Impact of Government Agricultural Policies on Major Staple Food Prices in Nigeria (1966 - 2011)

Research Article

Impact of Government Agricultural Policies on Major Staple Food Prices in Nigeria (1966 - 2011)

Opeyemi Eyitayo Ayinde1*, Kayode Ayinde2, Tofunmi Emmanuel Ilori1, Raphael Olanrewaju Babatunde1

1Department of Agricultural Economics and Farm Management, University of Ilorin, P.M.B.1515, Ilorin, Kwara State, Nigeria; 2Department of Statistics, Ladoke Akintola University of Technology, P.M.B. 4000, Ogbomoso, Oyo State, Nigeria.

Abstract | This study assessed the impact of government agricultural policies on the prices of major staple food in Nigeria. Secondary data were sourced from various organizations and used for this study. These data were transformed from their nominal value to real value and analysed using descriptive statistics, unit root test, ordinary least square model, Cochrane-Orcutt, least absolute deviation estimators and simultaneous equation model. The study further established that the prices of staple foods were inter-related. Also, it was showed that agricultural credit guarantee scheme funds (ACGSF), agricultural policies during structural adjustment period (SAP) and post-structural adjustment period (PSAP) were statistically significant while the agricultural input subsidy scheme was statistically insignificant in their impact on the prices of major staple crops. The study recommended painstaking formulation and implementation of agricultural policies and re-structuring of agricultural of input scheme.

Editor | Tahir Sarwar, The University of Agriculture, Peshawar, Pakistan.

Received | June 26, 2015; Accepted | September 30, 2015; Published | September 30, 2015

*Correspondence | Opeyemi Eyitayo Ayinde, University of Ilorin, Ilorin, Kwara State, Nigeria; E-mail | [email protected]

Citation | Ayinde, O. E., K. Ayinde, T. E. Ilori and R. O. Babatunde. 2015. Impact of government agricultural policies on major staple food prices in Nigeria (1966 - 2011). Sarhad Journal of Agriculture, 31(3): 191-198.

DOI | http://dx.doi.org/10.17582/journal.sja/2015/31.3.191.198

Keywords | Agricultural Policy, Staple food, Prices, Government

Introduction

The agricultural sector is an important economic sector in Nigeria’s economy because it plays a major role in rapid growth and development of the nation (Famoriyo and Nwagbo, 1981). Agriculture provides food for the growing population, employment for over 70% of the total population, raw materials and foreign exchange earnings for the development of industries (Giroh et al., 2010). In spite of the predominance of the petroleum sector and significant dependence of Nigeria economy on this sector, agriculture continues to be an important source of economic resilience and mainstay (Ojo and Akanji, 1996; NEEDS, 2004).

The performance of agriculture since 1970 in Nigeria clearly showed that it contributes more than 30% of the annual Gross Domestic Product (GDP), accounts for over 70% of the non-oil exports and provides over 80% of the food needs of the country (Adegboye, 2004). National Bureau of Statistics also reported in 2008 that Agriculture contributed 42 percent of Nigeria’s gross domestic product (GDP). It is the second largest export earner after crude oil and the largest employer of rural labor; thus, the sector ranks as a key contributor to wealth creation, poverty reduction and food security in the country.

However, the oil boom in the early 1970s caused a severe fall in the percentage contribution of the agricultural sector to 35 percent in the early 1980s and according to Okoh (2004), the export of crude oil constituted about 96% of total exports. It is imperative to note that Nigeria once a leading exporter of several agricultural products has lost her leadership position in the exportation of these agricultural products. Consequently, food imports continued to rise in value. For instance, food import as a percentage of total imports rose from 3.5% in 1991 to 11.8% in the year 2000 (CBN, 2000; Akosile, 2003; Nyanko, 2006). Also, for the past two decades, while population grew at a rate between 2.5% and 3% per annum, food production grew at a rate of about 2.5% per annum (CBN, 1999; World Bank, 2001). So, the pressure on domestic price levels persisted as the consumer prices; which reached very high levels at the end of 1993 increased further. Data from the Federal Office of Statistics showed that the average all-items composite consumer price Index (CPI) for the first half of 1994 stood at N1, 105.10. This represents an increase of 41.5% and 121.3% over the levels in the corresponding periods of 1993 and 1992 respectively (CBN, 1994). The CBN (1994) report further confirmed that the food components, which accounted for 69.1% of the expenditure bracket, recorded a lessen effect on the rate of price increase. This led to declining per capita production, high and rising food prices, increased food import and a growing deterioration in the nutritional status of the average Nigerian.

