during 2009-18, which is since there was a fast decline in the share of export to production mainly due to imposing severe quality standard from importing markets.

Table 1: Revealed comparative and competitive advantage indicators of cotton industry.

|

Country |

RCA |

RSCA |

RXA |

RMA |

RTA |

|

China |

2.10 |

0.35 |

2.10 |

2.14 |

0.15 |

|

USA |

1.42 |

0.17 |

1.42 |

0.15 |

-0.53 |

|

India |

7.61 |

0.76 |

7.61 |

0.58 |

5.66 |

|

Pakistan |

52.63 |

0.96 |

52.63 |

5.81 |

50.68 |

|

Viet Nam |

2.75 |

0.45 |

2.75 |

6.82 |

0.80 |

|

Turkey |

3.47 |

0.55 |

3.47 |

4.12 |

1.52 |

|

Australia |

1.97 |

0.29 |

1.97 |

0.12 |

0.02 |

|

Brazil |

1.96 |

0.31 |

1.96 |

0.57 |

0.01 |

|

Hong Kong |

0.04 |

-0.92 |

0.04 |

1.64 |

-1.91 |

|

Italy |

1.07 |

0.02 |

1.07 |

1.02 |

-0.88 |

Source: Authors calculations, RCA: Revealed Comparative Advantage; RSCA: Revealed Symmetric Comparative Advantage; RXA: Relative Export Advantage; RMA: Relative Import Advantage; RTA: Relative Export Advantage.

The competitive advantage of selected countries calculated by employing an alternative index presented by Vollrath (1991). The competitiveness of cotton exports was examined by using RXA to eliminate the RCA index’s weaknesses and to seize a strong approximation of the competitiveness of export commodities. This index is broadly used in the studies of international trade to scrutinize the competitiveness for exports of commodities and groups of commodities. The main reason to compute all three indices is to make more appropriate and comprehensive measurement of the competitiveness of cotton exports. The compatible results of all three indices indicate their strength of measurement.

The findings for RXA are consistent with the findings of RCA and RSCA indices. Results indicate that all countries which have their RXA index value greater than 1 have a competitive advantage in the export of cotton and vice versa. According to the findings of the RXA index, it has been cleared that Hong Kong is the only country that had a competitive disadvantage in cotton export. Although Pakistan dominates higher competitiveness of cotton export but the slightly declining trend in its competitiveness posing a competitive challenge for Pakistan in international markets.

Furthermore, Table 1 displaying the RMA index which revealed that if the calculated value of a country is less than 1 that country has a competitive advantage in its cotton import otherwise it has a competitive disadvantage. The calculated RMA values indicate that only four countries the USA, India, Australia, and Brazil have a competitive advantage in their imports of cotton because their RMA index value is less than unity. Pakistan holds a higher second value which is the indication of competitive disadvantage by importing cotton from the international market.

The positive values of RTA indicate the competitive advantage of trade in China, India, Pakistan, Vietnam, Turkey, Australia, and Brazil. Nevertheless, the other countries with their negative value of the RTA indicator represent comparative trade disadvantage. These indices are meager numbers though showing an order of declining and rising competitiveness patterns and are not similar from one to another country. Based on the study, all competitive indices cotton exports competitiveness of Pakistan is on the declining side and its share of export quantity-wise and value-wise has dropped during the study period.

Figure 2 described the changes in revealed comparative advantage and relative competitive advantage among selected countries from 2009 to 2018. Figure 2a explained all selected countries except China, Turkey, Pakistan, and Italy are more specialized in cotton export. The highest improvement can be noticed in the cause of Australia. It is unfortunate that Pakistan, although the prominent exporter and has a higher comparative advantage, it has no specialization in cotton exports during the study period. Figure 2b illustrated that the positive trend of the USA, India, Viet Nam, Australia, Brazil, and Hong Kong made them specialized in the global market for exporting cotton. The highest growth can be seen in the case of India while the largest decrease can be seen in the case of Pakistan which indicates that Pakistan has no specialization in cotton export along with China, Turkey, and Italy. Change in RMA in Figure 2c postulated that countries that have positive trends face a disadvantage in cotton imports and vice versa. Pakistan has a positive highest value among its competitors which shows its disadvantage in cotton imports. Figure 2d explains the clear disadvantage of Pakistan in the cotton trade due to its negative trend in the graph which is the worse sign for Pakistan’s trade sector. All other countries dominate the comparative trade advantage in the trade sector expect from China, Pakistan, Turkey, and Italy as their RTA value is directed by a positive value.

