Effects of Micro-credit Programme of Khushali Bank Limited on Agricultural Productivity in District Mardan, Pakistan

Effects of Micro-credit Programme of Khushali Bank Limited on Agricultural Productivity in District Mardan, Pakistan

Inayatullah Jan*, Sajid Khan, Noor Paio Khan and Muhammad Ashfaq

Institute of Development Studies (IDS), The University of Agriculture, Peshawar, Khyber Pakhtunkhwa, Pakistan.

Abstract | Khushali Bank Limited (KBL) is one of the micro-credit organizations in Pakistan which are extending micro-credit services to small farmers with the aim to increase agricultural productivity and income of farmers. This study was conducted with the aim to assess the effects of micro-credit programme of KBL on agricultural productivity in district Mardan in Khyber Pakhtunkhwa Province of Pakistan. The study was conducted in three purposively selected villages namely; Nasir Kaly, Shankar and Kodeenaka. From the field surveys, it was found that majority of the respondents were smallholders or tenants. After procuring and properly utilizing credit, the yield of the major crops such as wheat, maize, and sugarcane and the resultant income of the respondents exhibited significant increase, as confirmed by higher t-values. The study concludes that the socio-economic conditions of the farmers can be improved if credit programme is extended which could benefit all farmers in the area.

Received | April 27, 2017; Accepted | November 5, 2017; Published | November 28, 2017

*Correspondence | Inayatullah Jan, Institute of Development Studies (IDS), The University of Agriculture, Peshawar, Khyber Pakhtunkhwa, Pakistan; Email: [email protected]

Citation | Jan, I., S. Khan, N.P. Khan and M. Ashfaq. 2017. Effects of micro-credit programme of Khushali Bank Limited on agricultural productivity in District Mardan, Pakistan. Sarhad Journal of Agriculture, 33(4): 688-693.

DOI | http://dx.doi.org/10.17582/journal.sja/2017/33.4.688.693

Keywords | Micro-credit, Smallholders, Agricultural productivity, Khushali Bank Limited, District Mardan

Introduction

The dynamism of the green revolution has opened new opportunities for agricultural development in the developing countries. Agricultural development has a key influence on other sectors of the economy by contributing significantly to the national income and foreign trade (Patel, 2000).

Globally, agricultural productivity has increased rapidly due to a number of factors, among which the financial availability to farmers is the most important one. The factors that contribute to the development of agriculture are quality inputs, use of advance technology, and the achievement of technical efficiency which are all subject to financial availability (Jan et al., 2012). In developing countries where farmers, particularly smallholders and landless peasants, do not have saving potentials; agricultural credit plays an essential role in purchase of modern technology and inputs to increase farm productivity.

Agricultural sector in Pakistan

Agriculture sector is a vital component of Pakistan’s economy as it provides raw materials to industries and helps to alleviate poverty in rural areas. Agriculture contributes 19.8 percent to GDP and absorbs 42.3 percent of employed labor force (GoP, 2016). Besides, it is the single largest sector of foreign exchange earnings in Pakistan.

In Pakistan, favorable climatic conditions, fertile land, plentiful manpower, contiguous irrigation network, and extensive agricultural research system makes farmers more competitive in the international market (Khan et al., 2007). However, the agricultural sector performance in Pakistan remains low as compared to the developed countries. This situation motivates farmers to use all possible means to improve the existing farm productivity. Logical step towards this end is to identify the factors responsible for low crop yield. The use of conventional farming methods by farmers seems to be the most important one. Improved agricultural efficiency needs a change from traditional to the latest technology. The use of modern farming technology needs adequate agricultural finances to farmers for investment in agriculture (Jan and Manig, 2008). Hence, for modern technology adoption, sufficient finances are quintessential (Jan and Khan, 2012). The availability of finances is also required for purchasing inputs such as farm implements, quality seeds, fertilizers, chemicals and vigorous breeds of animals and birds. Hence, the availability of financial capital is seen as an important pre-requisite for adopting modern technology. However all farmers, particularly smallholders and landless peasants, do not have enough financial capital to purchase inputs in time. In the developing countries, formal, informal, and microcredit programme play their role to meet financial requirements of farmers.