The realization of this by the Government led to the formulation and implementation of different agricultural programmes and policies aimed at preventing the collapse of the economy and subsequently targeted at short-to-medium-term adjustment to ensure sustainable growth of the economy. The agricultural policies and programmes instituted by the government over the years.

Also, According to Manyong (2005), three agricultural policy phases can be recognized as; Pre-structural Adjustment Period (before 1986); Structural Adjustment Period (1986 – 1993) and Post-structural Adjustment Period (1994 till date).

But despite many attempts to increase domestic food crop production and subsequently reduce the food prices through agricultural policy programmes formulation and implementation by the federal government; Nigeria is still a net importer of many food commodities especially the grains (CBN, 2010). Also it is observed that several agricultural policy and programme periods in the country accompany food crop output and price variability (CBN, 2010). Therefore, this study seeks to determine the effects of government agricultural policies on the major staple food prices in Nigeria. The findings from this study would contribute to the increased understanding of impact of government agricultural policies on some key variables in the Agricultural sectors and the entire economy. Also, the results from this study would be useful for the agricultural policy makers and other researchers as well.

Materials and Methods

Study area

It is a federal constitutional republic comprising 36 states and its Federal Capital Territory, Abuja. The country is located in West Africa and shares land borders with the Republic of Benin in the west, Chad and Cameroon in the east, and Niger in the north. About 60% of Nigerians work in the agricultural sector, and Nigeria has vast areas of underutilized arable land.

Sources of data

Secondary data were used for this study. The sources were; World Bank Database, Food and Agriculture Organization (FAOSTAT), Central Bank of Nigeria (CBN), National Bureau of Statistics (NBS) and Federal Ministry of Agriculture and Rural Development (FMARD).

Method of data collection

In carrying out this study, six major staple foods were purposively selected as they are among the food products of majority of the population in Nigeria and even in African countries. The selected major staple foods were maize, cassava, cowpea, yams, sorghum and rice. For each staple food selected, data on price over forty years (1966-2011) were collected from Food and Agriculture Organization (FAOSTAT) and National Bureau of Statistics. Also, the information on the past and present prevailing agricultural policies was collected from FMARD and major economic and financial indicators were gathered from World Bank database and CBN. The prevailing policies considered were Agricultural Credit Guarantee Scheme Fund (ACGSF), Structural Adjustment Period (SAP), Agricultural Input Subsidy and Post-Structural Adjustment Period (PSAP) while economic and financial indicators considered were annual inflation rate and population growth rate.

Analytical techniques

The Data were analyzed using descriptive statistics, Regression analysis and Simultaneous Equation Model. The statistical packages employed were Eviews 8, gretl and SPSS 16 and Stata 10 (Statistical software) and statistical processes were employed in order to achieve an appropriate analysis. To deal with national currency fluctuations, which might cause price to look as though they are integrated; all prices were quoted in naira per tonne (N/tonne) and series of prices were all deflated by using Consumer Price Index (CPI). The real prices obtained were then used for the analyses:

Unit root test

The unit root test is the most widely adopted test of stationarity or non-stationarity over the past year which is mainly conducted on time series data. Test of the stationarity of the variables is paramount to avoid a spurious result. There are several methods for testing the presence of unit roots. The most widely used method is Augmented Dickey-Fuller (ADF). This method was employed in this study (Gujarati, 2003). These models were adapted from Ravallion (1986), Mohammad (2005), Ayinde et al (2013a, 2015) and Emakoro and Ayantoyinbo (2014).

