Analysis of Partial Effects of Agricultural Credit Guarantee Scheme Fund on Outputs in Nigerias Agricultural Subsectors

Analysis of Partial Effects of Agricultural Credit Guarantee Scheme Fund on Outputs in Nigeria’s Agricultural Subsectors

Akerele Dare*, Ashaolu Olumuyiwa Fowowe, Sanusi Rahman Akintayo and Egbetade Adedolapo

Department of Agricultural Economics and Farm Management, Federal University of Agriculture, Abeokuta, PMB 2240, Abeokuta, Ogun State, Nigeria.

Abstract | The study examined the effects of Agricultural Credit Guarantee Scheme Fund on agricultural outputs in three different agricultural subsectors in Nigeria. Data on the value of output of crop, livestock and fishery subsectors of agriculture,and the amounts of the fund allocated to each subsector from 1982 to 2013 were subjected to econometrics (time series) analysis. Results established positive and statistically significant influence of the amount of fund apportioned to crop (p<0.01) and livestock (p<0.05) subsectors on output growth in the respective subsectors. Likewise, the amount of the fund allocated to fishery subsector on fish output has positive influence on fish output but significant only at 10% level. While increases in the amount of the fund in a given year may substantially raise crop and fish production in that same year, it may take up to 2 years to experience a significant output expansion in livestock. Although results suggest that expansion of Agricultural Credit Guarantee Scheme Fund holds substantial positive signals for agricultural growth, especially in the crop and livestock subsector, the somewhat weak effect of the fund on fish production raises some curiosities for policy and strategy. Given that results are ceteris paribus,other incentives to raise agricultural production and measures to ensure that funds are used for the specified agricultural activities are suggested.

Received | April 11, 2017; Accepted | October 23, 2017; Published | November 07, 2017

*Correspondence | Akerele Dare, Department of Agricultural Economics and Farm Management, Federal University of Agriculture, Abeokuta, PMB 2240, Abeokuta, Ogun State, Nigeria; Email: akereled@funaab.edu.ng; akereledare@yahoo.co.uk

Citation | Akerele, D., O.F. Ashaolu, R.A. Sanusi and A. Egbetade. 2017. Analysis of partial effects of agricultural credit guarantee scheme fund on outputs in Nigeria’s agricultural subsectors. Sarhad Journal of Agriculture, 33(4): 630-638.

DOI | http://dx.doi.org/10.17582/journal.sja/2017/33.4.630.638

Keywords | Food production, Nigeria, Credit scheme, Agricultural sector

Introduction

The unique role of agriculture in a nation’s economy cannot be overemphasized. The agricultural sector contributed more than 60% of the Nigeria’s Gross Domestic Product (GDP) in the 1960s (Sanyal and Babu, 2010). It was after the oil boom era of the 1970s that the performance of agricultural sector began to decelerate because of over dependence on revenues from oil and lack of a sustainable development plan for the agricultural sector (Ugwu and Kanu, 2012; Umaru and Zubairu, 2012). Th edeclined went gradually to about 48.8 percent in the 1970s and further to 30.8 percent in 1980s (CBN, 2011). It was estimated at about 39 percent in 1990 but went down to 35.7 percent in 2000. It contributed 41.8 percent in 2009 (Corporate Nigeria, 2011) and declined slightly to 40.24 percent in 2011 (NBS, 2012). Recent available studies indicate that the contribution of agriculture to GDP is below 30% (NBS, 2015). Despite the decline in performance of agricultural sector over the past years, above 60 percent of Nigeria’s population nonetheless depends largely on agriculture for their livelihoods (Oyejide and Adewuyi, 2011).

The foregoing suggests the need for a strong and efficient agricultural sector for the economic prosperity of the country in terms food of production, employment generation, foreign exchange earnings and supply of raw materials for industries, among others. The lackluster performance and declining contribution of agriculture has been linked, among others, to the lack of (improperly coordinated) formal national agricultural credit policy and inadequate agricultural credit institutions (Odoemenem and Obinne, 2010; Ugbajah and Ugwumba, 2013; Ofana et al., 2016). In order to stimulate agricultural production through credit availability, governments over the years have intervened in agricultural credit markets through the provision of guarantees to banks for loans, andby setting up agricultural credit institutions to make credit available to farmers in Nigeria. Among the programs/schemes set up to increase institutional credit flow to farmers are Agricultural and Cooperative Bank (NACB) which was established in 1972. In 2000, the NACB became the Nigeria Agricultural Cooperative and Rural Development Bank (NAC and RDB) following a merger of the People’s Bank and the Family Economic Advancement Programme (FEAP) (Anetor et al., 2016).

