Credit Fungibility and Credit Margin of Investment: The Case of Subsistence Farmers in Khyber Pakhtunkhwa

Credit Fungibility and Credit Margin of Investment: The Case of Subsistence Farmers in Khyber Pakhtunkhwa

Shahab e Saqib1*, Himayatullah Khan2, Sanaullah Panezai3, Ubaid Ali4 and Mazhar Ali5

1Doctoral Student, Regional and Rural Development Planning (RRDP), School of Environment Resources and Development (SERD), Asian Institute of Technology (AIT), Thailand; 2Institute of Development Sciences (IDS), Agricultural University Peshawar, Khyber Pakhtunkhwa, Pakistan; 3Department of Disaster Management and Development Studies, University of Balochistan, Quetta, Pakistan; 4Higher Education Department, Khyber Pakhtunkhwa, Pakistan. 5Disaster Preparedness, Mitigation and Management (DPMM), Asian Institute of Technology (AIT), Thailand.

Abstract | In developing countries, credit fungibility is a crucial issue in agricultural credit market, and Pakistan is no exception. The aim of this study is to explore the credit fungibility and credit margin of investment among different farmers’ group in Khyber Pakhtunkhwa. The data were collected from 87 subsistence farmers in Mardan sub-district. Multistage sampling technique was used to select the study area. A standardized questionnaire was used to collect data from farming households’ heads. Credit fungibility ratio and ANOVA were used to explore the credit fungibility and credit margin of investment among the groups of farmers. Results showed that a considerable proportion of loan was used in non-agricultural activities by all farmers in general and small farmers in particular. The findings of the study suggest that a strong monitoring of farmers is needed in the study area. In addition, farmers may be supplied in-kind agricultural credit to control credit fungibility.

Received | September 2016, 2017; Accepted | October 23, 2017; Published | November 14, 2017

*Correspondence | Shahab e Saqib. Doctoral Student, Regional and Rural Development Planning (RRDP), School of Environment Resources and Development (SERD), Asian Institute of Technology (AIT), Thailand, and Lecturer at Government College of Management Sciences-2 Mardan; Email: shahabmomand@gmail.com

Citation | Saqib, S.E., H. Khan, S. Panezai, U. Ali and M. Ali. 2017. Credit fungibility and credit margin of investment: the case of subsistence farmers in Khyber Pakhtunkhwa.. Sarhad Journal of Agriculture, 33(4): 661-667.

DOI | http://dx.doi.org/10.17582/journal.sja/2017/33.4.661.667

Keywords | Credit fungibility, Credit margin of investment, Credit fungibility ratio, Subsistence farmers, Pakistan

Introduction

Agricultural credit is provided for production and development. Production credit is specified for agricultural inputs such as seeds, pesticides, fertilizer, animal feeds and medicines, water charges and labour, etc. The development loans are supplied for the purchase of agricultural equipment i.e. tractors, threshers, trolley, cutter binders, spray machinery and tube wells installations. In this regard, the small farmers have very low agricultural production due small landholding size and little capital for investment. Therefore, agricultural credit plays a vital role in development (Dawn News, 2007; Fayaz et al., 2006). In this regard, governments are trying to help the small farmers’ friendly policies (Saqib et al., 2016b). However, the stated objectives of the policies are not achieved and this might happen due to inefficient credit use or the credit used to fulfil other needs, also known as credit fungibility.

Fungibility exists in the whole system of credit delivery, from farmers to financial intermediary, and from the financial intermediary to the central bank. From farmer’s perspective, the fungibility means that the loans which are taken basically for fertilizers, seeds, machinery, and land preparation but are used for household needs like education, health, daily consumptions and many other needs (Saqib et al., 2016b). That is the way, agricultural credit is substituted or diverted to other heads. The fungibility at the lender level may also exist when the available funds are given for the purposes other than agriculture. The lenders or the financial institutions divert the funds to low-risk clients. Only on procedural criteria and documentations, the loans from one head can be transferred to another. For example, the loans specified for the small farmers are mostly given to large and medium farmers. The loans size restrictions can be evaded when the same borrower has issued loans on different names. The use of funds allocated to the small farmers or agriculture sector for other sectors by the central bank also falls under fungibility phenomenon. For instance, the donor allocates funds as sources of foreign exchange, but the funds are spent on other sectors such as industrial sector to buy arms and ammunitions. Because of this reason, many projects in the rural financial credit system do not achieve their stated objectives.