The unit root model is stated below:

Where

Xt = price at time t; δ = first difference operator; t = time indicator; εt = the error term; δ, α and β = parameters to be estimated; k = number of lag of the price variables to be included.

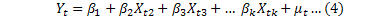

Regression analysis

A multiple regression is concerned with the relationship between a dependent variable and a series of m independent variables. The multiple regressions allow the analyst to control for the multiple factors that simultaneously affect a dependent variable. The multiple regression equation produces an (m+1) dimensional surface.

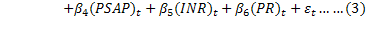

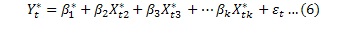

The generic linear regression model to examine the effect of the various agricultural policies on staple food prices takes the form:

Where

Pt = price of each major staple food in time t (major Staple foods are maize, cassava, sorghum, cowpea, yam and rice) in naira per tone; ACGSF = Agricultural Credit Guaranty Scheme Funds (the dummy variable took 1 from 1978 to 2011 and 0 otherwise); SAP = Structural Adjustment Period (the dummy variable took 1 from 1986 to 1993 and 0 otherwise); AIS = Agricultural Input Subsidy (the dummy variable took 1 from 1976 to 2011 and 0 otherwise); PSAP = Post-structural Adjustment Period (the dummy variable took 1 from 1994 to 2011 and 0 otherwise); INR = Inflation Rate; PR = Population Growth Rate; βi = Coefficients (i = 0,1,2,3,4,5 and 6); εt = Error term (adapted from Mesike et al., 2010 and Ayinde et al., 2013a).

Note: The dummy variables for the agricultural policies took one (1) in the active period of the policies and zero (0) when the policies were inactive. Also, some of these policies are still active till present but for the purpose of computation, this study considered them from 1966 to 2011.

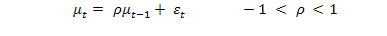

Cochrane-Orcutt estimator

Cochrane-Orcutt Estimator was employed where error terms were correlated i.e. autocorrelation problem occurred among the variables. It was used to correct for autocorrelation problem because the ordinary least square (OLS) estimator was less efficient.

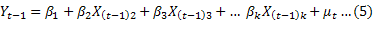

The Cochrane-orcutt procedure:

The Cochrane-orcutt (CORC) iterative procedure (Cochrane and Orcutt, 1949) requires the transformation of the regression model (8) to a form in which the OLS procedure is applicable. Re-writing equation 9 for the period t-1 we get:

The equation above is transformed by multiplying equation 8 term by term to by ρ and subtracting from equation 9, we obtain:

It should be noted that the error term in equation 9 satisfies all the properties needed for applying the least squares procedure. Therefore, the equation is efficient for the estimation of the effect of government agricultural policies on the prices of staple major foods.

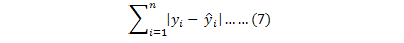

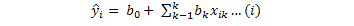

Least absolute deviation estimator (LAD)

One of the basic assumptions underlying ordinary least square estimation is that the error terms be normally distributed. Of course this assumption could be violated and whenever this occurs, least absolute deviation is used to correct for errors not normally distributed.

Considering equation (8), LAD regression involves finding the estimates of β0, β1, β2 … βk denoted b0, b1, b2, … bk, that minimize the sum of the absolute values of the residuals:

Where (i) represent predicted values.

LAD model is more trustworthy than the OLS model as the former is more robust, especially when the errors appear to be quite skewed (Adapted from Dielman, 2005).