To further enhance agricultural growth and increased farmers’ access to credit from formal sources, the Agricultural Credit Guarantee Scheme Fund (ACGSF) was introduced under the Agricultural Credit Guarantee Scheme Fund Decree 1977 (Ofana et al., 2016). The reason for introducing the fund is to raise credit supply to the agricultural sector by providing guarantee on loans given by bank for agricultural production. As contained in CBN (1990), ACGSF are given for plantation agriculture involving production of rubber, oil palm, cocoa and coffee, among others; growing of cereal and tuber crops, bananas and plantains, various kinds of fruits and vegetables, cotton, pulses, seeds and nuts, and the like. It is also granted for animal husbandry, including poultry, piggery, cattle rearing and other livestock, as well as fish farming and fish capture; for processing of agricultural products/output such as cassava to garri, oil palm fruit to oil and kernel and groundnut to groundnut oil, among others. The fund is also for the purchase farm machinery and hire services.

Although the challenges of agriculture in the country is multifaceted and ACGSF is one vital institutional credit schemes on which government have mobilized credit intensively close to four decades to boost agricultural production, the substantial decline in contribution of agricultural sector to GDP is an indication of a gap in (mix-matched between) resource (ACGSF) allocation to agricultural sector and the anticipated output from the sector. This therefore raises curiosity as to whether increased supply of ACGSF has had nontrivial positive impact on agricultural production in the country. In this regards, availability of evidence-based, up-to-date information on the partial impacts of ACGSF on production in specific subsectors of agriculture merits investigation. Such information is vital for the appraisal of the credit scheme in terms of performance and the need for shakeups in the policy, design or implementation. This is important, particularly now that the federal government is emphasizing massive diversification into agriculture as one key pathway to salvage the country from the ongoing economic recession in the country. It is on this background that the following research questions are raised. How does ACGSF affect crop subsector and in what way? What are the effects of ACGSF on the livestock subsector? Does ACGSF improve output in the fishery subsector? This is important especially in this period of dwindling earnings from crude oil and government’s emphasis now tilts heavily towards diversification into the agricultural sector.

A brief overview of agricultural credit guarantee scheme fund in Nigeria

The agricultural credit guarantee scheme fund (ACGSF) was established by the federal government of Nigeria (FGN) in 1977 and began operations in 1978 with the main purpose of assisting farmers who have weak resource/revenue base and lack collateral to obtain loans from commercial banks for agricultural activities. This is because, most often, commercial banks require huge collateral from farmers before they can access loan from the banks. One major reason for high collateral requirement may be attributed to the fact that agricultural production is characterized by high risks and uncertainty, including natural hazards, diseases outbreak and pest attacks, climate variability/ weather shocks, price volatility, poor institutions and infrastructures, among others.

The federal government of Nigeria, through the Central Bank manages ACGSF, and controls the day-to-day operations of the scheme. As mentioned earlier, the CBN specifies enterprises for which guarantees could be issued under the scheme. One uniqueness of ACGSF is that loans disbursed to the agricultural sector by the commercial bank sare allowed guarantee cover up to a maximum of 75% of the amount (outstanding balance) in default by farmers. Besides, the scheme has a farmers’ friendly package (Interest Drawback Programme) that enables farmers who repay their loans at the appropriate time to enjoy the benefit of 40% interest discount (rebate). This would imply (for example) that if a farmer services his/her loan facility very well and he/she is charged a total interest on loan of 1 million Naira, the CBN will pay four hundred thousand Naira back to the farmer under the Interest Drawback Programme.