Conclusions and Recommendations

In conclusion, under the whole study period, Pakistan dominates higher export comparative advantage and competitive advantage in the cotton industry over its rivals based on Balassa (1965) and Vollrath’s (1991) index of revealed comparative and relative competitive advantage. (Afridi et al., 2016; Chaudhry et al., 2009; Iqbal et al., 2013; Jin, 2003; Zaheer et al., 2015) supported the results of this study by revealing Pakistan’s export comparative advantage of cotton at the international level. Correspondingly, a study displays that growers are making more profit at the international price of cotton than at the local price. These conditions disclosed that the cotton crop is underpriced in the domestic market and growers are in a cots-price congestion situation (Dawn, 2020). Furthermore, it verified that Pakistan is in a better place in cotton export at the international market against its major rivals. Even though Pakistan has higher competitiveness in exports of cotton but has no specialization in its export. But there is no need to much worry about the competitiveness of the cotton crop of Pakistan because there are many kinds of cotton manufactured products that have a more comparative and competitive advantage at the same time.

The change in the RSCA values of the last decade shows that Pakistan did not improve its comparative advantage rather is remains almost the same. There are several reasons for this, i.e., regional devaluation in the currency, inconsistency in yield of the cotton crop, shrinking global demand resulted in the decrease of cotton prices in the market, low wages, high cost of energy, high tax rate, bad government policies, energy crisis, high running cost, shortage of raw material, less productivity of labor, low level of technology, law and order situation in the economy and global financial crisis (Maqbool et., 2019; Malik et al., 2017; Syed, 2009).

The cotton sector of Pakistan has a comparative advantage and competitiveness, doing well to fulfill the global demand and production share of the cotton crop. The value addition of this sector is growing, and it is more beneficial to earn a profit because of its higher demand in the international market. At the same time, imports of cotton in Pakistan are growing sharply which is not a good sign for the economy of Pakistan because there has been found a huge gap between its exports and imports of cotton. Furthermore, imports of the selected crop are higher than its exports in the global market. In the trade of cotton crops, positive values show that Pakistan still dominates the competitiveness in that market even its competitiveness is losing for the last few years.

Lastly, since consumer demand for cotton in the local market is high, it can be concluded the development in the local (domestic) industry is crucial if the demands of a rapidly growing population are to be encountered and Pakistan’s export potential is to be fully realized. Porter (1998) postulated that a key determinant to producing, nourishing, and promoting an appropriate environment and competitive advantage for any industry is developing in its domestic market. Ensuring the quality upgrading through proper utilization of all available resources to complete the value chain of the cotton sector and remain competitive under different circumstances.

Based on the findings it is suggested that the government should make some pleasant policy interventions to facilitate the cotton production, export, and imports of Pakistan. Farmers should be trained by the world’s innovative production techniques and facilitated by the quality of breeds, seeds, new verities of plats, latest mechanisms, trade statistics, and information. A private-public partnership can play a significant role to expand the export of cotton of the country by giving better infrastructure and all relevant information. Therefore, this is essential to explore new markets to enhance its competitive and comparative advantage and increase cotton export earnings. Additionally, the promotion of cotton will directly encourage industrialization and provide the imputes of exports.

Novelty Statement

The Present studies evaluates the cotton exports from Pakistan, its competitiveness and specialization compared with world-leading cotton exporters.

Author’s Contribution

Zarqa Khalid: Main idea, literature review, data collection.

Muhammad Asad ur Rehman Naseer: Write up, data analysis

Raza Ullah: Data analysis and result interpretation.

Shahzad Khan: Discussion and conclusion, write up.

Conflict of interest

The authors have declared no conflict of interest.

References

Abbas, S. and A. Waheed. 2017. Trade competitiveness of Pakistan: Evidence from the revealed comparative advantage approach. Int. Bus. J., 27(5): 462-475. https://doi.org/10.1108/CR-12-2015-0092

Afridi, G.S., A. Saboor, Z.U. Haq, S.A. Tariq and M. Ishaq. 2016. Exploring potential and opportunities for Pakistan’s cotton export. Pak. J. Agric. Res., 29(2): 188-201.