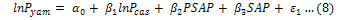

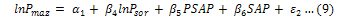

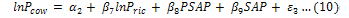

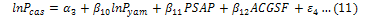

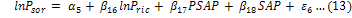

Simultaneous equation model

Simultaneous equation model consisted of more than one equation for each of the mutual or jointly dependent or endogenous variables. The model for this study is specified below:

Where

Pyam= Price of yams = (N per tonne); Pmaz = Price of Maize (N per tonne); Pcas = Price of Cassava (N per tonne); Pcow = Price of Cowpea (N per tonne); Pric= Price of Rice (N per tonne); Psor = Price of Sorghum (N per tonne); SAP= Structural Adjustment Period; PSAP= Post Structural Adjustment Period; ACGSF= Agricultural Credit Guarantee Scheme Funds; α0 – α5= Intercepts and β1 - β18= structural parameters or coefficients

The model was fitted based on the granger-causality test results and theoretical ground. This was done to identify each equation in the model. Identification of each equation in the equation system was necessary to obtain numerical estimates of the parameters of the structural equation from the estimated reduced-form coefficients. Some of the equations in the model were exactly identified while some were over-identified.

The procedures for equation identification were stated as: If k = g – 1, the equation is exactly identified; If k > g – 1, the equation is over-identified and If k < g – 1, the equation is under-identified (Maddala, 2001).

Where: K = number of excluded endogenous variable plus excluded exogenous variable and G = number of endogenous variable in the system.

Results and Discussion

Unit root test on the price of major staple foods in Nigeria

The Augmented Dickey-Fuller (ADF) unit root tests were carried out on all the variables of the analysis. One lag was used for the random walk regressions of major staple food prices because they are annual series and any autocorrelation problems they might have are expected to be corrected after one period. The results are presented in Table 1.

Table 1: Unit Root Test on the price of major staple foods in Nigeria

|

Price |

Level with drift |

Remarks |

|

Maize |

-3.225** |

Stationary |

|

Cowpea |

-2.865* |

Stationary |

|

Cassava |

-3.655*** |

Stationary |

|

Rice |

-2.645* |

Stationary |

|

Sorghum |

-3.498** |

Stationary |

|

Yams |

-3.362** |

Stationary |

|

GDP Deflator |

-5.942*** |

Stationary |

|

Inflation Rate |

-3.256* |

Stationary |

The results of stationarity test for the staple food prices using Augmented Dickey-Fuller (ADF) unit roots tests indicated that the variables were all stationary at their levels. This finding corroborates earlier findings that food commodity price series are mostly stationary at level (Chirwa, 2000; Mafimisebi, 2008; Desi and Yulius, 2012; Ojiako et al., 2012; Emakoro and Ayantoyinbo, 2014).

Effect of government agricultural policies on the staple food prices in Nigeria

Regression analysis was carried out to determine the effect of government agricultural policies on the major staple food prices. The model specified each staple food prices as a function of Structural Adjustment Period (SAP), Post Structural Adjustment Period (PSAP), Agricultural Input Subsidy (AIS), Agricultural Credit Guarantee Scheme Funds (ACGSF), Inflation rate and Population Growth rate. The results are summarized in Table 2.

The result shows that Structural Adjustment Period (SAP) and Post Structural Adjustment Period (PSAP) had negative effect on the price of sorghum. Hence, the sorghum price kept increase over the years despite various agricultural policies put in place. The Jarque-Bera (JB) test on the prices of cowpea, cassava and yams shows that their residuals were not normally distributed. This therefore violated one of the basic assumptions of ordinary least square (i.e. the error terms are normally distributed). Hence, robust estimator (least absolute deviation) is used to correct for the violation. In the same vein, the Durbin-Watson confirmed the presence of autocorrelation in the prices of maize and rice which also violated another Ordinary Least Square (OLS) regression basic assumption that the error terms are uncorrelated. Thus, the Cochrane-Orcutt estimator was used to correct for the problem of autocorrelation. All these tests are necessary so as to ensure that any inferences drawn from the OLS regression results are efficient. The results are presented in Table 3.