The focus of ACGSF in Nigeria is similar to some of the credit guarantee schemes operated in some European countries (Green, 2003) in that these schemes also provide guarantees to groups that are unable to access credit by guaranteeing part of the non-payment loan (risks), thereby enabling lenders to recoup the amount guaranteed. Regardless of the countries, and systems of operations, credit guarantee schemes are usually established for the purpose of diminishing the risks associated with loaning to farmers or small and medium scale enterprises. In Nigeria, the federal government, through the CBN that is responsible for the financing and operations of ACGSF, similar to the Partial Credit Guarantee Fund (FOGAPE) in Chile of which administration of the scheme is through governmental agency. However, the credit guarantee scheme (The Small Business Loans Act) in Canada is based on portfolio management with approval of loan and guarantee handled altogether by lenders (Riding and Haines, 2001).

Whereas in Nigeria, the ACGSF was established by the federal government, in some other developed countries, governments in conjunction with NGOs and the private sector pool efforts together to establish credit guarantee schemes (CGSs). In those settings, one key advantage of CGSs is that they help banks identify lending risks, thereby improving banks’ ability to make appropriate lending decisions (Levitsky, 1997). Risk management mechanisms such as reinsurance, loan sales or portfolio securitizations are also being used by some developed and developing countries to mitigate exposure of guarantee schemes to default (Beck et al., 2008).In a way, ACGSF may be regarded as a risk management strategies, working directly to assist commercial banks in the event of loan defaults, and indirectly indemnifying farmer sin case disasters or crop failures render them incapable of repaying their loans (besides enhancing their access to loans). In the United State of America, farm safety nets such as crop insurance programs have grown substantially to become an essential part of domestic policy instruments for risk management-guaranteeing the portion of crop loss suffered by farmers (Glauber, 2016; Glauber, 2013). Countries such as in the European Union, such as Austria, Belgium, Croatia, Spain and Italy, among others, operate partly subsidized yield insurance programmes, with Spain and Italy subsidizing yield insurance premiums up to an upper limit of 65% (Santeramo and Ramsey, 2017).

Materials and Methods

The study area

The area of study is Nigeria. The country is located in the tropical climate region of West Africa between Latitude 4 and 15 degree of the equator and between Longitude 2 and 15 of the Greenwich meridian. Agriculture is critical to the livelihoods of Nigeria as 55% to 65% of the population are engaged in agriculture. The southern parts of Nigeria is situated in the tropical rainforest, and mangrove forest regions, while the northern parts of the country region is largely dominated by savannah grasslands. The total land area of the country is approximately 923,768 km²of which 90% is useful for agricultural purposes. The country has only two main crop production seasons (Dry and Rainy seasons). The officially documented population figures of the country as at 2006 was 140million people (NPC, 2006). However, estimated population for 2016 is 186,987,563 (UNDP, 2016).

Sources of data

The study relies on annual time series data from 1982-2013. The data were sourced from the Central Bank of Nigeria (CBN) Statistical Bulletins for 2014. The data include, the amount of ACGSF (in Thousand Naira) allocated to the crop, livestock, fishery subsectors and the corresponding value of output (Gross Domestic Product at Constant Basic Prices in Billion Naira) for the crop, livestock and fishery subsectors respectively. The graphical presentation of the data used for the study are presented in appendix 1.

Analytical technique

Stationary (unit root) co-integration tests were first conducted, while Ordinary Least Square regression was latter applied on the first differencing of the data series to examine the effects of Agricultural Credit Guarantee Scheme Fund (ACGSF) on output growth in the crop, livestock and fishery subsector of agriculture respectively.

Unit root tests

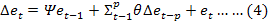

The first step in the data analysis wasto test for stationarity (unit roots) and order of integration in data series following Dickey and Fuller (1979).The DF-test requires estimating the simple first order autoregressive AR (1) modelas shown:

Sit = ℓi Sit-1+ uit ……………….. (1)

Where;

Si: Variable (data) of interest; For this study i: 1, 2, …,6 representing the natural logarithms of the value of crop output, livestock output, fishery output and the amount of ACGSF to the crop, livestock and fishery subsectors respectively; ut: Error term assumed to be an IID (0, σ2);1 St: Stationary if 1ℓ< 1 and non-stationary if ℓ= 1. The null hypothesis for the unit root can be stated as Ho: ℓ = 1 against the alternative hypothesis of stationary given as HA: ℓ< 1. This test of hypothesis is referred to as unit root tests for stationarity. If H0 is rejected, it indicates that St is stationary.