Akhtar, W., N. Akmal, H. Shah, M.A. Niazi and A. Tahir. 2013. Export competitiveness of Pakistani Horticultural products. Export competitiveness of Pakistan horticulture products. Pak. J. Agric. Res., 26(2): 87-96.

Alexandra, L., 2013. The sub-Saharan Africa cotton sector. Selected feature. Doctoral school in economics and management. University of Trento School of social sciences. pp. 1-244. https://core.ac.uk/download/pdf/35317277.pdf.

Anwar, S. and Z. Hussain. 2009. Dynamics of comparative advantage and competitiveness of cotton crop in Pakistan and policy implications. Pak. J. Appl. Econ., 19(2): 79-101. https://doi.org/10.35536/lje.2005.v10.i2.a7

Ariyawardana, A. and R. Collins. 2013. Balancing industry needs global competitiveness: Challenge for the Australian vegetable industry. Outlook Agric., 42(3): 155-166. https://doi.org/10.5367/oa.2013.0131

Balassa, B. 1965. Trade liberalization and “Revealed” comparative advantage. Manch. Sch., 33: 99-123. https://doi.org/10.1111/j.1467-9957.1965.tb00050.x

Balassa, B. 1977. ‘Revealed’ comparative advantage revisited. An Analysis of Relative Export Shares of the Industrial Countries, 1953-1971.

Bashimov, G., 2015. Revealed comparative advantage of Turkish cotton sector. Int. Res. J. Soc. Sci., 4(7): 16-18.

Bojnec and Fetro. 2012. Complementarities of trade advantage and trade competitiveness measures. Appl. Econ., 44(4): 399-408. https://doi.org/10.1080/00036846.2010.508725

Chaudhry, I.S., M.B. Khan and M.H. Akhtar. 2009. Economic analysis of competing crops with special reference to cotton production in Pakistan: The case of Multan and Bahawalpur regions. Pak. J. Soc. Sci., 29(1): 51-63.

Cole, M.A., R.J.R. Elliot and K. Shimamoto. 2005. Why the grass is not always greener: The competing effect of environmental regulations and factor intensities on US specialization. Ecol. Econ., 54: 95-109. https://doi.org/10.1016/j.ecolecon.2004.11.014

Dalum, R., K. Laursen and G. Villumsen. 1998. Structural change in OECD export specialization pattern: De-specialization and stickiness. Int. Rev. Appl. Econ., 12: 423-443. https://doi.org/10.1080/02692179800000017

Dawn. 2020. Cotton has Comparative Advanatge in WTO Regime. Available at https://www.dawn.com/news/375408/cotton-has-comparative-advantage-in-wto-regime.

Esmaeili, A., 2014. Revealed comparative advantage and measurement of international. Competitiveness of dates. J. Int. Food Agribus. Mark., 26: 209-217. https://doi.org/10.1080/08974438.2014.909280

GOP, 2006. Economic survey of Pakistan 2005-06. Trade and payments. Ministry of Finance, Government of Pakistan, Islamabad, Pakistan.

GOP, 2008. Economic survey of Pakistan 2005-06. Trade and payments. Ministry of Finance, Government of Pakistan, Islamabad, Pakistan.

GOP, 2018. Economic survey of Pakistan 2017-18. Agriculture. Ministry of Finance, Government of Pakistan, Islamabad, Pakistan.

GOP, 2019. Economic survey of Pakistan 2018-19. Agriculture. Ministry of Finance, Government of Pakistan, Islamabad, Pakistan.

Haberler, G., 1936. The theory of international trade. Edinburgh: William Hodge.

Hassan, M.A. and S. Rehman. 2015. Analysis of competitiveness of Pakistan’s Mango export in the World Market. IORS J. Bus. Manage., 17(7): 69-75.

Heckscher, E., 1949. The effect of foreign trade on the distribution of income. In: Ellis, H. and Metzler, L. (Eds), Readings in International Trade, Blaskistion Co, Philadelphia, PA.