The results in Table 4 reveals that Structural Adjustment Period (SAP) had positive effect on the prices of maize, rice and cowpea while it did not have any effect on the prices cassava and yams. The Post- Structural Adjustment Period (PSAP) had positive effect on the prices of maize and cowpea, negative effect on price of

Table 2: Ordinary Least Square Regression results of major staple food prices on Government Agricultural Policies (1966 – 2011)

|

Major staple food prices |

||||||

|

Variables |

lnMaize |

Lncowpea |

lnCassava |

lnRice |

lnSorghum |

lnYams |

|

Constant |

11.1996*** (0.589737) |

172543*** (58320.5) |

41413.3** (19090.3) |

12.5878*** (0.551469) |

10.7465*** (0.571989) |

12.1675*** (0.605767) |

|

Inflation rate |

0.000149087 (0.00244008) |

403.515 (241.306) |

71.9374 (78.9874) |

0.000109328 (0.00228175) |

0.715723 (0.130061) |

0.0005771 (0.00250641) |

|

PG.rate |

-0.197773 (0.242967) |

-28538.6 (24027.6) |

-5612.11 (7865.02) |

-0.478454** (0.227201) |

0.579697 (0.106422) |

-0.592268** (0.249571) |

|

SAP |

0.628387*** (0.134096) |

85493.3*** (13261.1) |

-4934.61 (4340.79) |

0.853027*** (0.125395) |

-0.0495837*** (0.139434) |

0.122589 (0.137741) |

|

PSAP |

0.666766*** (0.109725) |

45129.4*** (10850.9) |

-12228.5*** (3551.87) |

0.197726* (0.102605) |

-0.178301*** (0.147018) |

0.203375* (0.112707) |

|

AIS |

-0.094155 (0.14376) |

-13088.6 (14216.8) |

-1452.07 (4653.64) |

-0.107326 (0.134432) |

0.00082651 (0.00236665) |

0.0200477 (0.147668) |

|

ACGSF |

-0.359562** (0.15158) |

-41519.3*** (14990.1) |

12535.6** (4906.76) |

-0.426711*** (0.141744) |

-0.108778 (0.235655) |

0.321903** (0.1557) |

|

F-stat |

8.617249 |

11.74819 |

2.669120 |

15.47438 |

9.601144 |

5.828843 |

|

̅R2 |

0.503878 |

0.589000 |

0.182037 |

0.658693 |

0.534195 |

0.391670 |

|

DW |

1.699781 |

1.834624 |

1.435971 |

1.270237 |

2.077592 |

1.786983 |

|

JB |

1.5361 [0.463918] |

10.3019 [0.00579395] |

7.79464 [0.0202962] |

0.462064 (0.793714) |

5.27466 [0.0715521] |

6.94146 [0.0310944] |

( ) = Std. Error; ̅R2=Adjusted R-squared; DW = Durbin-Watson; JB = Jarque-Bera; ***, ** and * indicate 1%, 5% and 10% significance levels, respectively; Source: Author’s Computation using data from FAOSTAT, 2014.

Table 3: Cochrane-Orcutt and Least Absolute Deviation Regression results of major staple food prices on Government Agricultural Policies (1966 – 2011)