Application of Ordinary Least Square (OLS) regression to non-stationary data (at levels) would ordinarily produce spurious results of first-order serial correlation. Divergence in the distribution of the t-value often exist such that asymptotically correct critical values do not exist, even in large samples (Fuller, 1976; Dickey and Fuller, 1981). Dickey and Fuller (1979) presented the solution to these problems by reparameterising equation (1) by subtracting St-1 from both sides of the equation (1) with the reparametised Dickey-Fuller (DF) equation stated as:

∆Sit = ØiSit-1 + uit ………………. (2)

Where;

Øi: ℓi – 1. By applying OLS to equation 2, the null hypothesis that the series has a unit root, (H0: Øi = 0) can be tested against the alternative hypothesis of stationary (HA: Øi < 0).The Dickey Fuller (DF) test is based on the assumption that the data generating process (DGP) is a first order autoregressive (AR(1)) process. However, if the DGP is of a higher process, the serial correlation in the residual term will bias the test. Consequently, the Augmented Dickey-Fuller (ADF) is applied to fend off such bias in the test. The ADF test includes the first difference in lags (of the dependent variable) in such a way that the residual term is empirical white noise. For this study, the estimated equation for the ADF test is given as:

Where the lag length (f) for the ADF ensures that the residual terms ut are uncorrelated. OLS is then applied to the equation with the statistical significance of Øi tested against the null that Øi = 0. If the null hypothesis of non-stationarity (presence of unit root) cannot be rejected, the data series is said to be non-stationary (has unit root). For this study the unit root tests conducted on the data series (at level) indicates that the series have unit roots (test results presented in Table 1).

Table 1: Tests of presence of unit root and order of integration on data series.

| Variables (Data series) at level | ADF Statistics | Critical Value at (5%) | p-value |

| LN (CROP GDP) | 0.29 | -2.86 | 0.97 |

| LN(ACGSF CROP) | -1.18 | -2.86 | 0.67 |

| LN(LIVESTK GDP) | 3.77 | -2.96 | 1.00 |

|

*LN(LIVESTK GDP) |

2.66 | -2.96 | 1.00 |

| LN(ACGSF LIVESTOCK) | 0.15 | -2.86 | 0.96 |

| LN(FISH GDP) | -1.12 | -2.86 | 0.69 |

| LN(ACGSF FISH) | -1.89 | -2.86 | 0.33 |

|

FISH GDP |

3.76 | -2.96 | 1.00 |

| *FISH GDP | 1.78 | -2.96 |

1.00 |

Note: The critical values for the unit root test are based on Davidson and MacKinnon (1993). The lag length is selected automatically based on E-views package based on Schwarz Information Criteria; *: Estimates are from Phillip Ferron Tests.

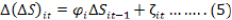

Co-integration test

Non-stationary time-series variables should not be used for analysis because of the problems of spurious regression. Nevertheless, there are special case in which non-stationary time series, say Qt and Zt are said to co-integrate. Co-integration means that Qt and Zt share similar stochastic trends, and the series never diverge too far from each other. A natural way to test whether co-integration exists between Qt and Zt is to examine whether the errors et= Qt -b1-b2Zt are stationary. Given that et is unobserved, co-integration test is performed on the empirical residuals. The equation is give as follows:

Similarly, OLS is then applied to the equation with the statistical significance of ѱ tested against the null that ѱ = 0. If the null hypothesis of non-stationarity (presence of unit root) cannot be rejected, we conclude that a co-integrating relationship exists between Qt and Zt. series is non-stationary (has unit root). For this study co-integrating relationships were examined between crop output (GDP) and ACGSF to crop subsector; livestock output (GDP) and ACGSF to livestock subsector and fish output (GDP) and ACGSF to fishery subsector respectively. The co-integration tests performed on the empirical residuals of the estimated regression models (test results presented in Table 2). For the data series examined in this study, the test results consistently suggest lack of sufficient evidence to establish co-integrating relationships between the variables in each of the regression models. Since the dependent and independent variables are not co-integrated, application of OLS to the regression models will results in spurious regressions. Consequently, we proceed to test for the order of integration of the data series.