Agricultural finance

Agricultural finance means making capital available for agricultural production. This capital is used for different agricultural purposes, such as planting, harvesting and marketing cycles. Agricultural finance is important for all farmers, particularly small scale farmers, to purchase farm inputs (Abbas et al., 2005). Farmers not only need improved seed, fertilizers and pesticides but also require liquid capital so that to carry out harvesting, storage, transportation, and marketing of the agricultural products more efficiently and timely (Iqbal et al., 2003).

Objectives of the study

This study was conducted with the main objective to determine the effects of micro-credit disbursed by Khushali Bank Limited on agricultural productivity and income of farmers in Mardan district of Khyber Pakhtunkhwa, Pakistan.

Material and methods

This study was conducted in Mardan district of Khyber Pakhtunkhwa Province during 2012. Mardan is an important farming region of the province, and its soil and climatic conditions are very conducive for agricultural crops. As per objectives of the study three villages were selected purposively. The respondents were household head or those who were actively engaged in borrowing of loan.

Sample size and data

Based on the initial discussion with Khushali Bank officials, three villages namely Nasir Kaly, Shankar, and Kodeenaka in district Mardan were purposively selected. The total number of farmers in these three villages was 345, out of which 104 got credits from KBL. Out of the total beneficiaries only 70 farmers had utilized the credit for agricultural purpose. Hence the total sample size was 70 respondents. The selected respondent list was obtained from KBL whose numbers are given in Table 1.

Table 1: Village wise selection of respondents in the area.

| Total | Total number of beneficiaries | Number of targeted beneficiaries | |

|

Nasir Kaly |

140 | 45 | 24 |

| Shankar | 73 | 34 | 23 |

| Kodeenaka | 132 | 25 | 23 |

| Total | 345 | 104 |

70 |

Source: KBL, 2010-11.

Primary data were collected from the respondents using a semi-structured questionnaire. The questionnaire contained information about education level of the sample respondents, their household size, family composition, landholding, land tenure system, sources of income, amount of loan disbursed and its effects on agricultural productivity etc. For validity of the questionnaire, it was pre-tested in the field and modified accordingly.

Analytical techniques

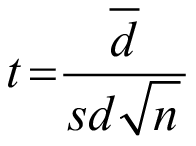

The data were analyzed using SPSS. Paired t-test was used to determine the difference in yield before and after (Haider et al., 2017) the credit was attained.

Where;

μ1: mean of crop yield and income before credit; μ2: mean of crop yield and income after credit.

Our null hypothesis is that the mean difference in productivity before and after credit is zero, i.e.,

H0: μ1 – μ2 = 0

Results and Discussion

In this section, a brief discussion of the results is provided. The section mainly focuses on differences between agricultural production before and after attainment of credit from KBL. In Pakistan, few selected crops such as wheat, rice, cotton, sugarcane, and maize dominates the overall crop production (Abbas, 2013). In this study, wheat, maize, and sugarcane are discussed.

Effect of credit on wheat production

Wheat is an important staple food in Pakistan. It contributes 2.2 percent to the GDP of Pakistan (Hussain et al., 2014). Research shows that agricultural credit plays an important role in increased productivity of wheat. For instance, Bashir et al. (2010) and Ahmad et al. (2015) found that credit has a significant and positive impact on the wheat productivity in different areas of Punjab, Pakistan.

In most parts of Pakistan, farmers are smallholders and they grow wheat for subsistence only (Asim et al., 2015). In the research area, however, most of the farmers grow wheat for their own consumption as well as marketing. Timely availability of finances enables farmers to grow more and get more benefits from their produce. Table 2 provides details of the effects of credit on wheat productivity in the area. The table shows that a significant increase was observed in wheat productivity after credit was attained. An overall 28 percent increase in wheat production after getting credit from KBL was observed. The greater increase was found in village Nasir Kaly (50 percent) followed by 18 percent and 16 percent in village Kodeenaka and Shankar respectively. The main reason for increase in the production in village Nasir Kaly was that maximum farmers got credit in time as compared to Kodeenaka and Shankar. The results of the paired t-test indicate that significant differences in wheat yield was observed after getting credit from KBL.