|

|

Cochrane-Orcutt Estimator |

Least Absolute Deviation (Robust)Estimator |

|||

|

Variables |

lnPMaize |

lnPRice |

lnPCassava |

lnPCowpea |

lnPYams |

|

Constant |

11.0412*** (0.67739) |

12.6966*** (0.856661) |

36551.8* (21131.6) |

82183.6 (82144.5) |

11.6186 (0.88201) |

|

Inf.rate |

0.00082615 (0.0025) |

-0.002734 (0.00243) |

42.0193 (114.2) |

46.5644 (375.467) |

0.0029439 (0.00428) |

|

PG.rate |

-0.147129 (0.275146) |

-0.528272 (0.338693) |

-2708.8 (8417.32) |

8944.07 (35047.8) |

-0.38593 (0.389797) |

|

SAP |

0.618398*** (0.1479) |

0.708531*** (0.166528) |

-5129.39 (8333.58) |

97707*** (20133.1) |

0.0681738 (0.23787) |

|

PSAP |

0.650902*** (0.1237) |

0.0666211 (0.158718) |

-12387.7* (6368.41) |

51288.8*** (10041) |

0.0660924 (0.16219) |

|

AIS |

-0.100929 (0.143424) |

-0.0283829 (0.116938) |

-2114.04 (4405.63) |

-8366.45 (24359.5) |

0.075325 (0.244585) |

|

ACGSF |

-0.3288* (0.162563) |

-0.310565* (0.175265) |

12009.8* (6896.86) |

-51389.8** (24664.9) |

0.403357 (0.2575) |

|

F-stat |

8.617249 |

5.459520 |

|||

|

̅R2 |

0.517950 |

0.714564 |

|||

|

P-value |

0.000107 |

0.000375 |

|||

|

DW |

1.892441 |

2.098520 |

|||

|

AIC |

954.6497 |

1057.747 |

3.135333 |

||

( ) = Std. Error; ̅R2=Adjusted R-squared; DW = Durbin-Watson; JB = Jarque-Bera; ***, ** and * indicate 1%, 5% and 10% significance levels, respectively; Source: Author’s Computation using data from FAOSTAT, 2014.

Table 4: Relations of staple food prices and Government Agricultural Policies

|

Staple Food Prices |

||||||

|

Variables |

Pyam |

Pmaz |

Pcow |

Pcas |

Pric |

Psor |

|

Constant |

2.922474 (5.345927) |

-10.19158** (5.09115) |

-2.337177 (1.691615) |

11.10003* (6.328248) |

7.046985*** (1.18748) |

6.1359*** (1.518652) |

|

SAP |

.2418624* (0.1271152) |

-.8245743*** (0.3135415) |

-.0585529 (0.1221885) |

0.5263546*** (0.0934015) |

0.3907287*** (0.109695) |

|

|

PSAP |

0.4849026*** (0.1051268) |

-.4973537** (0.2408042) |

.4096726*** (0.071643) |

-0.2335053* (0.1385091) |

0.4975939 (0.0643177) |

|

|

ACGSF |

0.2472921 (0.2002764) |

-0.3500614 (0.069542) |

||||

|

Pyam |

-0.0811016 (0.5899174) |

|||||

|

Pmaz |

0.762854 (0.5178217) |

|||||

|

Pric |

1.215653*** (0.1517879) |

0.3812152*** (0.136268) |

||||

|

Pcow |

0.3777785*** (0.1029764) |

|||||

|

Psor |

1.99331*** (0.4903175) |

|||||

|

Chi2(model Significance) |

25.45*** |

42.67*** |

111.98*** |

8.27*** |

131.43*** |

86.84*** |

|

̅R2 |

0.3215 |

0.4122 |

0.7382 |

0.1100 |

0.7782 |

0.6882 |

The number of observations in this simultaneous equation model is N = 46; Figures in parentheses are std. Error; *, ** and *** indicate significance level at the 10%, 5% and 1% level, respectively.

cassava and no effect on prices of rice and yams. Agricultural Credit Guarantee Scheme Funds (ACGSF) negatively impacted the prices of maize, rice and cowpea, positive effect on the price of cassava and no effect on the price of yams. The table further reveals that Agricultural Input Subsidy (AIS) had no effect on all the staple food prices under consideration.

Previously, it has been shown that some agricultural policies have either positive or negative impact while some agricultural policies did not have effect on the staple food prices. However, the mechanisms through which this impact occurs were not completely clear. An expected direct effect is that agricultural policies contribute to overall staple food prices. But there may also be more indirect effects when agricultural policies have an influence on staple food prices through inter-linkages in food prices.