Table 2: Results of co-integration tests on the residuals of estimated regression models.

| Variables | ADF Stat. | Crit. Value at (5%) |

| Regression of LN (CROP GDP) on LN(ACGSF CROP) | -2.04 | -3.37 |

| Regression of LN(LIVESTOCK GDP) on LN(ACGSF LIVESTOCK) | -2.82 | -3.37 |

| Regression of FISH GDP on LN(ACGSF FISH) | -1.99 |

-3.37 |

Note: The critical values for the con-integration tests are based on Hamilton (1994). One (1) lag length was selected and this corrects for the possible autocorrelation. Val.: critical. Stat.: Statistics. The estimated regressions are with constant and no trend.

Order of integration

Having established that the series are non-stationary and are not co-integrated, we then checked for the order on integration. The order of integration of a data series is the minimum number of times it must be differenced to make it stationary. The Dickey–Fuller equation for a random walk applied to the first differences of the data series is as stated:

OLS is then applied to the equation with the statistical significance of φ tested against the null that φ = 0. If the null hypothesis of non-stationarity cannot be rejected at the first difference, we conclude that the variable (data series) isnot integrated of order one, I (1). However, if the hypothesis is rejected at the first difference, it is integrated of order one. For this study all the variables are stationary at first difference. Results are presented in Table 3. Consequently, the first difference of the data series are used in the regression model for estimating the relationship between the variables.

Table 3: Tests of order of integration.

| Variable (Data series) at first difference | ADF Statistics | Critical Value at (5%) | p-value |

|

∆LN(CropGDP) |

-6.13 | -2.86 | 0.00 |

|

∆LN (ACGSFcrop) |

-5.46 | -2.86 | 0.00 |

|

∆LN(LIVESTK GDP) |

-3.51 | -2.96 | 0.02 |

|

*∆LN(LIVESTK GDP) |

-3.84 | -2.96 | 0.01 |

|

∆LN(ACGSF LIVESTOCK) |

-4.71 | -2.86 |

0.00 |

|

∆LN(FISH GDP) |

-7.11 | -2.86 | 0.00 |

|

∆(LN ACGSF FISH) |

-9.05 | -2.86 | 0.00 |

|

∆FishGDP |

-2.63 | -2.96 | 0.10 |

|

*∆FishGDP |

-3.30 | -2.96 |

0.02 |

Note: The critical values for the unit root test are based on Davidson and MacKinnon (1993). The lag length is selected automatically based on E-views package based on Schwarz Information Criteria; *: Estimates are from Phillip Ferron Tests.

Autoregressive distributed Lag (ARDL) modelswith first-differenced variables

Having established absence of cointegration between I(1) variables, we proceed to estimate autoregressive distributed lag models with first-differenced variables to capture short-run relationships between the data series. Application of the vector error correction models (VECM) (Hill et al., 2011), including the threshold VECM (Lence et al., 2017) are unimportant in this instance. With appropriate number of lags selected (based on the F-values, Durbin-Watson Statistics, Aikaike Information and Schwarz Criteria) to fend off possible serial correlations, the ARDL model for each of the pairs of (first difference) data series is as specified:

∆LnCropVt= α + η1 ∆LnCropVt-1 + ω0∆LnACropt + ω1∆LnACropt-1 + ξt …………(6)

∆LnLVt= α+η1∆LnLVt-1 + η2∆LnLVt-2 + ω0∆LnALt + ω1∆LnALt-1 + ω2∆LnALt-2 + ϑt …(7)

∆FVt= α + η1∆FVt-1 + η2∆FVt-2 + ω0∆LnAFt + ω1∆LnAFt-1 + ω2∆LnAFt-2 + εt ……….…(8)

Where;

LnCropV: Natural logarithm of value of crop output (GDP); LnACrop: Natural logarithm of the amount of ACGSF to crop subsector; LnLV: Natural logarithm of the value of livestock output (GDP); LnAL: Natural logarithm of the amount of ACGSF allotted to livestock subsector; FV: Value of fish output (GDP); LnAF: Natural logarithm of the amount of ACGSF allotted to fishery subsector; α, η, ω: Parameters to be estimated in each of the modelsand ξ, ϑ and ε are the associated error terms. The subscripts: t, t-1 and t-2 relates to the current year, one year lag (a year before the current year), and two-year lag (two years before the current year) respectively.