Credit fungibility has been explored by several studies. For instance, the credit was used for consumption and festivals (Akram et al., 2008; Hussain and Thapa, 2015; Siddiqi and Baluch, 2004), education and health and repayment of loans (Hussain and Thapa, 2015). Nosiru (2010), showed that in Nigeria the microcredit was provided to support farmers to buy the inputs required to increase their agricultural produce. However, the findings showed that credit received by the farmers in the study area has not contributed positively to the level of agricultural output. This was due to diversion of utilization of agricultural credit to other needs apart from the proposed farm enterprises.

Credit is provided to famers for the purpose to increase the productivity, ensuring food security and alleviate poverty. Several studies revealed that agricultural credit can improve the income level of small farmers, provided that it is used without credit fungibility (Ahmad, 2011; Bashir et al., 2010). Credit provision increased the use of modern technology and increased demand for credit which resulted in the increase in agricultural productivity of the small farmers (Saboor et al., 2009). Hence, Agricultural credit stimulated the adoption of yield-enhancing technologies.

Siddiqi and Baluch (2004) stated that farmers’ access to credit had enhanced their access to agricultural inputs that increased crop production and incomes. The following variables: income the dependent variable indicated that the production credit and tube wells (development credit) were positively and significantly associated with agricultural income. The total number of tractors and use of fertilizers were also found to have positive but insignificant association.

Research studies have found positive and significant relationship of institutional credit with agricultural production, fertilizers and seeds (Akram et al., 2008; Iqbal et al., 2003; Zuberi, 1990). There is strong correlation between the amounts of formal credit and the real GDP of agriculture sector in a given period (Carter and Wiebe, 1990; Feder et al., 1990; Pitt et al., 1996). In addition, positive relationships are revealed between institutional credit and agriculture productivity (Bernstein and Nadiri, 1993; Jaramillo and Schiantarelli, 2002; Nickell and Nicolitsas, 1999).

Ample of literature has discussed farmers’ access to agricultural credit and its impact on agricultural production and livelihood of farmers. To study the utilization of agricultural credit and the fungibility issues, limited literature available is available in Pakistan, particularly in Khyber Pakhtunkhwa. This study aims to investigate farmers’ utilization of agricultural credit in agriculture sector known as investment and non-agriculture sector which is known as credit fungibility. Furthermore, this study only endorsed the credit fungibility at the farm level, neither to the lender nor the state bank level.

Material and Methods

Study area

The survey was conducted in Mardan sub-district. It lies in 34° 11’ 54” North, 72° 2’ 45” East. The district has total area of 1632 square kilometres (GoP, 2010). Total population in Mardan is 1.46 million according to 1998 census, among that 51.6% are male while 48.39% are female (GoP, 2010). About 79.78% of the total population are living in rural areas, who practice faming as a source of living. The total number of farm households in the district are 70,009, (ACO, 2010). Mardan district is broadly divided into two parts, south western plain area and north eastern hilly part. The hills surround the whole northern side of the district. The highest points in these hills are Sakra or Pajja, 2056 meters high and Pato or Garo, 1816 meters high (DAR, 2014). The south-western half of the district has fertile plains with low hills strewn across it mostly. It is usually accepted that this plain once formed the bed of a lake which was gradually filled up by the load of the river flowing into from the surrounding hills. From the foot hills, the plain water runs down at first with a slope that carry it to the lower levels and ultimately to the Kabul river. The soil is very fertile in the southern part of the district and has heavy clay loamy soil. Whereas in the northern part, the soil ranges from clay to clay loamy and loamy soil. Due to this variation in soil properties, every type of crops is grown in the district.