The coefficients in columns 1 and 6 of Table 4 shows that structural adjustment period and post-structural adjustment period have positive impact on the prices of yams and sorghum. The coefficients in column 2 shows that structural adjustment period and post-structural adjustment period have negative impact on the price of maize. Column 3 shows that the post-structural adjustment period has positive impact on the prices of cowpea. Column 4 shows that only post-structural adjustment period has negative impact on the price of cassava. Column 5 shows that structural adjustment period has positive effect on the price of rice while agricultural credit guarantee scheme fund has negative effect on the price of rice. It can also be deduced from the table that the prices of staple food inter-relate: if the price of cassava increases by N 1.00, the price of yams would increase by N 0.76; if the price of sorghum increases by N 1.00, the price of maize would increase by N 1.99; if the price of rice increases by N 1.00, the prices of cowpea would increase by N 1.21; if the price of yams increases by N 1.00, the price of cassava would decrease by N 0.08; if the price of cowpea increase by N 1.00, the price of rice would increase by N 0.38 and if the price of rice increases by N 1.00, the price of sorghum would increase by N 0.38.

Conclusions

This study established that the some government agricultural policies have positive effect on the prices of most staple foods in Nigeria despite the several challenges bedeviling the growth and development of the agricultural sector. However, continuous increase in the price of major staple food which was the main problem identified in this study might be due to the fact that most agricultural policies formulated and implemented lack some elements that would revolutionize staple food production in Nigeria. Also, inference from the regression results shows that most agricultural policies focused on some staple foods such as maize, cassava and rice leaving other staple foods with little or no attention. Given that some of the important policies affecting agriculture originate from other sectors, deepened dialogues among the policy makers across the sectors is inevitable in order to make agricultural policies more effective. And re-structuring of Agricultural Input Scheme is encouraged.

Auhtors’ Contrbution

Opeyemi Eyitayo Ayinde and Tofunmi Emmunel Ilori provided basic concept for the manuscript. Opeyemi Eyitayo Ayinde and Kayode Ayinde designed approach to carry out the study; Tofunmi Emmunel Ilori reviewed the Literature; Rapheal Olarewaju Babatunde and Tofunmi Emmunel Ilori collected data; Kayode Ayinde and Tofunmi Emmunel Ilori analysed data. Data was interpreted by Opeyemi Eyitayo Ayinde Kayode Ayinde and Tofunmi Emmunel Ilori while Opeyemi Eyitayo Ayinde wrote the paper and Kayode Ayinde did final editing.

References

- Adegboye, R. O. (2004). “Land Agriculture and Food Security in Nigeria”. Faculty Lecture Delivered at the University of Ilorin, Faculty of Agriculture, 25th February.

- Akosile, A. (2003). “Agriculture; Can it Really Alleviate Poverty? This day 27th August, 47-48.

- Ayinde, K., Bello, A. A., and Ayinde, O. E. (2013a). “Modeling Nigerian Government Revenues and Total Expenditure: An Error Correction Model Approach. A Paper delivered at African Association of Agricultural Economics (AAAE) Conference, Tunisia.

- Ayinde, O. E; Ojehomon, V. E. T; Daramola, F. S. and Falaki, A. A. (2013b). Evaluation of the Effects of Climate Change on Rice Production in Niger state, Nigeria. Ethiopian Journal of Environmental Studies and Management 6 (7s). http://dx.doi.org/10.4314/ejesm.v6i6.7S

- Ayinde, K., Bello, A.A., Ayinde, O. E. and Adekanmbi, D. B. (2015): Modeling Nigerian Government revenues and total expenditure: Combined Estimators’ Analysis and Error Correction Model Approach.Central European Journal of Economic modeling and Econometrics. 7; 1-14. http://cejeme.org/about.aspx

- Central Bank of Nigeria (1994). CBN Annual Statement and Statement of Account. Garki, Abuja, Nigeria.

- Central Bank of Nigeria (1999). CBN Annual Statement and Statement of Account. Garki, Abuja, Nigeria.

- Central Bank of Nigeria (2000). “Changing structure of the Nigerian economy and implications for development”. CBN Publication, August, 2000.

- Central Bank of Nigeria (2001): Federal Government Budget Review and Appraisal. Publication of Central Bank of Nigeria 25(1)

- Central Bank of Nigeria (2007): Policy Seminar on Federal Government Budget. 28(2)

- Central Bank of Nigeria (2010): Annual Report. Garki, Abuja, Nigeria.