Table 4: Relationship between crop output and amount of ACGSF allotted to the crop subsector.

| Variables | coefficient | t-value | p-value |

| Constant | 0.049 | 4.587 | 0.000 |

|

∆CropVt-1 |

-0.101 | -0.560 | 0.580 |

|

∆LnACropt |

0.043 | 2.849 | 0.009 |

|

∆LnACropVt-1 |

-0.014 | -0.810 | 0.425 |

| R-squared | 0.274 | ||

| F-statistic | 3.271 | ||

| Prob(F-statistics) | 0.037 | ||

| Durbin-Watson statistics | 2.285 | ||

| Akaike Information Criterion | -3.494 | ||

| Schwarz Criterion | -3.307 |

Results and Discussion

Relationship between crop output and amount of ACGSF allocated to the crop subsector

The results of the OLS regression analysis of the relationship between crop output and ACGSF to the crop subsector of agriculture are interpreted in Table 4. The Durbin-Watson value (2.29) implies absence of serially correlated errors in the model. The F-value (3.27) with a p-value of 0.04 is statistically significant at 5% level. This establishes the overall significance of the regression model and that it can be used for explaining the relationship between the crop output and the amount of ACGSF to the crop subsector of agriculture. The R-square value is 0.274, indicating that approximately 27.4% of the total variation in the dependent variable (growth)in value of crop output is explained by changes in all the explanatory variables in the model. The sign of the coefficient associated with growth (the percentage change) in the amount of ACGSF allotted to the crop subsector is positive and statistically significant (p<0.01), implying that a small percentage increase in the amount of ACGSF allocated to the crop subsectorin a given year can substantially raise crop output within the same year. This is similar to Aliyu (2012) who found positive and significant relationship between formal credit supply and productivity of the crop subsector of Nigerian agriculture. In addition, the magnitude of the coefficient is 0.043; indicating that a 1-percent increase in the amount of ACGSF supply to the crop subsector in a year is expected to raise crop output in that year by 0.043 percent, all else equal.

Table 5: Relationship between livestock output and amount of ACGSF allocated to the livestock subsector.

| Variables | coefficient | t-value | p-value |

| Constant | 0.007 | 1.287 | 0.211 |

|

∆LnLVt-1 |

0.142 | 1.101 | 0.282 |

|

∆LnLVt-2 |

0.569 | 4.966 | 0.000 |

|

∆LnALt |

0.007 | 1.393 | 0.177 |

|

∆LnALt-1 |

0.006 | 1.346 | 0.191 |

|

∆LnALt-2 |

0.014 | 2.765 | 0.011 |

| R-squared | 0.734 | ||

| F-statistic | 12.671 | ||

| Prob(F-statistic) | 0.000 | ||

| Durbin-Watson statistics | 2.143 | ||

| Akaike Information Criterion | -5.521 | ||

| Schwarz Criterion | -5.238 |

Relationship between livestock output and amount of ACGSF allotted to the livestock subsector

The results of the OLS regression analysis of the relationship between livestock output and the amount of ACGSF disbursed to the livestock subsector are presented in Table 5. The Durbin-Watson value (2.14) also established absence of serially correlated errors in the model. The F-value (12.67) is statistically significant at 1% level, indicating overall significance of the regression model. The R-square value is 0.734, implying that approximately 73.4% of the total variation in the dependent variable (value of livestock output in a year relative to its value in the immediate past year) is explained by changes in all the regressors in the model. The coefficients associated with the percent change in the amount of ACGSF allotted to the livestock subsector in a year and its one-year lag (are both statistically insignificant, meaning that increases in ACGSF supply to the livestock sector in a given year is unlikely to substantially raise livestock output in that year, and in the next year. However, the coefficient of the two-year lag is positive and statistically significant at 5% level, implying that the effect of increase in ACGSF allocation to the livestock subsector in a given year (say this year) will be substantially felt on livestock output in the next two years, keeping other factors constant. Although the study was not based on sound econometric estimation strategy, Ihegboro (2014) reported a positive correlation between ACGSF and livestock output in Nigeria.