Hoang, V.V., K.T. Tran and B.V. Tu. 2017. Assessing the agricultural competitive advantage by the RTA index: A case study in Vietnam. Econ. Inf., 9(3): 15-26. https://doi.org/10.7160/aol.2017.090302

IGC, 2010. Economic growth and structural change in South Asia: Miracle or Mirage. International Growth Center, Working Paper 10/0859. Retrieved from http://eprints.lse.ac.uk/36389/1/Economic_growth_and_structural_change_in_South_Asia.pdf on 15th June 2019.

Ilyas, M., T. Mukhtar and M.T. Javid. 2009. Competitiveness among Asian exporters in the world rice market. 84(4): 783-794. https://doi.org/10.30541/v48i4IIpp.783-794

Iqbal, M., Z. Hussain, I.R. Noorka, M. Akhtar, T. Mahmood, S. Sana and I. Sana. 2013. Revealed comparative and competitive advantage of white gold of Pakistan (Cotton) by using Balassa and White Index. Int. J. Appl. Agric. Sci., 5(1): 64-68.

ITC. 2019. International Trade Statistics, Trade Statistics for International Business development. https://www.trademap.org/Index.aspx

Javed, I., M. Ashfaq and N. Anwar. 2017. Exports of major agricultural products from Pakistan to United Arab Emirates: Performance and comparative advantage. Sci. Technol. Dev., 36(1): 53-60.

Jin, Y., 2003. An analysis of cotton product competitiveness in the top ten cotton product exporters to the United States using the Environmental Analysis Framework (Doctoral dissertation, University of Georgia).

Joolaie, R., F.J.H. Yousafzadeh and B.F. Shirani. 2013. Investigation of Competitiveness and support from production cotton and rice in Golestan Province. 20(2): 197-216.

Juchniewicz, M., 2014. International competitiveness of the food industry in the European Union member states. Eur. J. Soc. Sci. Educ. Res., 1(2): 255-266. https://doi.org/10.26417/ejser.v2i1.p254-265

Latruffe, L., 2010. Competitiveness, productivity and efficiency in agriculture and agri-food sectors. OECD Food. Agriculture and Fisheries papers, No. 30, OECD Publishing, Pairs, France pp. 5-52.

Laursen, K., 1998. Revealed comparative advantage and the alternatives as measures of international specialization. DRUID, Copenhagen Business School, Department of Industrial Economics and Strategy/ Aalborg University, Department of Business Studies.

Laursen, K., 2015. Revealed comparative advantage and the alternative as measures of international specialization. Eur. Bus. Rev., 5: 99-115. https://doi.org/10.1007/s40821-015-0017-1

Leelavathai, C., V.K. Reddy and B. Naidu. 2015. Trade competitiveness of cotton and Andhra Pradesh. Int. J. Multidis. Res. Dev., 2(5): 428-431.

Malik, A., E. Ghani and M. Din. 2017. An assessment of Pakistan‘s export performance and the way forward (No. 2017: 153). Pakistan Institute of Development Economics.

Mamoon, D.D., S.A. Paracha, H. Mughal and A. Ayesha. 2011. Pakistan’s Trade Competitiveness and Complementarities in South Asia. https://www.researchgate.net/publication/254444030_Pakistan’scomplementarities_in_South_Asia.

Maqbool, M.S., H.U. Rehman, F. Bashir and R. Ahmad. 2019. Investigating Pakistan’s revealed comparative advantage and competitiveness in cotton sector. Rev. Econ. Dev. Stud., 5(1): 125-134. https://doi.org/10.26710/reads.v5i1.570

Maqbool, S.M., H.U. Rehman and T. Mahmood. 2020. A comparative analysis of export competitiveness of top five cotton exporting countries. Pak. J. Soc. Sci., 40(1): 123-131.

Misala, J., 2007. Międzynarodowa zdolność konkurencyjna i międzynarodowa konkurencyjność gospodarki narodowej. Podstawy teoretyczne, Politechnika Radomska, Radom.