- Chirwa, E. W. (2000). Food Marketing Reforms and Integration of Maize and Rice Markets in Malawi. Working Paper at the School of Economics, University of East, Anglia; 2000

- Cochrane, D. and Orcutt, G. H. (1949). “ Application of least Squares Regression to Relationships Containing Auto-correlated Error Terms” Journal of the American Statistical Association, 44:32-61

- Desi, A. and Yulius, J. (2012). Integration of Rice Market Inter-Provinces of Rice Production Center in Indonesia. International Conference on Environment. Energy and Biotechnology IPCBEE 33:42-51.

- Dielman T. E. (2005). “Least Absolute Value Regression: Recent Contributions” Journal of Statistical Computation & Simulation, 75(4):263-286.

- Department for International Development (2003). A DFID Policy paper. http://www/dfid.gov.uk

- Emakoro, C. O. and Ayantoyinbo, A. A. (2014). “Analysis of Market Integration and Price Variation in Rice Marketing in Osun State, Nigeria.” American Journal of Experimental Agriculture 4(5) SCIENCEDOMAIN International www.sciencedomain.org

- Famoriyo, S and Nwagbo, E. C (1981). Problems of Agricultural Finance in Nigeria. In Ojo M. O. et al.: Agricultural Credit and Finance in Nigeria: Problems and Prospects. Lagos, Central Bank of Nigeria 1981: 50-57

- Food and Agriculture Organization (2013). The state of Food and Agriculture. FAO, United Nations, Rome 2013. www.fao.org/publications

- Giroh, D. Y.; Waizah, Y. and Umar, H. Y. (2010): Technical Efficiency and Cost of Production among Gum Arabic Farmers in Jigawa State, Nigeria. Report and Opinion 2010:2(1) 52- 57

- Gujarati, D. N. (2003): “Basic Econometrics”, 3rd ed., New York: McGraw-Hill.

- Maddala, G. S. (2001). Introduction to Econometrics. 3rd ed. Published by John Wiley & Sons ltd

- Mafimisebi, T. E. (2008). Long–run price integration in the Nigerian Fresh fish market: Implication for development, Delhi Business Review 9(1):13-18.

- Manyong, V. M (2005) “Agriculture in Nigeria: Identifying Opportunities for Increased Commercialization and Investment”. International Institute of Tropical Agriculture, Nigeria.

- Mesike, C. S. (2012). Impact of Government Agricultural Policies on Exports of Cocoa and Rubber in Nigeria. Agricultura Tropica Et Subtropica 2012:45(4).

- Mohammad, S. (2005). Supply response analysis of major crops in different agro-ecological zones in Punjab. Pakistan Journal of Agricultural Research 124(54):144-156.

- NEEDS - National Economic Empowerment and Development Strategy Nigeria (2004). The NEEDS Secretariat, National Planning Commission, Federal Secretariat, Abuja. Tel/fax: 09-5236625.

- Nyanko, M. H. (2006): “Agriculture as a major foreign exchange earner: issues and implications”. National Pilot Paper 3(26): 19.

- Ojo, M. O., Akanji M. (1996): Responsiveness of Selected Agricultural Export Commodities to Exchange Rate Devaluation in Nigeria. An Econometric Analysis. CBN Economic and Financial Review 34(2) 511-578.

- Okoh, R. N. (2004). Global Integration and the Growth of Nigeria’s Non-Oil Exports. Paper Presented at the African Conference, 21-22 March, 2004, Oxford, United Kingdom. 2004:1-30

- Ojiako, I. A.; Ezedinma, C.; Asumugha, G. N. and Nkang, N. M. (2012). Spatial Integration and Price Transmission in Selected Cassava Products’ Markets in Nigeria: A Case of Lafun. World Applied Sciences Journal 18(9):1209-1219.

- Ravallion, M. (1986). Testing market integration. American Journal of Agricultural Economics 68:102-109.

- World Bank (2001). World Development Report. Oxford: Oxford University Press.

To share on other social networks, click on any share button. What are these?