Sampling

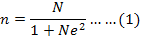

The data were collected through a standardized questionnaire from 87 subsistence landholders. Subsistence landholders are the farmers having landholding up to 12.5 acres (Saqib et al., 2016a). The target population was purposively selected for survey as we considered this group of farmers as more vulnerable to natural disasters like floods and heavy rains. Likewise, small farmers need agricultural credit more than the large farmers. The data of farmers were obtained from the Provincial Disaster Management Authority (PDMA). There were 3,535 vulnerable households in Mardan (PDMA, 2013). We have collected the data in rural areas of sub-district Mardan from selected village that were lying on the bank of river Kalpani. Among this rural population, subsistence farmers were purposively identified and the sample size was selected by the method suggested by Yamane (1967). From these farming households, the data were collected randomly by interviewing household’s head. The sample size was determined with ±10% margin of error as in equation (1):

n: Denotes the sample size; N: Denotes total number of farming households in an area (87); e: Denotes the margin of error (precision value); set as ±10% (0.10). From these farming household, the data were collected randomly by interviewing household head.

Materials and Method

Credit fungibility is the main problem in agricultural credit that hinders the stated objectives of credit programs. Fungibility at the farm level can be divided into two types: the financial substitution and expenditure substitution. Financial substitution occurs when the borrowers keep both agricultural and other rural credit in the common pool and utilize them for specified purpose (Hussain, 2012). Expenditure substitution occurs when the borrower uses the funds for purposes other than agriculture. This study has focused on the later issue.

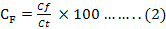

The following method suggested by Hussain (2012) and Saqib (2015) was used to analyse the credit fungibility and credit margin of investment.

Where:

CF: The credit fungibility in percentage; Cf : Average annual amount of credit used in other purposes; Ct: Annual average amount of Credit abstained from different sources.

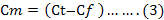

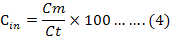

The credit margin of investment is specified in equation (3). The credit margin of investment is specified in equation (4) as follows:

Where:

Cm: Annual credit margin of investment; Cin: Credit margin of investment in percentage

Results and Discussion

Using the above estimation criteria, the results are presented in Table 1. Farmers obtained credit from both formal and informal sources in the study area. The total annual average credit received by small farmers was PKR. 43614.0. Whereas, the average annual amount of credit that they obtained from informal sources was PKR. 36596.5, comprising around 80% of the total credit received by them. Medium and large farmers received total credit PKR. 143734.0 as annual average amount while the credit fungibility that was observed in this group was PKR. 56766.7. Whereas in case of the credit margin, that is, how much of the credit is invested out of the total credit,

Table 1: Credit fungibility and credit margin of investment.

|

Farmer's Group

|

Average values/farm Household(PKR) | ||||

| Credit Received by X group of Farmers | Credit Used in Other Needs |

Credit Fungibility (%) |

Credit Margin of Investment | Credit Investment (%) | |

|

Ct |

Cf |

CF |

Cm |

Cin |

|

|

Small Farmers (n=57) |

43614.0 | 21386.0 | 49.0 | 22228 | 51.0 |

| Medium and large Farmers (n=30) | 143734. | 56766.7 | 39.5 | 86967.0 | 60.5 |

|

T-test |

11.32 | 15.25 | |||

| P-value | 0.000** | 0.000** | |||

Source: Field Survey, 2015; **: Indicates 99% of confidence level.

Table 2: Credit investment in agriculture sector.

| Investment | Famers Group | N | Average (PKR) | Std. Deviation | p-value |

| Fertilizers | Small Farmers | 57 | 8635.1 | 11832.3 | 0.000** |

| Medium and Large Farmers | 30 | 33066.7 | 32611.5 | ||

| Total | 87 | 17059.8 | 24211.8 | ||

| Seeds | Small Farmers | 57 | 6970.2 | 9412.8 | 0.000** |

| Medium and Large Farmers | 30 | 26500.0 | 26134.6 | ||

| Total | 87 | 13704.6 | 19369.7 | ||

| Land Preparation | Small Farmers | 57 | 7886.0 | 20602.3 | 0.000** |

| Medium and Large Farmers | 30 | 29933.3 | 32363.2 | ||

| Total | 87 | 15488.5 | 27215.2 | ||

| Labour | Small Farmers | 57 | 3210.5 | 5280.5 | 0.000** |

| Medium and Large Farmers | 30 | 17866.7 | 26704.9 | ||

| Total | 87 | 8264.4 |

17542.3 |

Source: Field Survey, 2015; **: indicates 99% of confidence level.

the small farmers invested PKR. 22,228.0 in agriculture, while medium and large farmers on average have invested PKR. 86,967.0 per year as mentioned in Table 1.