It was observed that increase in the wheat production was due to adopting high yielding varieties (HYVs) of wheat. A significant amount of credit was utilized for the purchase of HYVs, which resulted in increased agricultural productivity. The results are similar to Muhammad (2003) and Ahmad et al. (2015) who also found that agricultural production has increased in Pakistan due to the micro-credit programmes, which enabled the farmers to shift from traditional agriculture to commercialized agriculture by adopting HYVs. The timely availability of herbicides and fertilizers had also positively affected the wheat productivity.

Table 2: Effect of credit on wheat production (mounds per acre).

| Village name | Before | After | % Change | t-value | P-value |

| Nasir Kaly | 28 | 42 | 50 | 7.321 | 0.000 |

| Kodeenaka | 32 | 38 | 16 | 2.507 | 0.028 |

| Shankar | 34 | 40 | 18 | 10.698 | 0.000 |

| Total | 32 | 40 | 28 |

1 mound: 50 kg; Source: Field Survey, 2012

Effect of credit on maize production

Maize is an important crop in Pakistan and is grown on an area of 1144 thousand hectares. Besides its main use as food and fodder, it is used to produce an array of products as raw material (Chandio et al., 2015). Maize contributes 2.2 percent to the value added in agriculture and 0.4 percent to GDP. Maize crop production stood at 4.920 million tonnes during 2015-16 (GoP, 2016).

Table 3: Effect of credit on maize production (mounds per acre).

| Village name | Before | After | % Change | t-value | P-value |

| Nasir Kaly | 28 | 34 | 21 | 4.158 | 0.053 |

| Kodeenaka | 30 | 38 | 27 | 2.722 | 0.053 |

| Shankar | 32 | 40 | 25 | 4.000 | 0.057 |

| Total | 30 | 38 | 24 |

Source: Field Survey, 2012

Maize is also an important staple food in the study area. Farmers in the research area grow maize mainly for their own consumption and in some cases, for marketing. Table 3 illustrates maize production in the area and difference in yield before and after credit availability. The results show that an overall 24 percent increase in maize production was observed after getting credit from KBL. In village Kodeenaka, 27 percent increase in yield was observed followed by 25 percent and 21 percent in village Shankar and Nasir Kaly, respectively. As in the case of wheat, increase in maize production was due to proper and timely utilization of credit. Due to timely availability of credit, farmers were able to purchase inputs in time which significantly affected the crop productivity in the study area. Mghenyi (2015) found that agricultural cradit has significantly and positively affected maize productivity in Kenya. Similarly Khan et al. (2007) and Chandio et al. (2015) reported that timely access to credit is important factor in the increased productivity of maize crop in Pakistan.

Effect of credit on sugarcane production

Sugarcane is a high value cash crop of Pakistan and significantly important for the national economy of our country. Its production accounts for agriculture’s value addition and 0.6 percent in overall GDP. During 2015-16, the sugarcane crop was grown on an area of 1132 thousand hectares and has exhibited increase in production as compared to past. An increase in sugarcane production in past is accrued to favorable weather conditions (GoP, 2016).

Table 4: Effect of credit on sugarcane production (mounds per acre).

| Village name | Before | After | % Change | t-value | P-value |

| Nasir Kaly | 368 | 452 | 23 | 7.170 | 0.000 |

| Kodeenaka | 376 | 438 | 16 | 3.926 | 0.002 |

| Shankar | 370 | 418 | 13 | 3.774 | 0.004 |

| Total | 372 | 436 |

18 |

Source: Field Survey, 2012

Sugarcane is a major cash crop in the research villages. The main reason for growing sugarcane on a large portion of land is that the land is fertile for sugarcane production. Furthermore, the existence of a sugar mill in the area makes it a favorable choice for farmers to grow sugarcane. Farmers sell their crop to the sugar mill to increase their disposable income. Moreover, it is also used for consumption in the study area in the form of brown sugar. Table 4 describes the production of sugarcane in the study area. An increase in sugarcane production was observed in all three villages. The maximum increase was in Nasir Kaly, (23 percent) followed by 16 percent and 13 percent in Kodeenaka and Shankar respectively. The comparison shows that there was a significant difference in the score of before and after credit situations in all villages, as shown by p-values. This increase in sugar cane production was mainly because of timely availability of agricultural credit to the farmers. Bashir et al. (2007) also found that agricultural credit has significantly affected sugarcane production in Faisalabad, Pakistan.