Table 6: Relationship between fish output and amount of ACGSFAllottedto the fishery subsector.

| Variables | coefficient | t-value | p-value |

| Constant | -0.469 | -1.234 | 0.229 |

|

∆LnFVt-1 |

0.331 | 1.902 | 0.069 |

|

∆LnFVt-2 |

-0.108 | -0.646 | 0.524 |

|

∆LnAFt |

0.077 | 1.856 | 0.076 |

|

∆LnAFt-1 |

0.039 | 0.434 | 0.668 |

| R-squared | 0.352 | ||

| F-statistic | 3.255 | ||

| Prob(F-statistic) | 0.029 | ||

| Durbin-Watson statistics | 2.277 | ||

| Akaike Information Criterion | 1.418 | ||

| Schwarz Criterion | 1.654 |

Relationship between fish output and amount of ACGSF allocated to fishery subsector

The results of the OLS regression analysis of the relationship between fish output and ACGSF allocated to fishery subsector are presented in Table 6. The Durbin-Watson value is 2.28; indicating that the residuals of the estimated regression are serially uncorrelated. The statistical significance of the F-value (12.67) (p<0.01) shows all the explanatory variables in the model exert joint influence on fish output. The R-square value is 0.352, implying that approximately 35.2% of the total variation in the dependent variable (value of fish output in a year relative to its value in the immediate past year) is explained by changes in all the explanatory variables in the model. The coefficient associated with growth (percentage change) in the amount of ACGSF allotted to fishery subsector in current year is only significant at 10% level of significant. This suggests a somewhat miniscule effects of ACGSF allocation (to the fishery subsector) on fish output over the years. Similarly, the coefficient associated with change in value of fish output (GDP) lagged by one year is merely significant at 10% level of significant. This isalso indicative of a weak impact of immediate past year’s production on current output in the fishery subsector. The findings suggest that spill-over effects from fish production in past years appears to hold little positive impact on current year’s output and the influence of ACGSF on the agricultural subsector also seems rather miniscule.

Conclusion

The recent emphasis of the federal government to promote agricultural diversification presents a unique opportunity to examine the performance of the existing agricultural programmes/schemes on agricultural production. In this context, Agricultural Credit Guarantee Scheme Fund (ACGSF) merits investigation. Consequently, this study examined the short-run effects of ACGSF on crop, livestock and fish production in Nigeria using time series data from 1982 to 2013. Results show that ACGSF is still playing a prominent role in agricultural growth in Nigeria, with impacts appearing stronger in the crop and livestock subsectors. The effect of ACGSF on output growth in the fishery subsector seems weak, and this merits a closer attention from policy and strategy standpoints. It is acknowledged that findings are ceteris paribus; thus, we suggest alongside expansion and effective targeting of ACGSF, that some other complimentary agricultural related strategies should be developed to enhance performance of ACGSF and output growth in different subsectors the agriculture in Nigeria.

Author’s Contribution

Akerele Dare: Conceived the idea, wrote abstract, improved the quality of introduction, wrote methodology, worked on data entry in EViews and analysis, result and discussion. He was responsible for the overall management of the article.

Ashaolu Olumuyiwa Fowowe: Downloaded literature materials and wrote part of overview of agricultural credit guarantee scheme fund in Nigeria.

Sanusi Rahman Akintayo and Egbetade Adedolapo: Downloaded literature materials, contributed to introduction and organized references.

There is supplementary material associated with this article. Access the material online at: http://dx.doi.org/10.17582/journal.sja/2017/33.4.630.638

Reference

Aliyu A.A. 2012. An investigation into the relationship between agricultural production and formal credit supply in Nigeria. Int. J. Agric. Forestry. 2 (1): 46-52. https://doi.org/10.5923/j.ijaf.20120201.08

Beck, T., Klapperd, L.F. and Mendozae, C.J. 2010. The typology of partial credit guarantee funds around the world. J. Financ. Stab. 6(1): 10-25. https://doi.org/10.1016/j.jfs.2008.12.003

CBN. 2011. Statistical Bulletin. 2010. Central Bank of Nigeria, (Available at http://www.cenbank .org/OUT/2011/publications/statistics/2010/index.html).