The results showed that there was a large amount of fungibility in the total credit obtained by farmers. Almost all the farmers in the study area were using agricultural credit for non-agricultural purposes. The farmers had used their agricultural credit in education, family expenditures, health and other businesses. However, the ratio of the misuse of funds varied from one group of farmers to another. The analysis revealed that small farmers had the credit fungibility of around 49% of the total funds they received, whereas the medium and large farmers had 39.5% fungibility. Credit fungibility among small farmers was more than those of medium and large farmers. Small farmers had invested about half (51%) of the total amount of credit in agriculture sector. Likewise, medium and large farmers had made investment of about 60.5% of the total funds. Large farmers invested relatively higher amounts than small farmers. T test value showed that there is a significant difference among the group of farmers (p≤ 0.01). Similarly, a significant (p≤0.01) difference was observed among the farmers’ groups regarding their investment in agriculture sector. (p≤0.01).

The amount invested in agriculture is further analysed and the results are presented in Table 2. Among the farmers’ groups a significant difference was observed regarding investment in fertilizers. For instance, on average the medium and large farmers had invested more than small farmers (p≤0.01). Likewise, in seeds, land preparation and in labour investment the farmers were found significantly different (p≤0.01). Medium and large farmers had invested more compared to the small farmers in every agriculture activity. However, the small farmers invested more in fertilizers compared to other activities. Likewise, large farmers invested more in fertilizers than seeds, land preparation and labour cost.

The results indicated that small farmers lacked off-farm income sources. They relied more on agricultural income and had a low level of income diversification activities. Therefore, they tried to diversify their income generating activities in the form of other business such as street vendor: selling their produce in the nearby villages in wooden carts or sending their sons and brothers who were mature and grown up as migrants in the other cities of the country or abroad such as Saudi Arabia and United Arab Emirates.

As the agriculture is not more profitable business for us. The consecutive three-four years the floods have damaged our crops. In addition, different diseases have also damaged the crops. So, I feel it better not to involve my children in farming. That’s why I have applied for credit and used it in my son’s visa process for Saudi Arabia. (Farmer No 47, age 58).

Hence, this was the basic reason noticed that the small farmers were allocating more of their funds to these off-farm activities. Small farmers were more vulnerable to floods in the study area compared to medium and large farmers. After floods in the area, they already lost agriculture produce, and they had left with no option except to use the borrowed money to finance their daily domestic expenditures.

After the floods in 2010, whole of my field was damaged. I need immediate money for my family consumption, rehabilitation of fields and for the seeds. I borrowed money from Arthi in the local market with the contract that after harvesting I will sell the agriculture produce to his shop.” (Farmer No 34, age 42).

The farmers also reported that the universities have revised their fee structure and now it is difficult to finance their children’s educational expenditures only from agriculture income. Thus, they had no money except the agricultural credit to finance and fulfil these off-farm needs.

My son is studying at university and my daughter goes to secondary school. It is now difficult for me to finance their expenditures from agriculture. I have borrowed money from local trader for agriculture but in the meanwhile the admissions of my children were due, thus I used the borrowed money for their educational needs. (Farmer No 23, age 47)

The farmers mentioned that they had kept aside some money in their home as saving for precautionary purposes but unfortunately, they have also used all their savings in these activities. Therefore, there was observed more fungibility on the part of small farmers than medium and large farmers. Our results are in accordance with the findings of Ayaz and Hussain (2011) who revealed that informal credit was more used in consumption, social activities and off-farm activities other than agriculture.