Some of the farmers produced brown sugar in the study area. Therefore, credit helped sample respondents to arrange loading and transportation facilities in time. Jan (2007) has also found that credit is vital for the marketing of the sugarcane crops in Pakistan.

Effects of credit on income

Availability of finances enables farmers to grow more efficiently and get more income of their produce. Table 5 indicates the average annual income of the farmers before and after availing credit from KBL. The table shows that the overall annual income of the sample households increased significantly by 16 percent due to the micro-credit programme of KBL. The increase was observed more in village Nasir Kaly (21 percent) as compared to Kodeenaka (16 percent) and Shankar (12 percent). The reason for the high increase in income was that majority of the farmers in Nasir Kaly got credit in time. The results of the t-test shows that farmers in all villages observed significant increase in income after credit utilization as determined by p-value equals to 0.000 in all villages.

Table 5: Effect of credit on household annual income (in 000).

| Village name | Before | After | % Change | t-value | P-value |

| Nasir Kaly | 420 | 510 | 21 | 5.990 | 0.000 |

| Kodeenaka | 380 | 440 | 16 | 6.460 | 0.000 |

| Shankar | 365 | 410 | 12 | 7.663 | 0.000 |

| Total | 1165 | 1360 | 16 |

Source: Field Survey, 2012

The increase in income of the beneficiaries was due to the proper utilization of credit procured, which resulted in the positive effect on the consumption as well as social status of the sample households. Jan et al. (2012) studied the income of the farmers has increased due to the credit procurement in Pakistan. Similarly, Mohsin et al. (2011) and Shah et al. (2008) also reported increase in farm income and improvement in living standard of farmers after procuring credit from commercial sources.

Limitations of the study and implications for future research

Increase in farm production and net income from farm depends on a number of factors. These factors include quality and timely availability of inputs, mechanized farming, better and technical know-how, improved farming practices, timely availability of water, and many more. This study considers availability of finances to farmers in the form of credit as a mean to increased agricultural productivity. This study has some limitations. First, the study over-emphasize on agricultural credit as the main source of income from farm; there could be other factors as mentioned above which have not been considered in this study. Second, agricultural credit is not necessarily utilized for agricultural purpose; rather it is used for off-farm activities, which this study does not focus upon. Therefore, this study has important implications for future research. A detailed study can be designed which takes into account all the missing factors which are important for increased crop production and income of farmers.

Conclusion

This study was conducted in three selected villages of district Mardan in 2012. Field surveys exhibited that most of the farmers in the area were poor and landless peasants. Khushali Bank Limited (KBL) initiated a micro-credit programme in the area from which small farmers benefited. It was found during field surveys that micro-credit procured for agricultural purpose was properly utilized for the purpose by most of the respondents. As a result, yield of all major crops such as wheat, maize, and sugarcane increased in all villages. Similarly, income of the farmers also increased after the credit was obtained and properly utilized. The results of the paired t-test revealed that significant differences, as shown by p-values, were observed in crop yield and resultant income of the farmers after credit procurement from KBL. The study concludes that socioeconomic conditions of rural poor in general and farmers in particular can be improved if credit programmes are extended in rural areas and credit is provided to all deserving farmers at their doorsteps.

Conflict of Interest

The Authors declare that they do not have any conflict of interest.

Authors’ Contribution

Inayatullah Jan contributed in developing of basic idea of the study. The paper is derived from the MSc (Hons) thesis of Sajid Khan who completed his thesis under supervision of Inayatullah Jan. Noor Paio Khan and Muhammad Ashfaq helped in writing results and discussion.

Acknowledgement

The authors extend heartiest gratitude to the anonymous reviewers for their constructive remarks which helped in improving the paper.

References

Abbas, F., M.N. Sarwar, and S. Hussain. 2005. Microfinance route to income generation and poverty reduction: Evidence from District Faisalabad, Pakistan. J. Agric. Soc. Sci. 1(2): 144-147.

Abbas, S. 2013. Major crops of Pakistan. Agri-Business, Punjab. http://www.agribusiness.com.pk/major-crops-of-pakistan/.