CBN. 1990. Agricultural credit guarantee scheme fund guidelines for the agricultural credit guarantee scheme. Lagos: CBN

Corporate Nigeria. 2011. Agriculture overview: reinvigorating agriculture is a priority of Nigerian government, The business, trade and investment guide 2010/2011. (Available at http:// www.corporate-nigeria.com/assets/pdf/2010/cn-2010-agriculture.pdf).

Dickey D.A. and W.A. Fuller. 1979. Distribution of the estimators for autoregressive time series with a unit root. J. Am. Stat. Assoc. 74:427-431. https://doi.org/10.1080/01621459.1979.10482531

Dickey D.A., W.A. Fuller. 1981. Likelihood Ratio statistics for autoregressive time series with a unit root. Econometrica. 49: 1057-1072. https://doi.org/10.2307/1912517

Fuller W.A. 1976. Introduction to statistical time series. New York: John Wiley and Sons.

Glauber, J. W. 2016. The US crop insurance program and WTO disciplines. Agric. Finance Rev. 76(1) 6-14. https://doi.org/10.1108/AFR-03-2016-0017

Glauber, J.W. 2013. The growth of the federal crop insurance program, 1990-2011. Am. J. Agric. Econ. 95(2): 482-488. https://doi.org/10.1093/ajae/aas091

Hill, R.C., Griffiths, W.E. and Lim G.C. 2010. Principles of econometrics 4th edition. U.S: John Wiley and Sons, Inc.

Ihegboro I. 2014. The impact of agricultural credit on agricultural productivity in Nigeria. An MSc Dissertation, University of Nigeria, http://www.unn.edu.ng/publication s/files/IHEGBORO%20IFEOMA.pdf

Lence, S.H., Moschini, G. and Santeramo, F.G. 2017. Threshold cointegration and spatial price transmission when expectations matter. munich personal repec archive. https://mpra.ub.uni-muenchen.de/80202/1/MPRA_paper_80202.pdf

NBS. 2015. Nigerian gross domestic product report. Quarter One 2015. http://www.nigerians tat.gov.ng/pdfuploads/GDP_Q1_2015_old.pdf

NPC. 2006. National census news published in “The nation” , on January, 2007.

Odoemenem, I.U. and Obinne, C.P.O. 2010. Assessing the factors influencing the utilization of improved cereal crop production technologies by small scale farmers in Nigeria. Indian J. Sci. Technol. 3(1):180 – 183.

Ofana O.G., Efefiom, E.C. and Omini, E.E. 2016. Constraints to agricultural development in Nigeria. Int. J. Dev. Econ. Sustain. 4(2): 1-15.

Oyejide, T.A. and Adewuyi, A.O. 2011. Enhancing linkages of oil and gas industry in the Nigerian economy, Trade Policy Research and Training Programme (TPRTP), making the Most of Commodities Programme (MMCP) Discussion Paper No. 8.

Riding. A.L. and Haines J.G. 2001. Loan guarantees: Costs of default and benefits to small firms. J. Bus. Venturing. 16(6): 595 – 612. https://doi.org/10.1016/S0883-9026(00)00050-1

Sanreramo, F. G. and A. F. Ramsey. 2017. Crop insurance in the EU: Lessons and caution from the US. Eurochoices. https://doi.org/10.1111/1746-692X.12154

Ugwu, D.S. and I.O. Kanu. 2012. Effects of agricultural reforms on the agricultural sector in Nigeria. J. African Stud. Dev. (2): 51–59.

Umaru, A. and A.A. Zubairu. 2012. An empirical analysis of the contribution of agriculture and petroleum sector to the growth and development of the Nigerian economy from 1960-2010. Int. J. Soc. Sci. Education. 2(4): 758–769.

UNDP. 2016. Countries in the world by population (2016). United Nations Population Division estimates. http://www.worldometers.info/world-population/population-by-country/

To share on other social networks, click on any share button. What are these?