Medium and large farmers had the same problems, however, they had comparatively less fungibility than small farmers. They had more lands, higher productivity and income, consequently had more amount left as savings which was used for other needs. This group of farmers needed money only at the time of harvesting or growing season to finance their agricultural activities. To finance their expenditures, they needed funds for which they had approached both formal and informal sources. Moreover, the medium and large farmers had other sources of income that contributed to meet other needs while agricultural credit was used for agriculture purposes. The results of this study are in agreement with Hussain (2012), who reported that lower smallholders had more credit fungibility than middle and upper smallholders in Punjab Province of Pakistan. Furthermore, the results of this study are consistent with the findings of Akram and Hussain (2008), Hussain and Thapa (2015), and Siddiqi and Baluch (2004), who revealed that agricultural credit was used for non-agricultural purposes, such as consumption and festivals. Likewise, in education, health, and repayment of loans (Hussain and Thapa, 2015). In addition, the findings of our study are also consistent with the that of Nosiru (2010), who revealed that agricultural credit had not contributed positively to the level of agricultural output in the study area due to unwise utilization and diversion of agricultural credit to other needs from the proposed farm enterprises.

Conclusion and Recommendations

The findings of the study revealed that financial institutions and informal credit sources used to provide credit to farmers in the study area. Most of the small farmers received credit from informal sources. Almost all farmers had fungibility in the amount of agricultural credit. Small farmers have used considerable proportion of their loans for non-agriculture needs. Medium and large farmers in the study area invested more than small farmers. Most of the farmers were in shortage of funds, and they could not solve their farm problems out of this credit, thus they diverted this amount to other needs. The government needs to ensure supply of more credit to the farmers which can eliminate their dependency on informal sources. Enhanced supply of credit can increase income and productivity of farmers, provide sufficient resources to fulfil their domestic needs, and ultimately decrease credit fungibility. There is need of proper monitoring by banks in order to avoid the credit fungibility. The banks should have separate staff for monitoring farmers and special incentives may be given to the farmers who invest the loan in agricultural sector. For instance, farmers may be asked to submit the receipts for spending in the agricultural sector. To avoid fungibility, it is recommended that the loans may be more in-kind, rather than cash through which the fungibility can be decreased and the good quality inputs can be ensured. It is also recommended that the small farmers, who depend mostly on agricultural credit, may also be advised for crops diversification through selecting the profitable crops which could increase their income level.

Authors’ Contributions

Mr. Shahab E Saqib has designed the study by drafting the introduction, literature review and discussion part of the paper. Prof. Himayatullah Khan has supervised the entire process of the research. Dr. Sanaullah Panezai has critically evaluated and proof read the article. Mr. Ubaid Ali had contributed in data collection and summarizing the literature. Mr. Mazhar Ali main contribution was in the analysis of data.

References

ACO. 2010. Agriculture Census Organization. Retrieved from: http://www.pbs.gov.pk/sites/default/files/aco/publications/agricultural_census2010

/WRITE-UP%20AGRI.%20CENSUS%202010.pdf

Ahmad, N. 2011. Impact of institutional credit on agricultural output: A case study of Pakistan. Theo. Appl. Econ. 10(10): 99.

Akram, W. and Hussain, Z. 2008. Agricultural credit constraints and borrowing behavior of farmers in rural Punjab.

Akram, W., Hussain, Z. and Ijaz, H. 2008. Agricultural credit constraints and borrowing behavior of farmers in rural Punjab. Eur. J. Sci. Res. 23(2): 294-304.

Ayaz, S. and Hussain, Z. 2011. Impact of institutional credit on production efficiency of farming sector: A case study of District Faisalabad. Pak. Econ. Soc. Rev. 149-162.

Bashir, M.K., Mehmood, Y. and Hassan, S. 2010. Impact of agricultural credit on productivity of wheat crop: Evidence from Lahore, Punjab, Pakistan. Pak. J. Agric. Sci. 47(4): 405-409.

Bernstein, J.I., and Nadiri, M.I. 1993. Production, financial structure and productivity growth in US manufacturing. Cambridge: Natl Bur. Econ. Res. Available at: https://doi.org/10.3386/w4309

Carter, M.R., and Wiebe, K.D. 1990. Access to capital and its impact on agrarian structure and productivity in Kenya. Am. J. Agric. Econ. 1146-1150. https://doi.org/10.2307/1242523

Dawn News. 2007. Downside of informal agricultural credit, Daily Dawn. Retrieved from http://www.dawn.com/news/271351/downside-of-informal-agricultural-credit

District Agriculture Report. 2014. District agriculture statistics. Mardan.