Ahmad, A., I. Jan, S. Ullah and S. Pervez. 2015. Impact of agricultural credit on wheat productivity in District Jhang, Pakistan. Sarhad J. Agric. 31(1): 65-69.

Asim, M., M. Hussain, N. Nadeem, A. Ali and M.A. Imran. 2015. Does credit play a role in increasing the yields of wheat and cotton: A case study of district Sahiwal. Medit. J. Soc. Sci. 6(4-S3): 482-486.

Bashir, M.K., Z.A. Gill, S. Hassan, A.A. Sultan and S.A. Baksh. 2007. Impact of credit disbursed by commercial banks on the productivity of sugarcane in Faislabad District. Pak. J. Agric. Sci. 44(2): 361-363.

Bashir, M.K., Y. Mehmood and S. Hassan. 2010. Impact of agricultural credit on productivity of wheat crop: Evidence from Lahore, Punjab, Pakistan. Pak. J. Agric. Sci. 47(4): 405-409.

Chandio, A.A., J. Yuansheng and M.A. Koondher. 2015. Raising maize productivity through agricultural credit: A case study of commercial banks in Pakistan. Europ. J. Bus. Manag. 7(32): 159-165

GoP (Government of Pakistan). 2016. Economic Survey of Pakistan. Ministry of Finance, Islamabad. http://www.irispunjab.gov.pk/Economic%20Surveys-New/Economic%20Survey%202015-16.pdf

Haider, Z., I. Jan and W. Akram. 2017. Effect of conflict on farmers’ income from tomato crop in Kurram Agency, Pakistan. Sarhad J. Agric. 33(1): 171-176. https://doi.org/10.17582/journal.sja/2017.33.1.171.176

Hussain, A., M.A. Khalid, N. Badar. 2014. Yield gap determinants for wheat production in major irrigated cropping zones of Punjab, Pakistan. Pak J. Agric. Res. 27(3): 188-199.

Iqbal, M., K. Sajid and A. Kashif. 2003. The impact of institutional credit on agricultural production in Pakistan. Pak. Dev. Rev. 42(4-III): 469-485.

Jan, I. 2007. Institutional changes in agricultural support services in rural northwest Pakistan. Socioeconomic Studies on Rural Development, Vol.140. Wissenschaftsverlag Vauk Kiel KG, Germany.

Jan, I. and W. Manig. 2008. Influence of participation in agricultural support services on income from agriculture: results from the multiple regression model (A case from rural Northwest Pakistan). Sarhad J. Agric. 24(1): 129-136.

Jan, I., S. Munir, A. Usman and M. Idress. 2012. Agricultural credit markets in NorthWest Pakistan: Implications for the development policy. Sarhad J. Agric. 28(3): 521-529.

Jan, I. and H. Khan. 2012. Factors responsible for rural household participation in institutional credit programs in Pakistan. Afric J. Bus. Manag. 6(3): 1186-1190.

Khan, N., I. Jan and R. Mujeeb. 2007. The effects of short term agricultural loans scheme of Zari Taraqiati bank on increase in farm production in district Karak. Sarhad J. Agric. 23(4): 1285-1290.

Mghenyi, E.W. 2015. The impact of agricultural credit on demand for factors of production, farm output and profitability in Kenya. Unpublished PhD dissertation, Michigan State University.

Mohsin, A.Q., S. Ahmad and A. Anwar. 2011. Impact of supervised agricultural credit on farm income in the barani areas of Punjab. Pak. J. Soc. Sci. 31(2): 241-250.

Muhammad, W. 2003. An investigation into effectiveness of micro-credit program of AKRSP. A case study of three villages of sub-division Hunza district Gilgit. Un-published M.Sc (Hons) thesis, the University of Agriculture, Peshawar Pakistan.

Patel, A.R. 2000. Farm credit policy needs a re-look. National Bank News Review Bombay. 16(2): 43-46.

Shah, M.K., H. Khan, Jehanzeb and Z. Khan. 2008. Impact of agricultural credit on farm productivity and income of farmers in mountaneous agriculture in Northern Pakistan (A case study of selected villages in Chitral). Sarhad J. Agric. 24(4): 713-718.

To share on other social networks, click on any share button. What are these?