Naseer, M.A.R., A. Ashfaq, S. Hassan, S.A. Adil and A. Ariyawardana. 2019. Outlook on global trade competitiveness of Pakistan’s mandarin industry: An application of revealed symmetric comparative advantage framework. Outlook Agric., 48(1): 66-74. https://doi.org/10.1177/0030727018817788

Naseer, M.A.U.R., M. Ashfaq, M. Abid, A. Razzaq and S. Hassan. 2016. Current status and key trends in agricultural land holding and distribution in Punjab, Pakistan. Implications for food security. J. Agric. Stud., 4(4): 14-27. https://doi.org/10.5296/jas.v4i4.9670

Nwachukwu, I.F., Nwachukwu, N. Agwu and J.C. Nwaru. 2010. Competitiveness and detriments of Coca export from Nigeria. https://www.researchgate.net/publication/224002470_of_cocoa_export_from_nigeria.

Ohlin, B., 1993. Interregional and International Trade, Harvard University Press, Cambridge, MA.

PCCC, 2017. Pakistan institute of cotton research and technology Karachi. Pakistan Central Cotton Committee, Ministry of Textile Industry, Pakistan.

Porter, M.E. 1998. The competitive advantage of nations. Harvard Business Review.

Ricardo, D., 1817. The principles of political economy and taxation. Cambridge University Press, Cambridge.

Rifin, A., 2013. Competitiveness of Indonesian Cocoa beans export in the world market. Int. J. Trade, Econ. Finance, 4(5): 279-281. https://doi.org/10.7763/IJTEF.2013.V4.301

Sachithra, K.M.V., G.A.C. Sajeevi and M.P.K. Withanawasam. 2012. Comparative advantage of international trade of Sri Lanka in the SAARC Region. 4th Int. Conf. Bus. Inf., University of Kelaniya.

Salvatore, D., 2013. International economics. Hoboken: John Wiley and Sons.

Samuel, J. and R. Renjani. 2015. Production, growth and export competitiveness of raw cotton in India: An economic analysis. Agric. Res. Technol., 1(1): 1-5. https://doi.org/10.19080/ARTOAJ.2015.01.555551

Sheikh, W., 2014. Competitiveness of cotton export of India. A shift share analysis. Glob. J. Res. Anal., 3(2): 27-28. https://doi.org/10.15373/22778160/February2014/10

Sinngu, T. and M. Antwi. 2014. Competitiveness of the South African citrus fruit industry relative to Its Southern hemisphere Competitors. J. Agric. Sci., 6(12): 1-15.

Suntharalingam, C., T.M.A.T. Ahmad, A.K. Ali, R. Rusli and N.A. Halim. 2011. Competitiveness of Malaysia’s fruits in the global agricultural and selected export markets: analyses of revealed comparative advantage and comparative exports performance. Econ. Technol. Manage., 6: 1-17.

Syed, R., 2009. Leather industry demands support amid stiff international competition. www.iin.com.pk

Turi, A., G. Gonacalves and M. Mocan. 2014. Challenges and competitiveness indicators for sustainable development of supply chain in food industry. Proc. Soc. Behav. Sci., 124: 133-141. https://doi.org/10.1016/j.sbspro.2014.02.469

Valenciano, J.D.P., M.A. Giancinti and J. Uribe. 2012. Revealed comparative advantage and competitiveness in Pear. Int. J. Food Syst. Dyn., 3(1): 1-10.

Vollrath, T., 1991. A therotical evalution of alternative trade intensity measures of revealed comparative advantage. Weltwirtschaftliches Arch., 127: 265-280. https://doi.org/10.1007/BF02707986

Vollrath, T.L., 1987. Revealed comparative advantage for wheat, U.S. Competitiveness in the world Wheat Market. Proceedings of a Research Conference. Washington, D.C. USDA, ERS, International Economics Division.

Wiranthai, P.E. and F. Mubarok. 2017. Competitiveness and the factors affecting export of Indonesia canned pineapple in the world and the destination countries. Sustainable Agriculture and Food Security: a comprehensive approach (ICSAFS), Jantinangor, Sumedang, West Java, Indonesia. pp. 339-352. https://doi.org/10.18502/kls.v2i6.1056

Zaheer, R., M.F.K. Niazi, and U. Nizami. 2015. Cotton export potential: A case study of Pakistan. J. Econ. Sustainable Dev., 6(5): 134-140.

To share on other social networks, click on any share button. What are these?