Fayaz, M., Jan, D., Jan, A.U. and Hussain, B. 2006. Effects of short term credit advanced by ZTBL for enhancement of crop productivity and income of growers. J. Agric. Biol. Sci. 1(4): 15-18.

Feder, G., Lau, L.J., Lin, J.Y. and Luo, X. 1990. The relationship between credit and productivity in Chinese agriculture: A microeconomic model of disequilibrium. Am. J. Agric. Econ. 72(5): 1151-1157. https://doi.org/10.2307/1242524

GoP. 2010. District at a Glance. Islamabad: Retrieved from http://www.pbs.gov.pk/sites/default/files//tables/District%20at%20a%20glance%20Mardan.pdf

Hussain, A. 2012. Small holder access to agricultural credit and its effects on farm productivity, income and household food security in Pakistan. Ph.D Thesis, Asian Institute of Technology, Thailand.

Hussain, A., and Thapa, G.B. 2015. Fungibility of Smallholder Agricultural Credit: Empirical Evidence from Pakistan†. Eur. J. Dev. Res. 1-21.

Iqbal, M., Ahmad, M., Abbas, K. and Mustafa, K. 2003. The impact of institutional credit on agricultural production in Pakistan [with comments]. Pak. Dev. Review. 42(4): 469-485.

Jaramillo, F. and Schiantarelli, F. 2002. Access to long term debt and effects on firms’ performance: lessons from Ecuador. Credit Constraints and Investment in Latin America.

Nickell, S. and Nicolitsas, D. 1999. How does financial pressure affect firms? Eur. Econ. Rev. 43(8): 1435-1456. https://doi.org/10.1016/S0014-2921(98)00049-X

Nosiru, M.O. 2010. Microcredits and agricultural productivity in Ogun State, Nigeria. World J. Agric. Sci. 6(3): 290-296.

Pitt, M.M., Khandker, S.R. and Mundial, B. 1996. Household and intrahousehold impact of the Grameen Bank and similar targeted credit programs in Bangladesh: World Bank Washington, DC.

Provincial Disaster Management Authority. 2013. Contengency Plan Khyber Pakhtunkhwa. Available at: http://pdma.gov.pk/downloads/Monsoon_Contingency_Plan_KP_2013.pdf. [14 October 2014 Accessed 14 October 2014].

Saboor, A., Hussain, M. and Munir, M. 2009. Impact of micro credit in alleviating poverty: An Insight from rural Rawalpindi, Pakistan. Pak. J. Life Soc. Sci. 7(1): 90-97.

Saqib, S. 2015. Access, Adequacy and Utilization of Agricultural Credit to Farmers in Pakistan: The Case of Mardan District, Khyber Pakhtunkhwa. MS Thesis, Asian Institute of Technology, Thailand.

Saqib, S.E., Ahmad, M., Sanaullah, P. and Khattak, K. 2016a. Access to credit and its adequacy to farmers in Khyber Pakhtunkhwa: the case of Mardan district. Sarhad J. Agric. 32(3): 184-191. https://doi.org/10.17582/journal.sja/2016.32.3.184.191

Saqib, S.E., Ahmad, M.M. and Panezai, S. 2016b. Landholding size and farmers’ access to credit and its utilisation in Pakistan. Development in Practice 26(8): 1060-1071. https://doi.org/10.1080/09614524.2016.1227301

Siddiqi, M.W. and Baluch, K.N. 2004. Institutional credit: A policy tool for enhancement of agricultural income of Pakistan. Int. Res. J. Arts Humanit. 37: 157-174.

Yamane, T. 1967. Statistics: an introductory analysis Harper and Row, New York, Evanston and London and John Weather Hill, Inc., Tokyo.

Zuberi, H.A. 1990. Institutional Credit and Agricultural Development. J. Econ. Dev. 2(1): 12-35.